When I first started exploring retirement options, the term “401k” felt like financial jargon that was hard to unpack. But as I dove deeper, I realized that a Vanguard 401k is one of the most powerful tools you can use to secure your financial future.

If you’re looking to understand what a Vanguard 401k is, how it works, and why it’s a solid choice for retirement planning, you’re in the right place.

In this article, I’ll share my insights, blend in practical advice for you, and break down everything you need to know about Vanguard’s 401k plans.

What Is a Vanguard 401k?

A 401k is a retirement savings plan offered by employers, allowing you to save and invest a portion of your paycheck before taxes are taken out. When I learned that Vanguard, one of the world’s largest investment companies, manages many of these plans, I was intrigued by their reputation for low-cost, investor-focused services.

Vanguard 401k plans are typically offered through your employer, who partners with Vanguard to manage the plan’s investments.

This means you get access to Vanguard’s extensive range of mutual funds, index funds, and other investment options, all designed to help you build wealth over time.

Why does this matter to you? Because a Vanguard 401k comes with tax advantages, potential employer contributions, and a variety of investment choices that can grow your savings. According to Vanguard’s website, they serve millions of investors globally, emphasizing low-cost funds that maximize your returns.

Key Terms to Understand

Before we dive deeper, let’s clarify some related keywords you’ll encounter:

- Retirement Savings: Money set aside for your post-work years, often in accounts like a 401k or IRA.

- Employer-Sponsored Plan: A retirement plan, like a 401k, provided by your workplace.

- Tax-Deferred Growth: Earnings on your investments grow without being taxed until you withdraw them.

- Mutual Funds: Pooled investments managed by professionals, a staple of Vanguard 401k plans.

- Index Funds: Low-cost funds that track market indexes, a hallmark of Vanguard’s offerings.

Why Choose a Vanguard 401k?

When I first considered a 401k, I wondered why Vanguard stood out. After researching, I found that their focus on low fees and investor-first principles makes a big difference. Here’s why you might want to consider a Vanguard 401k:

Low-Cost Investment Options

Vanguard is renowned for its low expense ratios, which means you keep more of your money working for you. High fees can erode your savings over decades, so this is a game-changer.

For example, Vanguard’s index funds often have expense ratios as low as 0.04%, compared to industry averages closer to 0.5% or higher.

Diverse Investment Choices

You can choose from mutual funds, index funds, ETFs, and target-date funds, which automatically adjust your investments as you approach retirement.

I love how Vanguard’s target-date funds simplify things. If you’re unsure where to start, these funds do the heavy lifting by balancing risk and reward based on your retirement timeline.

Employer Matching Contributions

Many employers offer a matching contribution, where they add to your 401k based on what you contribute. For instance, if you put in 6% of your salary, your employer might match it dollar-for-dollar up to a certain limit.

When I realized this was essentially “free money,” it motivated me to contribute more. Check with your employer to see what they offer—it’s a perk you don’t want to miss.

Tax Benefits

Your contributions to a Vanguard 401k are made with pre-tax dollars, lowering your taxable income now. Plus, your investments grow tax-deferred until you withdraw them in retirement.

For example, if you earn $60,000 a year and contribute $6,000 to your 401k, you’re only taxed on $54,000. This was a lightbulb moment for me, and it’s something you can leverage to save smarter.

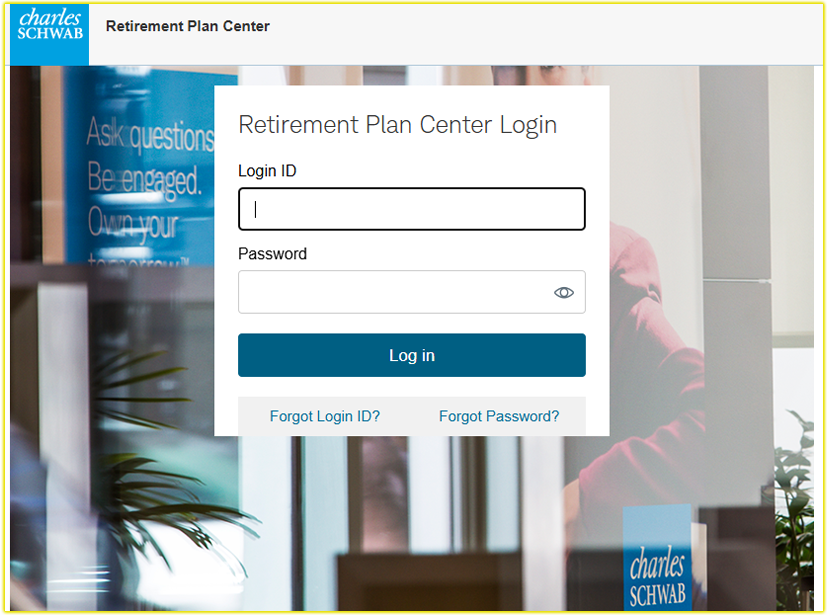

What to Know About Fidelity 401k

How to Get Started with a Vanguard 401k

If your employer offers a Vanguard 401k, getting started is straightforward. Here’s what I learned about the process, with steps you can follow:

- Enroll Through Your Employer: Your HR department will provide enrollment forms and plan details. You’ll need to decide how much to contribute (a percentage of your salary) and select your investments.

