As a long-time Westpac customer, I’ve found their online banking platform to be a reliable and convenient way to manage my finances. Whether you’re paying bills, checking balances, or transferring funds, Westpac Online Banking offers a secure and user-friendly experience.

What Is Westpac Online Banking?

Westpac Online Banking is a secure digital platform that allows you to manage your personal, business, or corporate accounts from anywhere, anytime.

Established in 1817 as the Bank of New South Wales, Westpac has evolved into a trusted institution serving over 13 million customers worldwide.

I find its online banking system particularly appealing because it combines accessibility with advanced features tailored to diverse financial needs.

You can access it via the Westpac website or the mobile app, available on iOS and Android, ensuring flexibility for your busy lifestyle.

Key Features of Westpac Online Banking

When I first signed up, I was impressed by the range of tools at my fingertips. Here’s what you can expect:

- Account Management: View real-time balances, transaction histories, and e-Statements for your savings, checking, credit card, or loan accounts. You can nickname accounts for easy identification, which I find incredibly handy for organizing multiple accounts.

- Payments and Transfers: Make instant transfers between Westpac accounts or pay bills via BPAY. You can also set up recurring payments, saving you time on routine expenses.

- Westpac Protect™ Security Code: This feature sends a one-time passcode to verify transactions, adding an extra layer of protection against fraud. I’ve used this for high-value transfers, and it gives me peace of mind knowing my money is secure.

- Money Management Tools: Budgeting tools and spending insights help you track expenses and plan for the future. I love how the app categorizes my spending, making it easy to spot areas where I can save.

- SafeCall: An Australian-first feature, SafeCall lets you confirm calls from Westpac through the app, protecting you from scammers. This is a game-changer in today’s world of increasing cyber threats.

- Business Banking: If you run a business, you can switch seamlessly between personal and business accounts in the app. Features like transaction tracking and data feeds simplify cash flow management.

These features are designed with you in mind, ensuring a user-friendly experience whether you’re paying a bill or managing a complex business portfolio.

Enrolling in Westpac Online Banking

When I first signed up for Westpac Online Banking, I was impressed by how straightforward the process was. You can complete enrolment in just a few minutes, and I’ll walk you through each step to ensure you’re set up successfully.

Gather Your Account Details

To enrol, you’ll need your Westpac account details. This could be your account number, card number, or customer ID, which you can find on your bank statement or welcome letter.

If you’re unsure, you can retrieve your customer ID via the Westpac App or by contacting Westpac’s support team at 1300 655 505 (or +61 2 9155 7700 if you’re overseas). Having these details ready will make the process smoother.

Visit the Westpac Website

Head to the official Westpac website (www.westpac.com.au) and navigate to the Online Banking section. Look for the “Register” or “Sign Up” button, typically found on the login page.

Clicking this will take you to the enrolment form. I recommend using a secure, private device to protect your personal information during this step.

Complete the Registration Form

You’ll be prompted to enter your customer ID or account details, along with some personal information to verify your identity. This might include your name, date of birth, and contact details.

Westpac uses this information to ensure your account is secure. When I registered, I found it helpful to double-check my entries to avoid any errors that could delay the process.

Set Up Your Login Credentials

Next, you’ll create a password. Westpac requires a strong password with at least eight characters, including one uppercase letter, one number, and one special character. I suggest choosing a unique password that you don’t use for other accounts to enhance security.

You may also be asked to set up security questions or enable two-factor authentication, such as Westpac Protect™ Security Code, which sends a one-time passcode to your phone for added protection.

Confirm and Activate Your Account

Once you submit the form, Westpac will verify your details. You may receive a confirmation email or SMS with a link or code to activate your online banking account.

Follow the instructions to complete the setup. When I did this, the activation link arrived within minutes, and clicking it took me straight to the login page.

Troubleshooting Enrolment Issues

If you encounter issues during enrolment, such as an error message or a missing confirmation email, don’t worry. I’ve had to troubleshoot a few hiccups myself.

First, check your spam or junk folder for the confirmation email. If you still can’t proceed, contact Westpac’s support team. They’re available 24/7 and can help resolve issues like incorrect account details or technical glitches.

Logging Into Westpac Online Banking

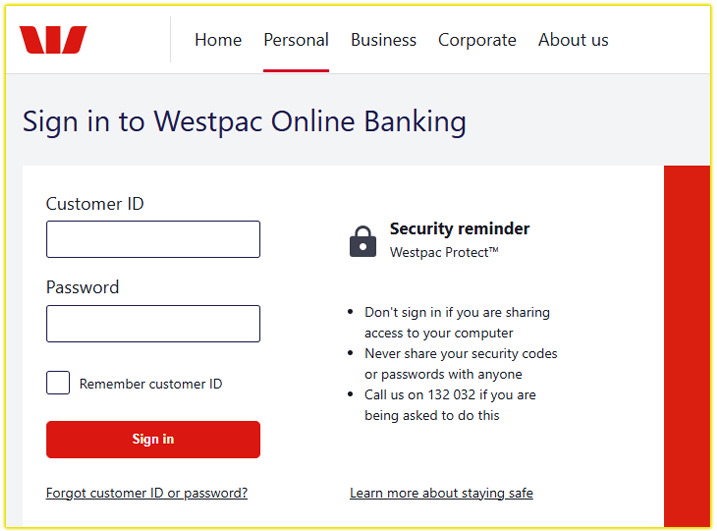

Now that you’re enrolled, logging in is a breeze. I access my account regularly to check transactions or pay bills, and the process is quick and secure. Here’s how you can log in:

Go to the Login Page

Visit www.westpac.com.au or open the Westpac mobile app, available on Google Play or the App Store. On the website, click the “Sign In” button for Online Banking.

