As I’ve navigated the world of retirement planning, I’ve come to appreciate the importance of understanding the tools available to secure a financially stable future. One such tool is the John Hancock 401k, a retirement plan offered through employers that can help you build a nest egg.

If you’re considering or already enrolled in a John Hancock 401k, this article will walk you through everything you need to know, from its features to how you can make the most of it.

What Is a John Hancock 401k?

A 401(k) is a retirement savings plan sponsored by an employer, allowing you to save and invest a portion of your paycheck before taxes are deducted. John Hancock, a well-established financial services company, provides 401k plans to employers, who then offer them to employees like you.

I’ve found that John Hancock’s plans are designed with flexibility and user accessibility in mind, making it easier for you to plan for retirement.

John Hancock’s 401k plans are part of their broader retirement plan services, which aim to provide tools and guidance for financial wellness. They offer resources to help you manage your account, choose investments, and plan for the future you envision.

Whether you’re just starting your career or nearing retirement, understanding the specifics of their 401k can empower you to make informed decisions.

Key Features of John Hancock 401k

When I explored John Hancock’s 401k offerings, several features stood out:

- Investment Options: You can choose from a variety of mutual funds, target-date funds, and other investment vehicles to align with your risk tolerance and retirement goals.

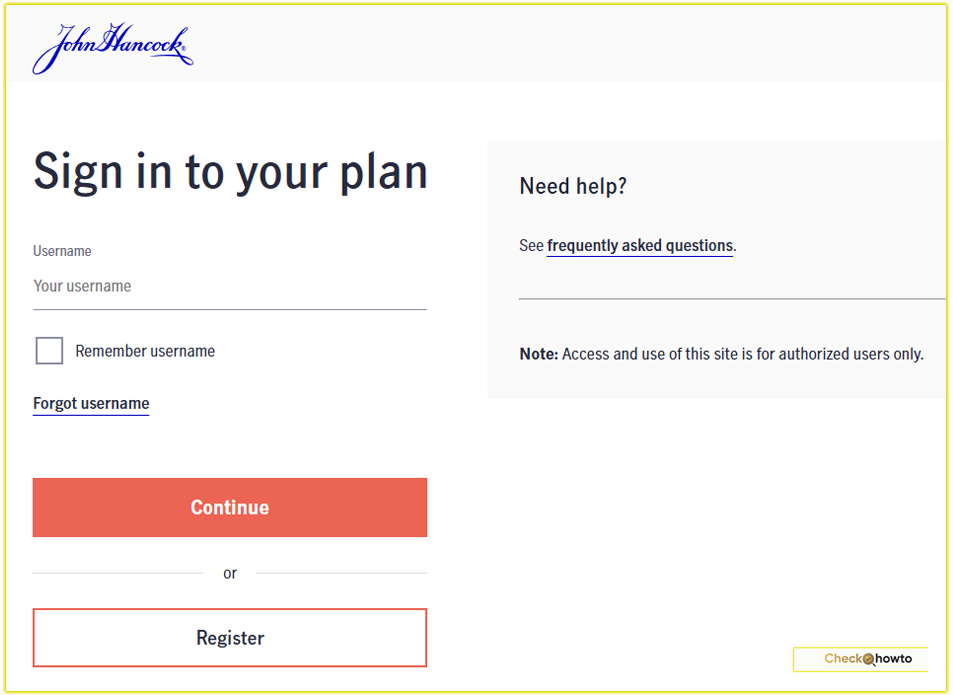

- Online Account Management: John Hancock’s participant portal, accessible at myplan.johnhancock.com, allows you to check balances, update contributions, and review performance anytime, anywhere.

- Mobile App: The John Hancock Retirement app makes it easy for you to manage your plan on the go, offering a seamless way to stay connected to your savings.

- Employer Match: Many employers offering John Hancock 401k plans provide matching contributions, which can significantly boost your savings. Check with your HR department to see if this applies to you.

- Rollover Options: If you change jobs, John Hancock allows you to roll over your 401k into another qualified plan or an IRA, preserving your savings.

These features make the John Hancock 401k a robust option, but you’ll want to dig into the specifics of your employer’s plan, as terms can vary.

How to Enroll in a John Hancock 401k

Enrolling in a John Hancock 401k is straightforward, and I’ve seen how a little preparation can make the process even smoother for you. Typically, your employer will provide enrollment materials when you’re hired or during open enrollment periods. Here’s what you need to do:

- Review Plan Details: Your employer will share information about contribution limits, matching programs, and available investments. Take time to read through these materials.

- Complete Enrollment Forms: You may need to fill out forms online via John Hancock’s enrollment portal (jhgoenroll.com) or through your employer’s HR system.

- Choose Your Contribution Rate: Decide how much of your paycheck you want to contribute. In 2025, the IRS allows contributions up to $23,500 annually for those under 50, with an additional $7,500 catch-up contribution for those 50 and older.

- Select Investments: Pick funds that match your retirement timeline and risk tolerance. If you’re unsure, target-date funds can be a low-maintenance option.

- Set Up Beneficiaries: Designate who will inherit your account in case of unforeseen events.

Once enrolled, you can log in to myplan.johnhancock.com to monitor your account and make adjustments as needed. I recommend checking your account periodically to ensure it aligns with your goals.

How I Login to My John Hancock 401k Account

Understanding Fees in a John Hancock 401(k)

One thing I’ve learned is that fees can impact your retirement savings over time, so it’s crucial to understand them. John Hancock 401(k) plans, like most, come with fees that cover administration, investment management, and other services. However, finding detailed fee information can be challenging, as I discovered through research.

