Ever heard of the Total Visa Card and wondered if it’s the right fit for you? You’re not alone. This article will delve deep into everything you need to know about the Total Visa Card, from its features and benefits to the application process and even some frequently asked questions. So, whether you’re considering building credit or simply looking for a new credit card option, this comprehensive guide will equip you with the knowledge to make an informed decision.

What is a Total Visa Card?

The Total Visa Card is a credit card issued by issuing banks specifically designed for people with limited credit history or bad credit. It acts as a stepping stone to improve your credit score by offering the opportunity to build positive credit behavior through responsible use. While it boasts the benefits of a traditional Visa card, there are some key factors to consider before applying, which we’ll explore further in this article.

Total Visa Card Benefits

While some credit cards for rebuilding credit lack enticing rewards programs, the Total Visa Card offers a modest 1% cash back on purchases. This might seem small compared to other cards, but even a small reward can incentivize you to use your card responsibly and pay your balance in full each month, maximizing the benefit and avoiding interest charges.

Perhaps the biggest advantage of the Total Visa Card is that it reports your credit activity to all three major credit bureaus (Experian, Equifax, and TransUnion). This means that by using your card responsibly and making on-time payments, you can gradually build a positive credit history, which can open doors to better credit card options and loan opportunities in the future.

See; Onemain Financial Brightway Credit Card Reviews

Different Types of Credit Cards Total Visa Card Offers

Currently, there seems to be only one variation of the Total Visa Card offered. However, it’s important to understand the general categories of credit cards before deciding if the Total Visa Card aligns with your needs. Here’s a quick breakdown:

- Rewards Cards: These cards offer points, miles, or cash back on purchases, often with bonus categories for specific spending habits like travel or groceries. While the Total Visa Card offers a basic cashback program, it wouldn’t be categorized as a high-rewards card.

- Balance Transfer Cards: If you’re carrying a high balance on another credit card, a balance transfer card can help you consolidate your debt with a potentially lower interest rate for a limited introductory period. The Total Visa Card isn’t designed for balance transfers.

- Travel Cards: These cards offer benefits specifically geared towards travelers, such as airport lounge access, travel insurance, and bonus rewards on travel purchases. The Total Visa Card wouldn’t be considered a travel card.

- Secured Cards: Secured cards require a security deposit upfront, which becomes your credit limit. This can be a good option for individuals with no credit history or bad credit. While the Total Visa Card doesn’t function exactly like a secured card, it does cater to a similar audience.

Pre-approved Total Visa Card

Unfortunately, the Total Visa Card issuer doesn’t seem to offer pre-approval options. However, you can still check your eligibility by applying for the card. The application process typically involves a soft credit check, which won’t negatively impact your credit score.

