When I first stumbled upon Firstnationalcc.com Accept, I was curious about how it could simplify the process of applying for a credit card. Like many of you, I’ve faced the confusion of navigating financial applications, wondering if there’s an easier way to access the tools I need to manage my finances. The First National Credit Card, offered through Firstnationalcc.com/accept, promises a straightforward path to financial empowerment, and I’m excited to share what I’ve learned about it. In this article, I’ll break down everything you need to know about this platform, from how it works to why it might be the right choice for you, all in simple, everyday language.

You might be wondering why a credit card application process deserves its own spotlight. Well, I’ve been there, sifting through endless forms, trying to figure out what numbers or codes I need, and hoping I’m not missing a step. Firstnationalcc.com/accept is designed to make this process feel less like a chore and more like a step toward achieving your financial goals. Whether you’re rebuilding credit or just looking for a reliable card, I’ll walk you through the ins and outs of this platform, sharing tips and insights to help you feel confident. Let’s explore what makes Firstnationalcc.com/accept stand out.

Firstnationalcc.com Accept: What It’s All About

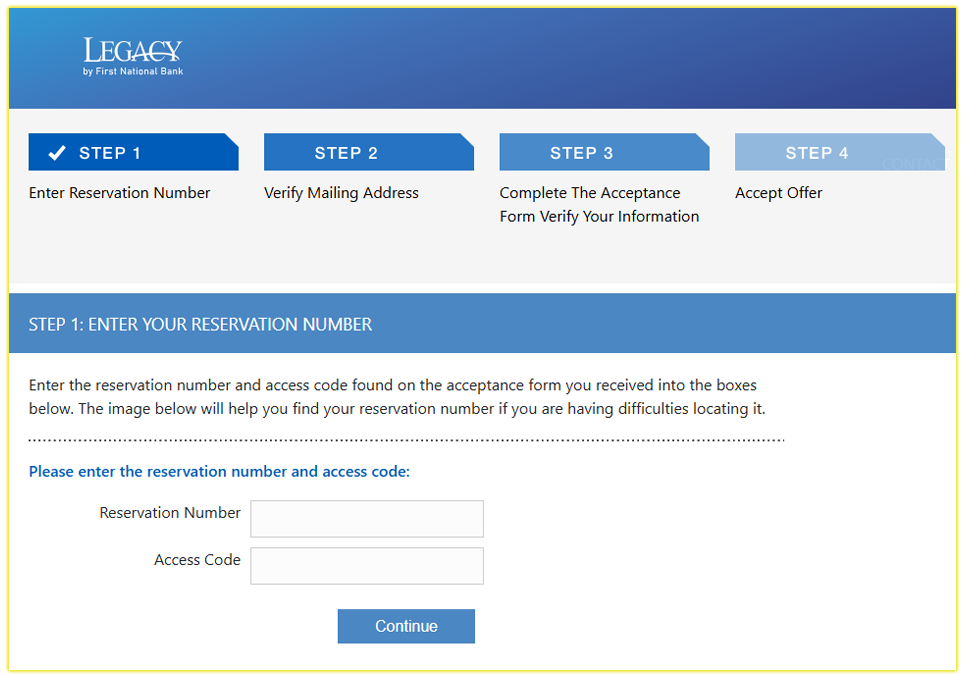

Firstnationalcc.com Accept is the online portal where you can apply for the First National Credit Card, specifically the Legacy Visa Credit Card, issued by First National Bank. I remember the first time I visited the site; I was struck by how user-friendly it seemed compared to other financial websites. You’re prompted to enter a Reservation Number, a unique code sent to you via mail or email if you’ve been pre-selected for the card. This number is your golden ticket to starting the application process, and it’s designed to make things quick and personalized.

