As someone who’s navigated the world of personal finance, I’ve learned that a Health Savings Account (HSA) can be a game-changer for managing healthcare costs and building long-term wealth. If you’re exploring options to save for medical expenses, the Schwab Health Savings Brokerage Account (HSBA) might catch your attention.

In this article, I’ll walk you through what a Schwab HSA is, how it works, and why it could be a smart choice for you.

What Is a Schwab Health Savings Account?

A Health Savings Account is a tax-advantaged savings account designed for individuals enrolled in a high-deductible health plan (HDHP).

I first encountered HSAs when I realized they offer a triple tax benefit: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

The Schwab HSBA takes this a step further by combining the flexibility of an HSA with the investment options of a brokerage account.

Charles Schwab, a trusted name in financial services, partners with industry-leading HSA providers to offer the Schwab Health Savings Brokerage Account.

Unlike a standard HSA that might limit you to a savings account or basic mutual funds, Schwab’s HSBA allows you to invest your HSA funds in a wide range of assets, such as stocks, bonds, ETFs, and mutual funds.

This feature excited me because it means you can potentially grow your savings over time, making it a powerful tool for both healthcare and retirement planning.

Fidelity Health Savings Account (HSA)

Why Choose a Schwab HSA?

When I started researching HSA providers, I was drawn to Schwab’s reputation for low fees and robust investment options. Here’s why you might consider the Schwab HSBA:

- Investment Flexibility: Unlike some HSA providers that restrict you to a handful of mutual funds, Schwab lets you invest in a broad array of securities. This means you can tailor your portfolio to your risk tolerance and financial goals.

- Low Costs: Schwab is known for competitive pricing. While specific fees depend on your HSA provider and account activity, Schwab’s brokerage platform generally offers low-cost trading and no account maintenance fees for the HSBA.

- Tax Advantages: As I mentioned, the triple tax benefit is a standout feature. You can contribute pre-tax dollars, invest them, and withdraw funds for qualified expenses without owing taxes.

- Long-Term Growth Potential: By investing your HSA funds, you can potentially grow your savings to cover future medical costs or even supplement retirement income. I’ve seen how this strategy can turn an HSA into a “super IRA” for healthcare.

If you’re someone who values choice and wants to maximize your HSA’s potential, Schwab’s HSBA is worth exploring.

Health Savings Account for Self-Employed

How to Open and Manage a Schwab HSA

Opening a Schwab Health Savings Brokerage Account is straightforward, but it requires coordination with an HSA provider. Here’s how you can get started, based on my understanding of the process:

- Confirm Eligibility: You must be enrolled in a qualified HDHP to open an HSA. Check with your health insurance provider to ensure your plan meets IRS requirements.

- Choose an HSA Provider: Schwab doesn’t administer the HSA directly; it partners with providers like HealthEquity or Further. Your employer or HSA provider will provide a “HSA Program ID” and “Program Access Code” to link your Schwab HSBA.

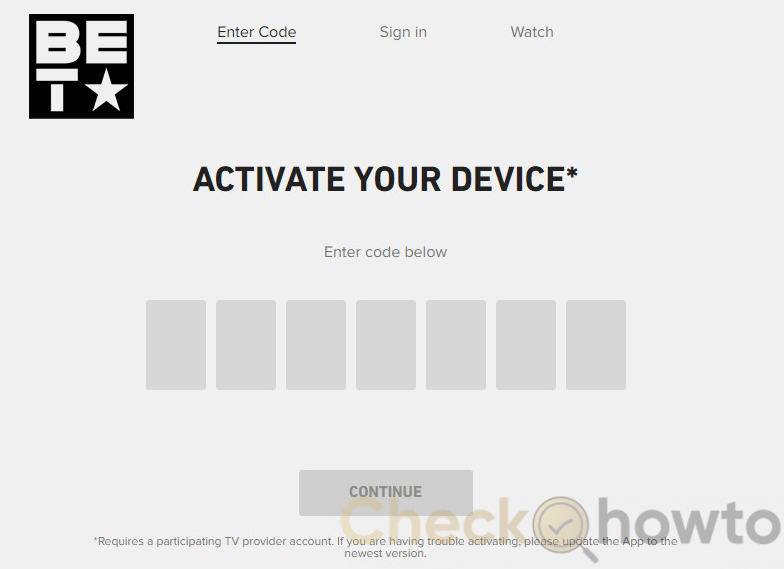

- Open the Account: Visit Schwab’s HSBA login page (www.schwabhsba.com) and enter your details, including your Social Security Number, which must match the provider’s records. I found this step seamless when I helped a friend set up their account.