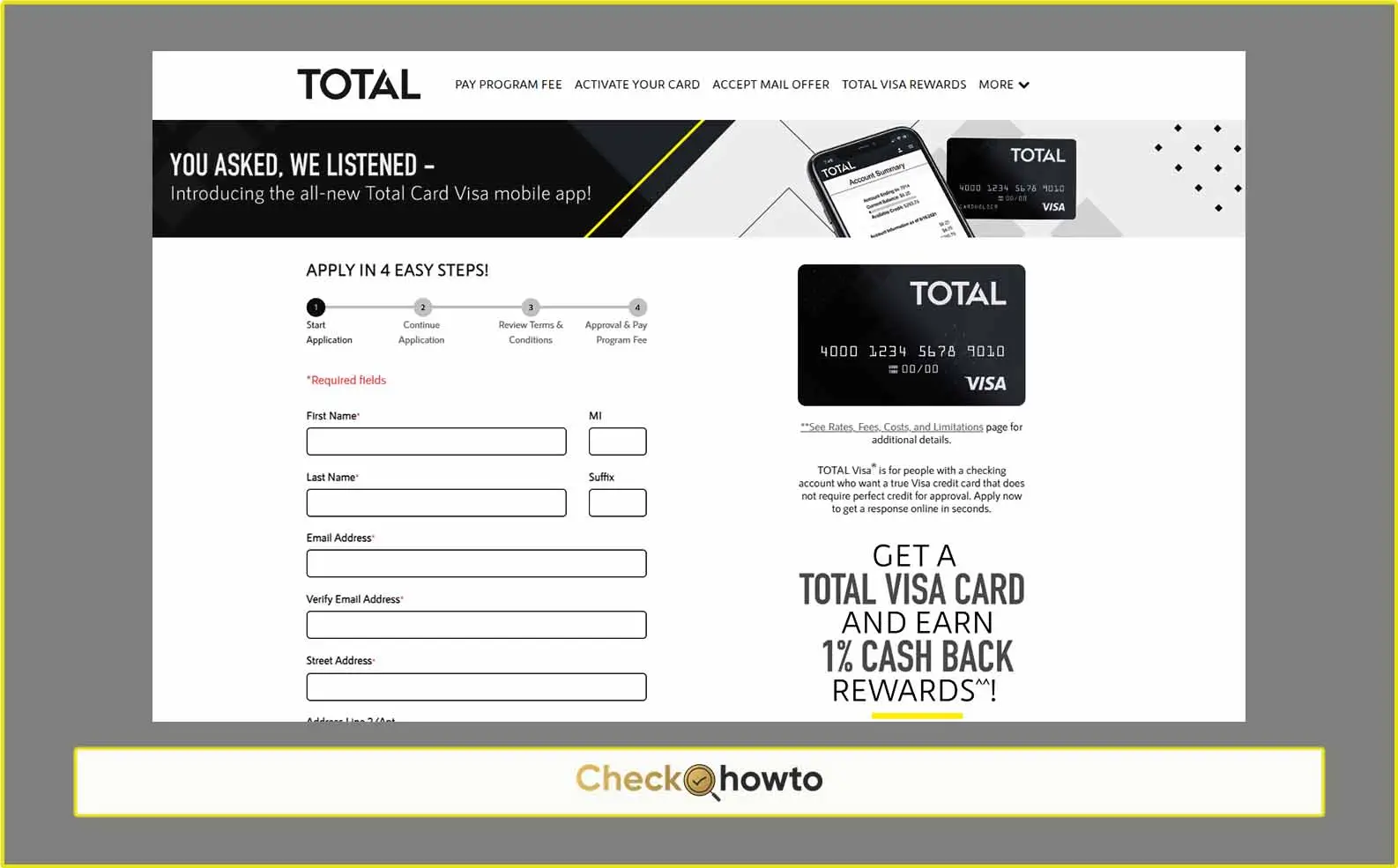

Apply For Total Card VISA

The application process for the Total Visa Card can likely be completed online through the issuer’s website. Be prepared to provide your personal information, employment details, and income information. Once you submit your application, you’ll receive a notification regarding the approval decision.

Activate Total Visa Card

If your application is approved, you’ll receive instructions on how to activate your Total Visa Card. This usually involves following a link or calling a phone number provided by the issuer. Once activated, your card will be ready for use.

How to Pay Your Program Fee or Activate Your Card

Specific details on paying your program fee or activating your card will likely be included in the welcome packet you receive with your new card. It’s also likely you’ll find this information on the issuer’s website or by calling customer service.

Total Visa Rewards

As mentioned earlier, the Total Visa Card offers a basic 1% cash back rewards program on purchases. While not the most lucrative rewards program on the market, it can still provide some incentive to use your card responsibly and pay your balance in full each month.

How to Download the Total Visa Card App

There currently isn’t any information readily available regarding a dedicated Total Visa Card app. It’s best to check the issuer’s website or contact customer service to see if there’s a mobile app for managing your account.

See; 5 Things You Need to Know About Big Star Credit

5 Things to Know About Community First Credit Union

Total Visa Credit Card Sign Up

Signing up for the Total Visa Card involves submitting an application online through the issuer’s website. The application process typically requires basic personal information, employment details, and income information. Once you submit your application, you’ll receive a notification regarding the approval decision. There’s a program fee associated with the Total Visa Card, which you’ll need to pay if your application is approved. This fee typically needs to be settled before your card is activated.

Here’s a more detailed breakdown of the potential Total Visa Card sign-up process:

- Visit the Issuer’s Website: Locate the official website of the bank issuing the Total Visa Card. This information should be readily available during your research phase.

- Navigate to the Application Page: Look for a dedicated section for credit card applications. You might find it labeled as “Credit Cards,” “Apply Now,” or something similar.

- Choose the Total Visa Card: Once on the application page, identify the specific section for the Total Visa Card.

- Complete the Application Form: The online form will likely request personal information like your name, address, date of birth, Social Security number, and contact details. Employment information such as your employer’s name and income details will also be required.

- Review and Submit: Carefully review all the information you’ve entered to ensure accuracy. Once everything seems correct, submit the application form electronically.

- Approval Decision: The issuer will review your application and inform you of their decision within a short timeframe. This notification might come via email, phone call, or a message displayed on the website after submitting the application.