When you land on Firstnationalcc.com/accept, you’ll notice the interface is clean and simple. You don’t need to be a tech wizard to navigate it. Just enter your Reservation Number, and the site guides you through the steps to complete your application. I found this refreshing because, let’s be honest, financial websites can sometimes feel like a maze. The platform is built to help you apply with confidence, ensuring you know exactly what information you need to provide. It’s all about removing the guesswork, so you can focus on what matters—getting a card that fits your needs.

The Legacy Visa Credit Card, which you’re applying for through this portal, is tailored for people like you and me who might be working on building or rebuilding credit. I’ve learned that it’s accepted anywhere Visa is, which is a huge plus for everyday purchases. Plus, responsible use can help improve your credit score over time. You’ll also get access to online account management tools, which I’ll cover later, to keep track of your spending and payments. For now, just know that Firstnationalcc.com/accept is your starting point to accessing these benefits.

Why Choose the First National Credit Card?

You might be asking yourself, “Why should I consider the First National Credit Card?” I asked the same question when I first explored Firstnationalcc.com/accept. The answer lies in its simplicity and focus on helping people in various financial situations. Whether you’re starting fresh or recovering from past credit challenges, this card offers a practical way to build a stronger financial foundation. I’ve seen how overwhelming it can be to choose a credit card, so let me share a few reasons why this one caught my attention.

First, the card is designed with flexibility in mind. You can use it for everyday purchases, from groceries to gas, and it’s accepted worldwide wherever Visa is welcomed. I love that it doesn’t restrict you to specific stores or categories. Another big draw is the potential to increase your credit limit over time. I read testimonials from cardholders who mentioned their limits went up after consistent, responsible use—pretty motivating, right? This can give you more purchasing power as you prove you’re a reliable cardholder.

Another thing I appreciate is the transparency. When you apply through Firstnationalcc.com/accept, you’re not left wondering what’s next. The site clearly outlines the steps, and once approved, you get access to tools like custom alerts and paperless statements. These features make it easier for you to stay on top of your account. I’ve found that having these tools at my fingertips helps me feel more in control of my finances, and I’m sure you’ll find them helpful too.

How to Apply Using Firstnationalcc.com/accept

Let’s get to the nitty-gritty: how do you actually apply for the card? I’ll walk you through the process step-by-step, just like I wish someone had done for me when I first started exploring credit card options. The good news is that Firstnationalcc.com/accept makes it pretty straightforward, but there are a few things you’ll want to have ready to ensure a smooth experience.

First, you’ll need that Reservation Number I mentioned earlier. This is a unique code sent to you by First National Bank, usually through a mailed offer or email. If you don’t have one, you might not be able to apply directly through Firstnationalcc.com/accept, but you can contact their Customer Service at 888-883-9824 to check your eligibility. Once you have the number, head to the website and enter it in the designated field. You’ll also need to provide some personal information, like your name, address, and Social Security Number, to verify your identity.

After submitting your information, the application process typically takes just a few minutes. I was impressed by how quickly I could complete it no endless forms or confusing jargon. Once you submit, the bank reviews your application, and you’ll usually hear back within a few days. If approved, you’ll receive your Legacy Visa Credit Card in the mail, along with details on how to activate it. Pro tip: make sure your browser is up-to-date (Firefox, Chrome, or Edge work best) to avoid any technical hiccups during the application.

Managing Your Account: Tools and Tips

Once you’re approved, the real fun begins—managing your card! I’ve always found that staying organized with my finances makes life so much easier, and Firstnationalcc.com/accept offers tools to help you do just that. After logging into your account, you can view recent transactions, check your balance, and set up custom alerts via text, email, or push notifications. These alerts are a lifesaver for keeping track of due dates or spotting unusual activity.

You can also enroll in paperless statements, which I highly recommend. Not only is it eco-friendly, but it also means less clutter in your mailbox. To set this up, log into your account, go to “Manage Statement Delivery Method,” and follow the prompts. If you prefer automatic payments to avoid missing due dates, you can set those up too. Just head to the “Payments” tab and enter your bank details. I’ve found that automating payments takes the stress out of remembering deadlines, and I bet you’ll appreciate the convenience too.