If you’re using the app, tap the login icon. I prefer the app for its convenience, especially when I’m on the go.

Enter Your Credentials

Input your customer ID and password. If you’ve enabled biometric login (like fingerprint or face recognition) on the app, you can use that for faster access.

I set up biometric login, and it’s saved me time while keeping my account secure. If you’ve forgotten your password, click “Forgot Password” to reset it via email or SMS.

Complete Two-Factor Authentication

For added security, you may need to enter a Westpac Protect™ Security Code sent to your registered phone number. This step ensures that only you can access your account. I’ve found this extra layer of protection reassuring, especially when logging in from a new device.

Access Your Account

Once authenticated, you’ll land on the Online Banking dashboard. From here, you can view your account balances, transfer money, pay bills, or explore budgeting tools.

The interface is intuitive, with a search bar to quickly find transactions or features. I often use the search function to track specific payments, and it’s a real time-saver.

How I Login to My Westpac Online Banking Account

Benefits of Using Westpac Online Banking

As a user, I’ve experienced firsthand how Westpac Online Banking enhances financial control. Here are some benefits you’ll enjoy:

- Convenience: Manage your finances 24/7 without visiting a branch. Whether you’re at home or traveling, you can check balances, pay bills, or apply for loans with a few clicks.

- Security: Westpac guarantees to repay funds lost to online banking fraud, provided you comply with their Terms and Conditions. Features like SafeCall and Westpac Protect™ further safeguard your accounts.

- Cost-Effective: There are no establishment or ongoing fees for accessing Online Banking, though some payment processing fees may apply. This makes it an affordable option for everyday banking.

- Mobile Integration: The Westpac app, rated #1 by Forrester in 2024, offers seamless integration with digital wallets and biometric logins. I appreciate how I can use fingerprint or face ID to access my accounts instantly.

- Comprehensive Support: If you encounter issues, you can use the app’s chat feature, call 1300 655 505 (or +61 2 9155 7700 from overseas), or browse FAQs. I’ve used the chat support and found it responsive, though some users report occasional disconnections.

Tips for a Seamless Westpac Online Banking Experience

To help you get the most out of Westpac Online Banking, I’ve compiled some practical tips based on my experience:

- Update the App Regularly: Recent user reviews highlight occasional glitches, such as slow performance or login issues. Westpac often releases updates to fix these, so keep your app updated. If issues persist, clear the app’s data (Settings > Apps > Westpac > Storage > Clear Data) and restart your device, as suggested by Westpac’s support team.

- Use Nicknames for Accounts: If you’re a sole trader or manage multiple accounts, nicknaming them (e.g., “Savings,” “Business”) keeps things organized. I wish the app had a tab to separate personal and business accounts, but nicknames work well.

- Opt Out of Unnecessary Cards: When opening new accounts, you may receive debit cards you don’t need. Contact Westpac to deactivate unused cards to declutter your account dashboard.

- Explore Budgeting Tools: Take advantage of the app’s spending insights to set financial goals. I’ve used these to cut back on non-essential expenses, and they’re surprisingly easy to customize.

- Stay Vigilant Against Scams: Always verify calls via SafeCall and avoid sharing your Westpac Protect™ codes. If something feels off, contact Westpac immediately.

Why Choose Westpac Online Banking?

Westpac Online Banking stands out for its blend of security, convenience, and innovation. As someone who relies on digital banking, I appreciate how Westpac balances user-friendly features with robust protections like SafeCall and Westpac Protect™.

The platform’s recognition as Australia’s #1 banking app in 2024 by Forrester underscores its quality, though it’s not without minor flaws.

For you, the choice comes down to your priorities, whether it’s seamless mobile access, comprehensive business tools, or peace of mind against fraud.

If you’re considering Westpac, I encourage you to explore the platform yourself. Registering takes minutes, and the free access means you can test it without commitment.

For more details, visit www.westpac.com.au or download the app. If you have questions, Westpac’s support team is just a call or chat away.

Conclusion

Westpac Online Banking has transformed how I manage my finances, and I’m confident it can do the same for you. From real-time account tracking to advanced security features, it’s a powerful tool for anyone seeking control over their money.

By understanding its features, setting up your account correctly, and applying a few practical tips, you’ll unlock a banking experience that’s both efficient and secure.

Ready to take the next step? Dive into Westpac Online Banking today and see how it fits into your financial journey.