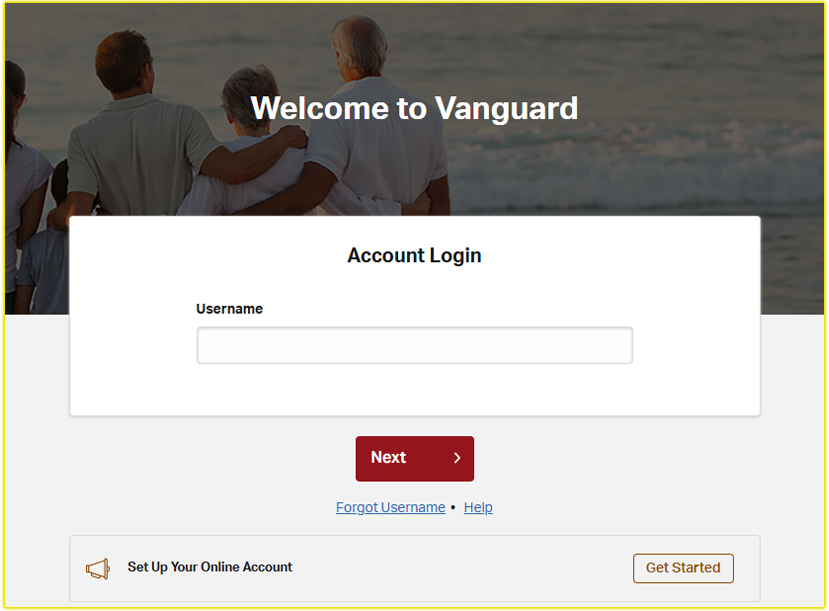

- Set Up Your Account: Once enrolled, you’ll receive Vanguard 401k login credentials. Visit Vanguard’s retirement plan website (my.vanguardplan.com) to create your account.

- Choose Your Investments: You can pick from Vanguard’s funds based on your risk tolerance and retirement goals. If you’re new to investing, target-date funds are a great starting point.

- Monitor and Adjust: Log in regularly to check your balance and performance. I make it a habit to review my account every quarter, and you can do the same to stay on track.

Pro Tip: Contribution Limits

In 2025, you can contribute up to $23,000 to a 401k, with an additional $7,500 “catch-up” contribution if you’re 50 or older. I always aim to contribute at least enough to get the full employer match, it’s like giving yourself a raise.

Managing Your Vanguard 401k: Tips for Success

Once your account is set up, managing it effectively is key. Here are some strategies I’ve found helpful, along with advice for you:

Log In Regularly

You can access your account at investor.vanguard.com or through Vanguard’s mobile app, available on iOS and Android. I check my balance monthly to stay motivated, and you can use the app to track investments, trade funds, or update your contribution rate.

Diversify Your Investments

Don’t put all your eggs in one basket. Vanguard’s 401k plans offer a mix of stocks, bonds, and other assets. I spread my investments across index funds and target-date funds to balance risk, and you should consider a similar approach based on your goals.

Avoid Early Withdrawals

Withdrawing funds before age 59½ can trigger taxes and a 10% penalty. I learned this the hard way when I considered dipping into my 401k for a big purchase. Instead, explore other options like a 401k loan (if your plan allows) or saving separately for short-term goals.

Plan for Rollovers

If you leave your job, you can keep your 401k with Vanguard, roll it into an IRA, or transfer it to a new employer’s plan. Rolling over to an IRA gives you more control, and services like Capitalize can simplify the process.

How I Login to My Vanguard 401k Account

Common Challenges and How to Solve Them

Even with a great provider like Vanguard, you might hit some bumps. Here’s how I’ve navigated issues, with solutions for you:

Login Problems

If you can’t access your account, double-check your username and password at my.vanguardplan.com. If you’ve forgotten your credentials, use the “Forgot your username or password” option to reset them.

I once had trouble logging in due to an outdated browser—switching to a different one fixed it. You can also contact Vanguard’s client services at 800-523-1188, available Monday to Friday, 8:30 a.m. to 9 p.m. ET.

Understanding Fees

While Vanguard’s fees are low, some plans charge administrative fees. Review your plan documents to understand costs. I was surprised to find a small annual fee in my plan, but it was minimal compared to the growth I was seeing.

Investment Confusion

If you’re overwhelmed by investment options, start with Vanguard’s educational resources at ownyourfuture.vanguard.com. Their tools helped me understand risk and diversification, and you can use them to make informed choices.

What to Know About John Hancock 401k

Why Vanguard’s Reputation Matters

Vanguard’s track record speaks for itself. With over $8.5 trillion in assets under management, they’re a leader in low-cost investing.

Their client-owned structure means they prioritize investors, not shareholders, which I find reassuring. For you, this translates to a provider you can trust to manage your retirement savings responsibly.

However, it’s worth noting some criticism. For example, Google’s Vanguard 401k plan has been flagged for heavy fossil fuel investments, which may concern you if sustainability is a priority. You can explore Vanguard’s socially responsible funds or discuss options with your plan administrator to align your investments with your values.

Final Thoughts

When I started my Vanguard 401k, I felt empowered knowing I was building a nest egg with a trusted provider. You have the same opportunity to take charge of your financial future.

By contributing regularly, choosing low-cost funds, and staying informed, you can make your Vanguard 401k a cornerstone of your retirement plan.

If you’re ready to dive in, log in to your account, explore Vanguard’s resources, or contact their support team for personalized guidance.

For more details, visit Vanguard’s official site at investor.vanguard.com or check out their retirement planning tools at ownyourfuture.vanguard.com. Your future self will thank you for starting today.