If you ever run into issues, like needing to dispute a charge or report a lost card, the Customer Service team is just a call away at 888-883-9824. I’ve had to contact customer support for other cards in the past, and it’s reassuring to know help is available when you need it. The mobile app, available on Google Play or the Apple App Store, is another handy tool for managing your account on the go. You can check your balance, make payments, or even request a due date change—all from your phone.

FAQs About Firstnationalcc.com Accept

Here are some common questions you might have about Firstnationalcc.com/accept, based on my own curiosity and what I’ve learned:

How long does it take to process my application?

Once you submit your application through Firstnationalcc.com/accept, it typically takes a few days to hear back. The exact time depends on the bank’s review process, but you’ll usually get a response within a week.

What if I don’t have a Reservation Number?

If you haven’t received a Reservation Number, you might not be pre-selected for the offer. Contact First National Bank’s Customer Service at 888-883-9824 to see if you’re eligible to apply.

Can I use the card anywhere?

Yes! The Legacy Visa Credit Card is accepted anywhere Visa is, which means you can use it for online shopping, in-store purchases, or even when traveling internationally.

Is there a fee for online payments?

Debit card payments made online or through a Customer Service Representative come with a $3.50 processing fee. ACH payments (from a checking account) don’t have this fee, so consider setting those up to save a bit.

How do I protect my account?

Use a strong, unique password and consider a password manager like LastPass or Dashlane. Also, enable custom alerts to stay informed about account activity. If you suspect fraud, report it immediately by calling 888-883-9824.

Tips for Responsible Credit Card Use

Using a credit card wisely is key to making the most of Firstnationalcc.com/accept. I’ve learned a few tricks over the years that I’d love to share with you. First, always pay your balance in full each month if you can. This helps you avoid interest charges and keeps your credit score healthy. If you can’t pay in full, aim to pay more than the minimum to reduce your balance faster.

Another tip is to keep your credit utilization low—ideally under 30% of your credit limit. For example, if your limit is $1,000, try not to carry a balance above $300. I’ve found this helps boost my credit score over time, and it’s a habit you can easily adopt. Also, check your account regularly for errors or unauthorized charges. The tools on Firstnationalcc.com/accept make this easy, so take advantage of them.

Finally, be patient. Building or rebuilding credit takes time, but every on-time payment and responsible purchase moves you closer to your goals. I’ve seen my own credit improve by sticking to these habits, and I’m confident you can achieve similar results with a bit of discipline.

Why Firstnationalcc.com Accept Stands Out

What makes Firstnationalcc.com/accept different from other credit card application platforms? For me, it’s the combination of simplicity, accessibility, and support. The Reservation Number system feels personal, like the bank is reaching out directly to you. The online tools and mobile app make managing your card a breeze, and the focus on helping people build credit shows a commitment to financial empowerment.

I also appreciate the transparency. There’s no hidden fine print or confusing terms to wade through. Everything is laid out clearly, from the application process to account management. For you, this means less stress and more confidence as you navigate your financial journey. Plus, the card’s acceptance at millions of Visa locations worldwide gives you the flexibility to use it however you need.

Wrapping Up

Exploring Firstnationalcc.com/accept has been an eye-opening experience for me, and I hope this guide has helped you understand what it’s all about. Whether you’re looking to build credit, manage everyday expenses, or simply want a reliable card, this platform offers a straightforward way to get started. By following the steps I’ve shared and using the card responsibly, you can take control of your financial future with confidence. Ready to take the next step? Grab your Reservation Number and head to Firstnationalcc.com/accept to begin your journey.

References

- First National Credit Card Official Website: https://www.firstnationalcc.com

- Legacy Visa Credit Card FAQs: https://www.firstnationalcc.com/FAQ

- Guide to Applying for Credit Cards: General information from various financial education resources.