- Pay Program Fee (if approved): If your application is approved, you’ll likely receive instructions on how to pay the program fee associated with the Total Visa Card. This fee can typically be settled online or through a phone payment system.

- Card Activation: Once the program fee is settled, you’ll receive instructions on activating your card. This process might involve following a link in an email, calling a phone number, or visiting a specific section on the issuer’s website.

Total Visa Card Login

Assuming the Total Visa Card offers online account management, you should be able to log in to your account after successful card activation. The login portal will likely be located on the issuer’s website. To log in, you’ll typically need your credit card number, a username or account number you create during the application process, and a secure password. Once logged in, you can potentially manage your account by:

- Viewing your account balance and transaction history

- Making online payments

- Downloading your monthly statements

- Updating your contact information

See; Credit Hero Score Login at Creditheroscore.com

Big Star Credit Login at Bigstarcredit.com

Total Visa Card Customer Service

The issuer should provide customer service options for any questions or concerns you might have regarding your Total Visa Card. Here are some potential ways to reach customer service:

- Phone: A dedicated phone number for Total Visa Card customer service might be listed on the issuer’s website or included in the welcome packet you receive with your card.

- Secure Messaging: The issuer’s website might offer a secure messaging system where you can communicate with customer service representatives electronically.

- Live Chat: Some issuers offer live chat functionality on their website, allowing you to chat with a customer service representative in real-time.

FAQs

Here are some frequently asked questions regarding the Total Visa Card:

How much is the credit limit for a Total Visa Card?

Unfortunately, readily available information regarding the specific credit limit offered with the Total Visa Card is limited. It’s best to consult the issuer’s website or contact customer service for details on the typical credit limit for this card.

What is the credit limit for Total Select?

It’s important to note that there currently isn’t any information available regarding a “Total Select” variation of the Total Visa Card. The focus seems to be on a single card option.

How long does it take for a Total Visa Card to arrive?

Once your card is approved and activated, you can expect to receive it in the mail within approximately two weeks. This timeframe can vary depending on the issuer’s processing timelines and your mailing address.

What is the Total Card Limit?

As mentioned previously, specific details on the credit limit for the Total Visa Card are limited. Consulting the issuer directly is the best way to get a definitive answer.

How Do I Activate My Total Visa Card?

Instructions on activating your Total Visa Card will likely be provided after your application is approved. This information might come via email, phone call, or a message displayed on the issuer’s website after submitting the application.

Is $5,000 Credit Card Limit Good?

A $5,000 credit limit can be considered good, especially for individuals with limited credit history. However, credit limits can vary depending on the card and your creditworthiness.

What’s the highest credit limit?

There’s no single “highest” credit limit across all cards. Credit card issuers offer varying limits based on the specific card and your individual creditworthiness. However, some premium reward cards can offer limits exceeding $20,000.

Can I get a $500 credit card?

Yes, it is possible to obtain a credit card with a limit as low as $500. Secured cards, often used to build credit, typically come with lower limits. The Total Visa Card might fall into this category, but again, it’s best to confirm with the issuer.

Can I use my total credit limit?

It’s generally advisable not to utilize your entire credit limit. Ideally, you should aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total limit) below 30%. This can positively impact your credit score.

How can I get a 15000 credit limit?

Obtaining a credit limit of $15,000 typically requires a good to excellent credit history. Building a strong credit score through responsible credit card use and on-time payments is key to achieving higher credit limits.

How is Total Credit Limit Calculated?

Credit card issuers consider various factors when determining your credit limit, including your credit score, income, employment history, and existing debts. They use this information to assess your ability to repay borrowed funds.

Additional Considerations

Before applying for the Total Visa Card, it’s crucial to weigh the pros and cons carefully. Here are some additional factors to consider:

- Fees: The Total Visa Card comes with a program fee and potentially monthly service fees. These fees can significantly eat into any rewards earned.

- Interest Rates: The Total Visa Card is likely to have a high Annual Percentage Rate (APR). Interest charges can quickly accumulate if you don’t pay your balance in full each month.

- Alternatives: Explore other credit card options specifically designed for building credit. Some cards might offer lower fees, better rewards programs, or even introductory periods with 0% APR.

Conclusion

The Total Visa Card can be a stepping stone for those seeking to build credit. However, the high fees and potentially high APR make it a less attractive option compared to other credit card choices. Carefully consider your financial situation and credit goals before applying. By taking the time to research alternative cards and understand the associated fees and interest rates, you can make a more informed decision that aligns with your financial needs.