Why Timely AT&T Bill Payments Matter

Paying my AT&T bill on time keeps my services running smoothly and helps me avoid extra charges, which can add up quickly. AT&T offers a variety of payment methods, so you can pick one that fits your schedule and preferences.

Whether you’re tech-savvy or prefer traditional methods, there’s an option for you. By understanding these choices, you can stay on top of your account and enjoy uninterrupted connectivity.

AT&T Bill Pay Online

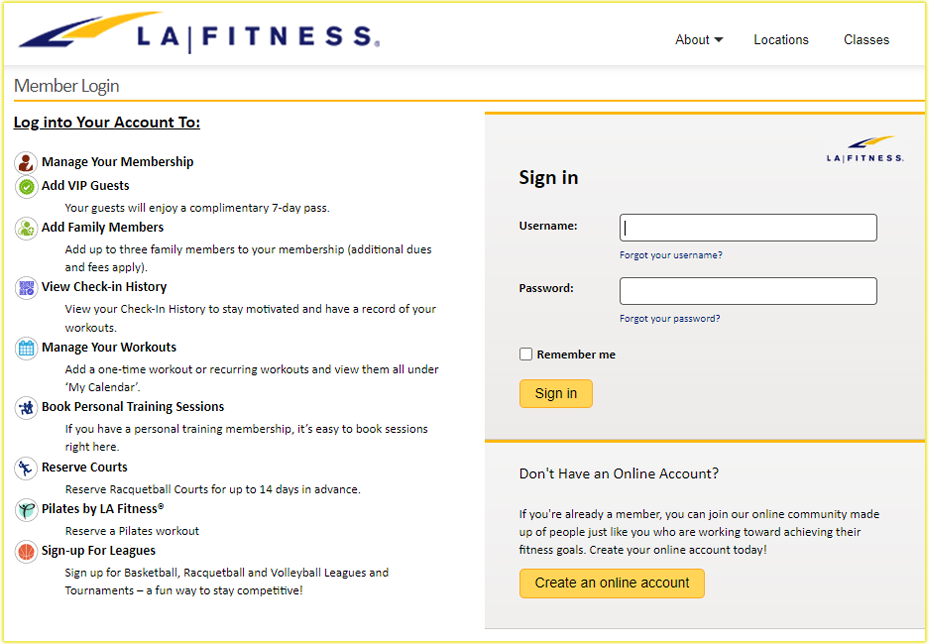

Using the myAT&T Website

I often pay my bill through the AT&T website because it’s fast, secure, and doesn’t always require logging in. Here’s how you can do it:

- Navigate to the Payment Portal: Visit www.att.com and find the “Pay Your Bill” section, usually under the “Billing & Payments” tab. The quick-pay option is perfect if you’re short on time.

- Enter Account Information: You’ll need your AT&T account number or the phone number linked to your account. I store my account number in a password manager for quick access, and I recommend you do the same for convenience.

- Select a Payment Method: Options include credit/debit cards (Visa, MasterCard, etc.), checking accounts, or digital wallets like Apple Pay or Google Pay. I’ve noticed occasional glitches with Apple Pay, so have a backup card ready just in case.

- Review and Submit: Verify the payment amount and account details, then submit. You’ll receive a confirmation email, which I always save in a dedicated folder for record-keeping.

Pro Tip: Signing into your myAT&T account unlocks additional features, like viewing detailed billing statements, tracking data usage, and setting up payment reminders. It’s a game-changer for staying organized.

Using the myAT&T App

The myAT&T app is my go-to when I’m on the move. You can download it from the App Store or Google Play. Here’s how you can pay through the app:

- AT&T login pay bill: Open the app and sign in with your AT&T credentials. If you don’t have an account, you can create one in minutes.

- Go to Billing: Tap the billing section to see your current balance, due date, or past payments. The app’s interface is intuitive, making it easy to spot any unusual charges.

- Make a Payment: Choose your payment method, enter the amount (or pay the full balance), and confirm. I love how the app lets me handle everything in under a minute.

- Explore Extra Features: You can also check your plan details, upgrade services, or chat with support directly in the app.

Why I Like It: The app’s convenience is unmatched, especially if you’re juggling a busy schedule. It also sends push notifications for due dates, which has saved me from missing a payment more than once.