- Fund Your HSA: You can contribute up to the IRS annual limits (for 2025, $4,300 for individuals and $8,550 for families, with a $1,000 catch-up for those 55+). Contributions can come from you, your employer, or both.

- Invest Your Funds: Once your account is funded, you can transfer money to the brokerage portion and start investing. Schwab’s platform offers tools to research investments, which I’ve found intuitive even for beginners.

Managing your HSA is just as important. You’ll need to track qualified medical expenses, keep receipts, and ensure withdrawals comply with IRS rules. I recommend using Schwab’s online portal or mobile app to monitor your investments and account activity, as it simplifies the process.

Benefits of Investing Your HSA with Schwab

One of the most compelling reasons to choose Schwab’s HSBA is the ability to invest your funds. When I first learned about HSA investing, I was skeptical—could it really make a difference? But the numbers don’t lie. By investing a portion of your HSA, you can harness the power of compound growth.

For example, let’s say you contribute $3,000 annually to your HSA and invest it with an average annual return of 6%. Over 20 years, that could grow to over $120,000, compared to just $60,000 if left in a non-invested savings account.

This potential for growth is why I encourage you to consider investing at least a portion of your HSA funds, especially if you don’t need the money for immediate expenses.

Schwab’s platform makes this easy by offering:

- Diverse Investment Options: From low-cost ETFs to individual stocks, you have choices to match your financial strategy.

- Research Tools: Schwab provides market insights, stock screeners, and educational resources to help you make informed decisions.

- No Minimum Investment: You can start investing with as little as the cost of a single share, which is great if you’re just getting started.

Is a Health Savings Account Worth It?

Potential Drawbacks to Consider

While I’m enthusiastic about the Schwab HSBA, it’s important to be transparent about potential downsides. Here are a few things you should keep in mind:

- Investment Risk: Unlike a traditional HSA savings account, investments can lose value. If you’re risk-averse, you might prefer keeping funds in cash or conservative options.

- Fees: While Schwab’s fees are competitive, trading commissions or mutual fund expense ratios can add up. Review the pricing guide to understand costs.

- Provider Dependency: Since Schwab partners with third-party HSA providers, you’ll need to coordinate between two entities, which can feel cumbersome.

- Not for Everyone: If you frequently need to withdraw HSA funds for medical expenses, investing might not be practical, as you’ll want immediate access to cash.

I’ve found that weighing these factors against your financial situation helps you decide if the Schwab HSBA aligns with your goals.

How Does Schwab Compare to Other HSA Providers?

You might be wondering how Schwab stacks up against competitors like Fidelity, HealthEquity, or Optum Bank. Based on my research, here’s a quick comparison:

- Schwab vs. Fidelity: Both offer robust investment options, but Fidelity provides a fully integrated HSA without requiring a third-party provider, which might simplify management. However, Schwab’s broader investment choices and lower fees on certain trades can be a draw.

- Schwab vs. HealthEquity: HealthEquity is a leading HSA administrator but offers fewer investment options. If you prioritize flexibility, Schwab’s HSBA is a better fit.

- Schwab vs. Optum Bank: Optum Bank focuses on ease of use for medical payments but has limited investment choices compared to Schwab’s brokerage platform.

Ultimately, the best provider depends on your priorities—whether it’s low fees, investment variety, or simplicity. I suggest you compare based on your specific needs.

Tips for Maximizing Your Schwab HSA

To make the most of your Schwab Health Savings Account, here are some strategies I’ve found effective:

- Pay Medical Expenses Out of Pocket: If you can afford it, pay for current medical costs with other funds and let your HSA grow tax-free.

- Track Expenses: Save receipts for medical expenses, as you can reimburse yourself tax-free from your HSA years later.

- Diversify Investments: Spread your HSA investments across asset classes to reduce risk.

- Review Annually: Check your contributions, investments, and expenses each year to stay aligned with your goals.

By following these tips, you can turn your HSA into a powerful financial tool.

Health Savings Account vs. Flexible Spending Account

Final Thoughts

As I’ve explored the Schwab Health Savings Brokerage Account, I’ve come to appreciate its blend of tax advantages, investment flexibility, and user-friendly tools. It’s not just about covering today’s medical bills, it’s about building a nest egg for your future healthcare needs.

If you’re enrolled in an HDHP and want to take control of your healthcare savings, I encourage you to consider the Schwab HSBA. With its robust platform and competitive pricing, it’s a compelling option for savvy savers like you.

Ready to get started? Visit www.schwab.com or contact your HSA provider to open your Schwab HSBA. Your future self will thank you for planning ahead.