What Is a Walmart Money Order?

A money order is a prepaid payment instrument, similar to a check, but it’s guaranteed by the issuer, meaning it can’t bounce. Walmart partners with trusted providers like MoneyGram and Western Union to offer money orders at their MoneyCenter or Customer Service Desk.

These are ideal for secure transactions, especially if you don’t have a bank account or prefer not to use cash. The cost is typically under $1, making it a budget-friendly choice for sending money domestically.

Why Choose a Walmart Money Order?

I’ve used money orders when I needed to send money securely without sharing my bank details. They’re widely accepted, easy to purchase, and perfect for situations like paying rent, settling bills, or sending gifts.

Walmart’s MoneyCenter makes the process accessible, with most stores open late and on weekends. Plus, you can pay with cash or a debit card, though credit cards aren’t accepted for money orders.

How to Fill Out a Walmart Money Order

Filling out a money order is straightforward, but attention to detail is key to avoid issues. Here’s how I do it, and how you can too:

1. Purchase the Money Order

First, head to your local Walmart’s MoneyCenter or Customer Service Desk. You’ll need to bring cash or a debit card, as these are the only accepted payment methods. Tell the associate the amount you want for the money order (up to $1,000 per order).

For larger amounts, you’ll need to buy multiple money orders. Don’t forget to bring a government-issued ID if you’re purchasing over $1,000. The fee is usually less than $1, but it can vary by location. Once you pay, the associate will print the money order with the amount and date.

2. Write the Payee’s Name

As soon as you receive the money order, fill out the “Pay to the Order of” field. This is where you write the recipient’s full legal name or the business name if you’re paying a company. For example, if you’re sending money to your landlord, John Smith, write “John Smith” clearly.

I always double-check the spelling to ensure the recipient can cash or deposit it without issues. If you leave this blank, someone else could potentially fill it out and cash it, so complete this field immediately.

3. Add Your Information as the Purchaser

Next, find the section labeled “Purchaser,” “From,” or “Sender.” This is where I put my full name and address. You’ll want to do the same, as this identifies you as the buyer. For instance, I’d write “Jane Doe, 123 Main St, Anytown, USA 12345.”

This step is crucial for record-keeping and helps the recipient contact you if needed. Some money orders may also ask for your phone number, so have that handy.

4. Include a Memo or Account Number (If Applicable)

If you’re paying a bill, look for a “Memo” or “Payment For/Account Number” field. Here, you can note the purpose of the payment, like your utility account number or “Rent for October.” I find this step helpful to ensure the recipient applies the payment correctly.

For example, when I paid my electric bill with a money order, I included my account number from the bill. You should check your bill or contact the recipient to confirm if this is needed.

5. Sign the Money Order

On the front of the money order, there’s a line labeled “Purchaser’s Signature” or “Signer for Drawer.” This is where I sign my name to validate the money order.

You’ll need to sign here too, but make sure it’s on the front, as the back is for the recipient’s signature when they cash or deposit it. I always sign clearly to avoid any confusion.

6. Keep the Receipt

After filling out the money order, detach the receipt or stub. I always keep this in a safe place, and you should too. The receipt is your proof of purchase and includes tracking information to confirm the money order has been cashed.

If you lose the money order or need to cancel it, this receipt is essential. Walmart allows refunds within 10 days of purchase, provided the money order is intact and you have the receipt and ID.

Common Mistakes to Avoid

When I first used a Walmart money order, I made a few rookie errors. Here’s what you should watch out for:

- Leaving Fields Blank: An incomplete money order is vulnerable to theft or misuse. Fill out all required fields before sending it.

- Incorrect Payee Information: Misspelling the recipient’s name can prevent them from cashing the money order.

- Losing the Receipt: Without the receipt, canceling or tracking a money order is nearly impossible.

- Using a Credit Card: I once tried to use a credit card, only to learn it’s not an option. Stick to cash or debit.

How to Send or Cash a Walmart Money Order

Once you’ve filled out the money order, you can mail it or deliver it in person to the recipient. If you’re mailing it, use a secure method like certified mail to ensure it arrives safely.

The recipient can cash it at a Walmart store, their bank, or another MoneyGram or Western Union location, but they’ll need a valid ID. If you need to cash a money order yourself, note that Walmart may require a 10-day waiting period for refunds if you’re the purchaser.