Pay AT&T Bill on the Phone

When I need to clarify a charge or prefer a guided process, I pay my bill by phone. You can do this too with these steps:

- Call AT&T: Dial 800-331-0500 or *729 (*PAY) from your AT&T mobile device. The call is free from your AT&T phone, which I appreciate.

- Follow the Automated Prompts: The system guides you to the payment section. You can use voice commands or keypad inputs. If you need help, press “0” to speak with a representative.

- Provide Payment Details: Enter your credit/debit card or bank account information. I always read the numbers aloud to ensure accuracy.

- Get Confirmation: You’ll receive a confirmation number at the end of the call. I jot it down in my notes app for reference.

Note: Phone payments take a bit longer than online methods, especially if you speak with a representative.

However, it’s a solid option if you’re without internet or want to discuss billing questions. Be prepared for potential wait times during peak hours.

Paying my AT&T bills In Person

Sometimes, I prefer the personal touch of paying my bill in person. You can visit an AT&T store or authorized retailer to do the same:

- Locate an AT&T Store: Use the store locator on www.att.com to find a nearby location. I always check the store hours and address to plan my visit.

- Bring Necessary Details: Have your account number or phone number ready, along with your payment method (cash, credit/debit card, or check). I carry a copy of my bill just in case.

- Authorized Retailers: Some third-party locations, like Walmart or Kroger, offer AT&T bill payment services for a small fee (typically $2–$4). You can pay while running errands, which I find super convenient.

My Experience: In-person payments are great for resolving billing disputes or upgrading devices at the same time. The staff at AT&T stores are usually knowledgeable, and I leave with a printed receipt for peace of mind.

Pay your AT&T Bill by Mail

On rare occasions, I’ve mailed a payment when I wanted to avoid digital transactions. It’s a bit old-school, but here’s how you can do it:

- Prepare Your Payment: Write a check or money order payable to “AT&T.” Include your account number on the memo line to ensure proper crediting.

- Find the Mailing Address: Check your bill or the AT&T website for the correct payment address, as it varies by region. I once sent a payment to the wrong address by mistake, so double-check this step.

- Mail Early: Allow 5–7 business days for processing. I use certified mail to track delivery and confirm it arrives before the due date.

Heads-Up: Mailing payments is slower and less common, so I only use it as a last resort. If you’re close to the due date, opt for a faster method to avoid late fees.

Setting Up AutoPay for Effortless Payments

One of my best decisions was enrolling in AT&T’s AutoPay, which automatically deducts my bill each month. It saves time and often comes with discounts. Here’s how you can set it up:

- Enroll via myAT&T: Log into your account on the website or app, navigate to the billing section, and select “Sign up for AutoPay.” You may be eligible for a $5–$10 monthly discount, depending on your plan.

- Choose a Payment Method: Link a credit/debit card or bank account. I use my debit card to track payments easily through my bank’s app.

- Review Settings: Confirm the payment date and amount. You can adjust or cancel AutoPay anytime if your needs change.

Why I Love AutoPay: It eliminates the stress of remembering due dates, and the discount is a nice perk. Just make sure your linked account has sufficient funds to avoid overdraft fees.

Understanding Your AT&T Bill

I always review my bill before paying to catch any errors or unexpected charges. You can do the same by:

- Checking Online: Log into myAT&T to view a detailed breakdown of charges, including talk, text, data, and any additional fees (like device installments). I once spotted an overage charge that prompted me to switch to an unlimited plan.

- Reading Your Paper Bill: If you receive paper statements, they include a summary of charges and a detachable payment stub. Look for sections like “Monthly Charges” and “One-Time Charges” to understand your costs.

- Using the App: The myAT&T app displays your bill in an easy-to-read format. You can tap into specific categories, like data usage, to see where your money’s going.

- Contacting Support: If anything looks off, call 800-331-0500 or visit a store. I resolved a billing error by chatting with a representative through the app, which was faster than I expected.

Key Charges to Watch: Look out for taxes, surcharges, or promotional credits expiring, as these can affect your total. I also check for autopay or paperless billing discounts to ensure they’re applied.

What to Do If You Can’t Pay on Time

I’ve had months where paying my full bill on time was challenging, and AT&T offers solutions to help. If you’re in a pinch, try these:

- Request a Payment Arrangement: Log into myAT&T or call AT&T to set up a payment plan. You can split your balance into manageable installments. I’ve used this once and appreciated the flexibility.