- Administrative Fees: These cover the cost of managing the plan and may be a flat fee or a percentage of your account balance.

- Investment Fees: Each fund in your 401(k) has an expense ratio, which is a percentage of your investment that goes toward fund management. Lower-cost funds, like index funds, can help you save more over time.

- Service Fees: Additional charges may apply for services like loans or withdrawals.

To find your plan’s specific fees, check your plan’s summary or contact John Hancock’s Participant Service Center at 1-800-395-1113 (for plans with under 200 employees) or 1-800-294-3575 (for larger plans).

You can also ask your employer for a fee disclosure document. Being proactive about fees can help you maximize your savings.

Benefits of Choosing a John Hancock 401(k)

I’ve found that John Hancock’s 401(k) plans offer several advantages that make them appealing for retirement savers like you:

- User-Friendly Tools: The online portal and mobile app are intuitive, making it easy for you to track your progress and adjust your strategy.

- Educational Resources: John Hancock provides calculators, webinars, and planning tools to help you understand your retirement needs.

- Customer Support: With dedicated phone lines and online support, you can get answers to your questions quickly.

- Vitality Program Integration: For those with John Hancock life insurance, the Vitality Program offers rewards for healthy habits, which can complement your financial wellness efforts.

These benefits can give you confidence in managing your retirement savings, but it’s worth comparing your plan to others to ensure it’s the best fit.

Potential Drawbacks to Consider

No 401(k) plan is perfect, and I’ve noted a few potential drawbacks with John Hancock’s offerings that you should keep in mind:

- Fee Transparency: As mentioned, finding detailed fee information can be difficult, which may require extra effort on your part.

- Investment Limitations: While John Hancock offers a range of funds, your employer’s plan may limit your options compared to an IRA or brokerage account.

- Plan Variability: The quality of your 401k depends on your employer’s setup. Some plans may have higher fees or fewer investment choices.

To address these, I suggest reviewing your plan’s documentation and speaking with a John Hancock representative or financial advisor to clarify any concerns.

Tips to Maximize Your John Hancock 401(k)

To make the most of your John Hancock 401(k), I’ve compiled a few strategies that have worked for me and can help you:

- Contribute Enough for the Match: If your employer offers a match, contribute at least enough to get the full benefit—it’s essentially free money.

- Diversify Investments: Spread your contributions across different asset classes to reduce risk.

- Rebalance Regularly: Check your portfolio annually to ensure it aligns with your goals, especially as you age.

- Take Advantage of Tools: Use John Hancock’s retirement calculators and resources to plan your savings trajectory.

- Consider a Rollover When Changing Jobs: If you leave your employer, rolling over your 401(k) to an IRA or new plan can keep your savings growing tax-deferred.

By staying proactive, you can build a robust retirement fund with your John Hancock 401(k).

How to Contact John Hancock for Support

If you need assistance, John Hancock offers multiple ways to get in touch. I’ve found their customer service to be responsive, which can be a lifesaver when you’re navigating your plan. Here’s how you can reach them:

- Phone: Call 1-800-395-1113 for plans with fewer than 200 employees or 1-800-294-3575 for larger plans.

- Online: Visit www.johnhancock.com or myplan.johnhancock.com for account access and resources.

- Mail: Send inquiries to John Hancock at 601 Congress Street, Boston, MA 02210-2805.

For lost accounts or unclaimed policies, you can submit an Account Search Request through their website.

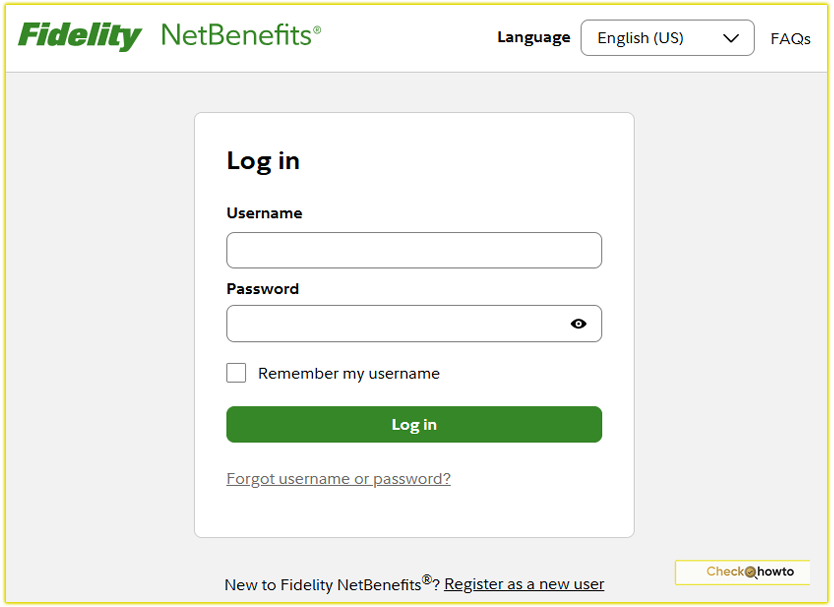

What to Know About Fidelity 401k

Is the John Hancock 401k right for you?

In my experience, the John Hancock 401k is a solid choice if your employer offers it, especially with its user-friendly tools and robust support. However, its value depends on your plan’s specifics, like fees and investment options.

I encourage you to compare your 401(k) with other retirement accounts, such as IRAs, to ensure you’re maximizing your savings.

Ultimately, a 401(k) is just one piece of your retirement puzzle. By contributing consistently, monitoring fees, and leveraging John Hancock’s resources, you can take control of your financial future.

If you’re unsure about your plan or need personalized advice, consider consulting a financial advisor to tailor your strategy.