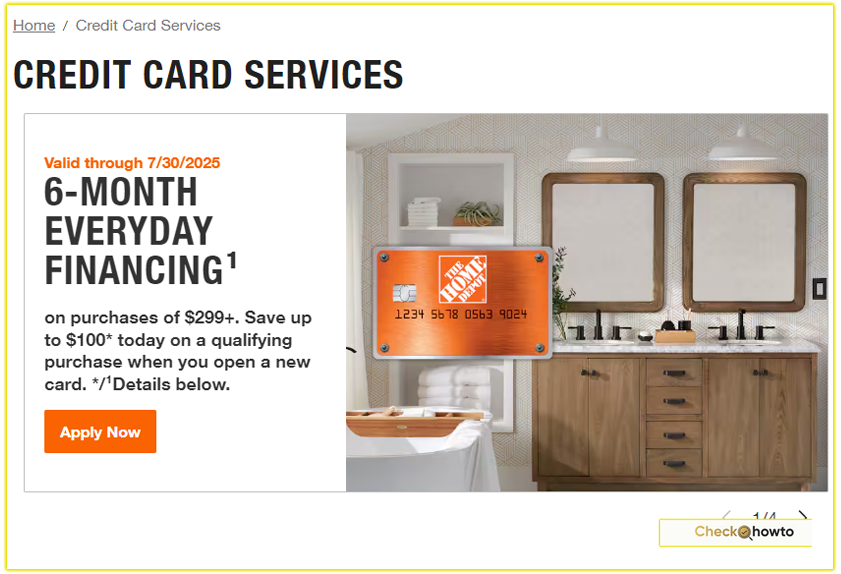

Have you ever found yourself standing in the middle of a home improvement store, staring at a cart full of supplies, and wondering how you’re going to manage the cost? I’ve been there too, and that’s when I discovered the Home Depot Credit Card. Whether you’re a DIY enthusiast, a contractor, or just someone who loves tackling home projects, this card might be the solution you’ve been searching for. But what exactly makes it stand out from other credit cards, and is it really worth it?

Let me tell you, the Home Depot Credit Card isn’t just another piece of plastic in your wallet. It’s a tool designed to make your home improvement journey smoother and more affordable. From special financing offers to exclusive discounts, this card has perks that can save you money and help you budget for both small repairs and major renovations. But here’s the real question: could this card be the key to unlocking your next big project without breaking the bank?

As someone who’s used this card for everything from painting a room to remodeling a kitchen, I can tell you it’s more than just a payment method—it’s a strategic advantage. So, are you ready to explore how the Home Depot Credit Card can transform the way you approach home improvement?

What Happens When Your Credit Card Expires

1. Two Card Options to Suit Your Needs

One of the first things I discovered about the Home Depot Credit Card is that it comes in two distinct versions: the Home Depot Consumer Credit Card and the Home Depot Project Loan Card. Each option caters to different spending habits and project scales, so it’s important to understand which one aligns with your goals.

Home Depot Consumer Credit Card

This is the standard version of the card, ideal for everyday purchases at Home Depot. Whether you’re buying paint, tools, or gardening supplies, this card offers special financing options. For example, if your purchase is over $1,000, you may qualify for 6–12 months of deferred interest financing. This means you won’t pay interest if you pay off the balance within the promotional period.

Home Depot Project Loan Card

If you’re tackling a larger project, like a kitchen remodel or a new roof, the Project Loan Card might be a better fit. This card allows you to borrow between 1,000 and 1,000 and 55,000, with fixed monthly payments and a fixed interest rate. I found this option particularly useful for budgeting big-ticket projects without worrying about fluctuating interest rates.

Before applying, assess the scope of your project. If it’s a small repair, the Consumer Credit Card should suffice. For major renovations, the Project Loan Card offers more flexibility.

2. Exclusive Financing Offers

One of the standout features of the Home Depot Credit Card is its special financing offers. As someone who loves saving money, I was thrilled to learn about these perks.

- Deferred Interest Financing: For purchases over $1,000, you can enjoy 6–12 months of deferred interest. This means if you pay off the balance within the promotional period, you won’t incur any interest charges.

- 24-Month Financing: For purchases over $2,299, you may qualify for 24-month financing with fixed monthly payments. This is perfect for larger projects where you need more time to pay off the balance.

If you don’t pay off the balance within the promotional period, interest will be charged from the original purchase date. So, make sure you’re confident in your ability to meet the deadline.

How to Get a Business Credit Card

3. No Annual Fee and Easy Application Process

As someone who dislikes hidden fees, I was pleased to learn that the Home Depot Credit Card has no annual fee. This makes it a cost-effective option for frequent Home Depot shoppers.

The application process is also straightforward. You can apply online or in-store, and you’ll typically receive a decision within minutes. To apply, you’ll need to provide basic information like your name, address, Social Security number, and annual income.

If you’re planning a big purchase, consider applying for the card beforehand. This way, you can take advantage of the financing offers right away.

4. Rewards and Discounts

While the Home Depot Credit Card doesn’t offer traditional rewards like cashback or travel points, it does come with some exclusive discounts and perks.

- Special Offers: Cardholders often receive exclusive discounts and promotions, such as $25 off your first purchase or discounts on select items.

- Returns and Exchanges: The card simplifies returns and exchanges, making it easier to manage your purchases.

I’ve used the card to take advantage of seasonal sales, saving hundreds of dollars on tools and materials. If you’re a frequent Home Depot shopper, these discounts can add up over time.

See; What is a Student Credit Card?

5. Considerations Before Applying

While the Home Depot Credit Card offers many benefits, it’s important to weigh the pros and cons before applying. Here are a few things I considered:

- High APR: If you don’t qualify for promotional financing or miss a payment, the card’s APR can be quite high, ranging from 17.99% to 26.99%.

- Limited Use: The card can only be used at Home Depot stores, their website, and affiliated brands. If you’re looking for a card with broader usability, this might not be the best option.

- Credit Score Impact: Like any credit card, applying for the Home Depot Credit Card will result in a hard inquiry on your credit report, which can temporarily lower your score.

If you’re unsure about your creditworthiness, check your credit score before applying. This will give you a better idea of your chances of approval.

See; Guide to Understanding Your Credit Score

Final Thoughts

After using the Home Depot Credit Card for several projects, I can confidently say it’s a valuable tool for anyone who frequently shops at Home Depot. The special financing offers, exclusive discounts, and flexible payment options make it a standout choice for home improvement enthusiasts.

However, it’s not without its drawbacks. The high APR and limited usability mean it’s best suited for those who are committed to paying off their balance on time and primarily shop at Home Depot.

If you’re planning a home improvement project and want to save money while managing your budget, the Home Depot Credit Card is worth considering. Just make sure to read the terms and conditions carefully and use the card responsibly.