- Act Promptly: Contact AT&T before your bill is overdue to avoid service interruptions or late fees (typically $9 per service). I set a calendar reminder a week before my due date to stay proactive.

- Check for Assistance Programs: AT&T offers programs like Lifeline for eligible low-income customers. Visit www.att.com/support to see if you qualify.

Troubleshooting Common Payment Issues

Over the years, I’ve encountered a few hiccups when paying my bill. Here are common issues and how you can address them:

- Payment Not Processing: If your online payment fails, double-check your card or bank details. I once entered an expired card by mistake, and switching to another method fixed it.

- Incorrect Bill Amount: If your bill seems high, review the detailed statement for overages or new fees. You can dispute errors by contacting AT&T support.

- AutoPay Not Working: Ensure your linked account has funds and the card isn’t expired. I had to update my AutoPay after getting a new debit card.

- Late Payment Fees: If you’re charged a late fee, call AT&T to explain your situation. I’ve had fees waived by politely requesting a one-time courtesy.

Tips for a Seamless Payment Experience

Here are my top tips to make paying your AT&T bill stress-free:

- Save Account Details Securely: Store your account number in a password manager or secure note for quick access.

- Set Up Alerts: Use myAT&T’s email or text reminders to stay on top of due dates. I set a backup reminder on my phone’s calendar.

- Verify Payments: Always check your confirmation email or app for proof of payment. I screenshot confirmations for my records.

- Explore Discounts: Enroll in AutoPay and paperless billing for potential savings. I save $10 a month on my wireless plan this way.

- Plan for Processing Times: Online and phone payments post within 24 hours, but mailed payments take longer. Plan accordingly to avoid delays.

Frequently Asked Questions (FAQs)

How can I find my AT&T account number?

You can find your account number on your bill (paper or digital), in the myAT&T app, or on the myAT&T website under your account profile. I keep mine saved in a secure note on my phone for quick reference.

Is there a fee for paying my AT&T bill online or through the app?

No, AT&T doesn’t charge fees for online or app payments. However, some authorized retailers (like Walmart) may charge a convenience fee of $2–$4 for in-person payments.

Can I pay my AT&T bill with a credit card?

Yes, you can use major credit cards (Visa, MasterCard, etc.), debit cards, checking accounts, or digital wallets like Apple Pay. I prefer my debit card for easier tracking, but credit cards work just as well.

What happens if I miss my AT&T bill due date?

If you miss the due date, you may face a late fee (around $9 per service) or service interruptions. I recommend contacting AT&T immediately to set up a payment arrangement and avoid penalties.

How do I know if my payment went through?

You’ll receive a confirmation email or text after paying online, through the app, or by phone. In-store payments come with a receipt. I always check myAT&T to confirm the payment posted to my account.

Can I pay someone else’s AT&T bill?

Yes, you can pay another person’s bill using the quick-pay option on www.att.com or at a store. You’ll need their account number or phone number. I’ve done this for a family member by entering their details online.

How do I cancel AutoPay if I no longer want it?

Log into myAT&T, go to the billing section, and select “Manage AutoPay” to turn it off. I once canceled it temporarily when switching bank accounts, and the process was straightforward.

Are there discounts for paying my bill a certain way?

Yes, enrolling in AutoPay and paperless billing can save you $5–$10 per month, depending on your plan. I’ve saved $120 a year on my wireless plan by doing both.

Can I pay my AT&T bill in installments?

If you can’t pay the full amount, contact AT&T to set up a payment arrangement. I’ve used this option during tight months, and it helped me avoid service disruptions.

What should I do if I don’t understand a charge on my bill?

Review your bill details in myAT&T or call 800-331-0500 to speak with a representative. I once clarified a surcharge by chatting with support through the app, and they explained it was a temporary regulatory fee.

Final Thoughts

Paying my AT&T bill has become second nature thanks to the variety of options available. Whether you prefer the convenience of the myAT&T app, the personal touch of in-store payments, or the reliability of AutoPay, there’s a method that suits your lifestyle.

I recommend starting with the app or AutoPay for ease, but explore all options to find your perfect fit. By reviewing your bill regularly and acting promptly if issues arise, you can keep your services running smoothly and avoid surprises.