Alternatives to Walmart Money Orders

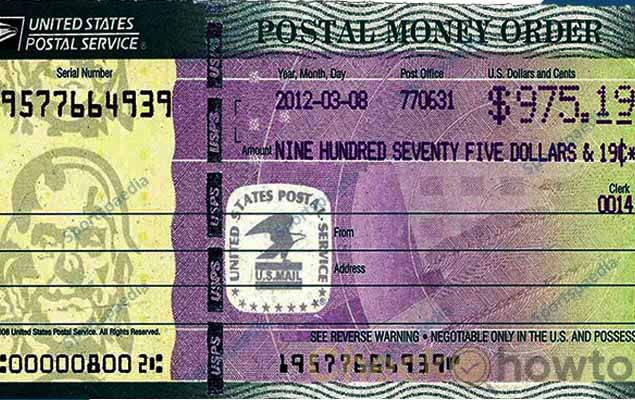

While I find Walmart money orders reliable, you might explore other options depending on your needs. For example, the U.S. Postal Service offers money orders up to $1,000 for a slightly higher fee ($2.35–$3.40).

Banks and credit unions also provide money orders, though fees may be higher. For international transfers, services like Wise offer low-cost, transparent options with mid-market exchange rates, which I’ve used for overseas payments.

What Are Walmart Money Order Rates?

The rates for purchasing a Walmart money order are typically referred to as fees, which are very affordable. I’ve found that Walmart charges around $0.88 to $1 per money order, though the exact rate can vary by location.

Always check with your local Walmart store to confirm the fee, as it’s one of the most cost-effective options compared to banks or the U.S. Postal Service.

What Is the Walmart Money Order Limit?

Walmart sets a limit of $1,000 per individual money order. If you need to send more, you can purchase multiple money orders, but there’s a daily limit of $3,000 per customer.

For example, if you need $2,500, you’d buy three money orders (two for $1,000 and one for $500). I always plan ahead to ensure I stay within these limits to avoid complications.

What Is the Walmart Money Order Cost?

The cost of a Walmart money order is the same as the fee, typically $0.88 to $1 per order, depending on the store. This makes it a budget-friendly choice.

For instance, when I bought a $500 money order, I paid just $0.88 in fees at my local Walmart. Confirm the exact cost with your store, as it may vary slightly.

What Is the Walmart Money Order Max?

The maximum amount for a single Walmart money order is $1,000. The daily maximum purchase limit is $3,000 per person.

If you’re sending a larger amount, you’ll need to spread it across multiple transactions or visit on different days. I’ve found this cap reasonable for most personal transactions, like paying bills or rent.

Walmart Money Order: How Much?

As mentioned, the fee for a Walmart money order is usually between $0.88 and $1 per order, and the maximum amount per order is $1,000.

You’ll pay the fee for each money order, so if you buy three $1,000 money orders, expect to pay up to $3 in fees total. Always have cash or a debit card ready, as credit cards aren’t accepted.

What Is Walmart Money Order Online?

Currently, Walmart does not offer the option to purchase money orders online. You must visit a physical Walmart store’s MoneyCenter or Customer Service Desk to buy one.

However, you can track a money order online through MoneyGram’s website using the serial number from your receipt. I’ve used this feature to confirm when a recipient cashed my money order, which is super convenient.

What Is Walmart Money Order Time?

The time it takes for a Walmart money order to clear depends on how it’s sent and cashed. If delivered in person, the recipient can cash it immediately at a Walmart store, bank, or MoneyGram/Western Union location with a valid ID.

If mailed, it typically takes 1-2 business days to clear within the U.S., depending on the recipient’s bank. For refunds, Walmart requires a 10-day waiting period if you’re the purchaser. I always advise sending via certified mail for added security if mailing.

Walmart Money Order: FAQs

Here are answers to common questions about Walmart money orders to help you navigate the process with ease:

Can I buy a Walmart money order with a credit card?

No, Walmart only accepts cash or debit cards for purchasing money orders. I learned this the hard way when I tried to use a credit card, so make sure you have cash or a debit card ready.

What is the maximum amount for a Walmart money order?

The maximum amount is $1,000 per money order. If you need to send more, you’ll have to purchase multiple money orders. For example, for a $2,500 payment, you’d need three money orders.

Can I get a refund for a Walmart money order?

Yes, you can request a refund within 10 days of purchase if the money order hasn’t been cashed. You’ll need the receipt and a valid ID. I always keep my receipt in a safe spot just in case.

Can I use a Walmart money order internationally?

Walmart money orders are primarily for domestic use. If you’re sending money abroad, check with the recipient to ensure they can cash it. Alternatively, consider Walmart’s international money transfer services through MoneyGram or Western Union.

What should I do if I lose my money order?

If you lose your money order, contact Walmart’s MoneyCenter or customer service (1-800-Walmart) with your receipt. The receipt has tracking details to help replace or refund it. I recommend storing the receipt securely to avoid this hassle.

How long does it take to cash a Walmart money order?

The recipient can cash it immediately at a Walmart store, bank, or MoneyGram/Western Union location with a valid ID. However, if you’re requesting a refund as the purchaser, Walmart may impose a 10-day waiting period.

Are there fees for cashing a Walmart money order?

Cashing a money order at Walmart may involve a small check-cashing fee, which varies by location. Check with your local store for details. I’ve found that banks often cash money orders for free if you have an account.