As a college student, you need to improve your credit. It does not matter if you just entered or are leaving college already; you must still build your credit. Improving your credit will help you qualify for loans, cell phone plans, rental applications, and impact job prospects, etc.

Improving your credit as a college student will offer you more options in the financial marketplace. And opportunities to score good terms for loans and credit cards in time.

Improving your credit will help you achieve your financial goals as a student before and after graduation. It will also enable you to think about financial products and low-interest rates in the future.

7 Ways to Improve Credit as a College Student

There are many ways you can improve your credit as a college student. Below are some of the steps.

1. Become an Authorized User

When your parents or your guardian adds you as an authorized user on their credit card, it poses an excellent way to improve your credit score.

If you are an authorized user, you will have the benefit of your credit card and a permit to access the primary cardholder’s credit limit. However, you will not have any legal right to clear off the debt on the credit card.

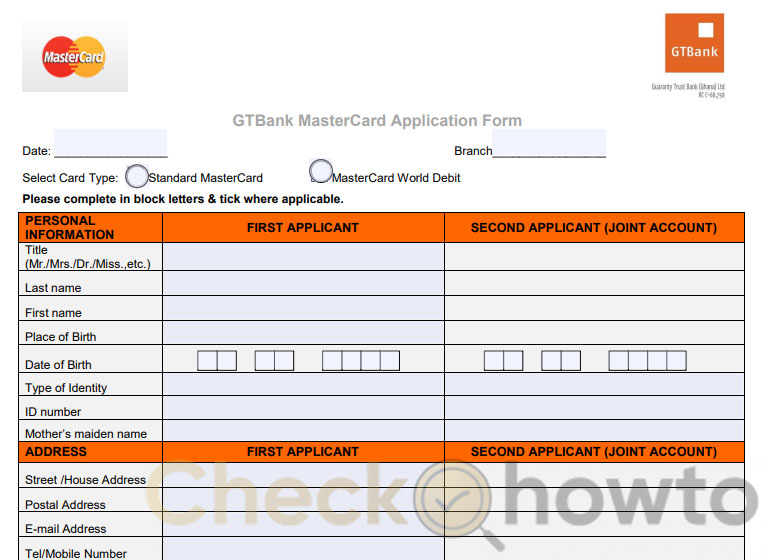

2. Get a Student Credit Card

Some banks issue student credit cards. However, these cards come with a lower credit limit and a higher annual percentage rate than normal ones. A student credit card does not require you to have an established credit history.

The student credit card program is modelled to accommodate college students’ credit needs and financial situations. You will likely get approved for a student card as a college student.

Even if you have a short or non-existent credit history and a low income, note that you will need a co-signer if you are below 21 years old or do not have a high income.

3. Apply for a Secured Credit Card

Suppose your application for a student credit card is declined for one reason or another. Or, if the student credit card does not fit your bills, you can obtain a secured credit card.

These cards have little risk since they require you to put in money on deposit to serve as security.

When you use a secured credit card, your payments are reported to the credit bureaus, allowing you to keep a record of paying on time.

4. Keep your Credit Usage Low as a College Student

Keeping your credit usage low is a great act. This is because it shows your spending power and your capacity to keep your balances low or clear. And these are great signs for any lender.

5. Ensure you make your Payments on Time

Making payments on time is one significant component in determining your credit score. When you start using credit, you must ensure you do not miss any payments. It would be best if you established a good payment habit.

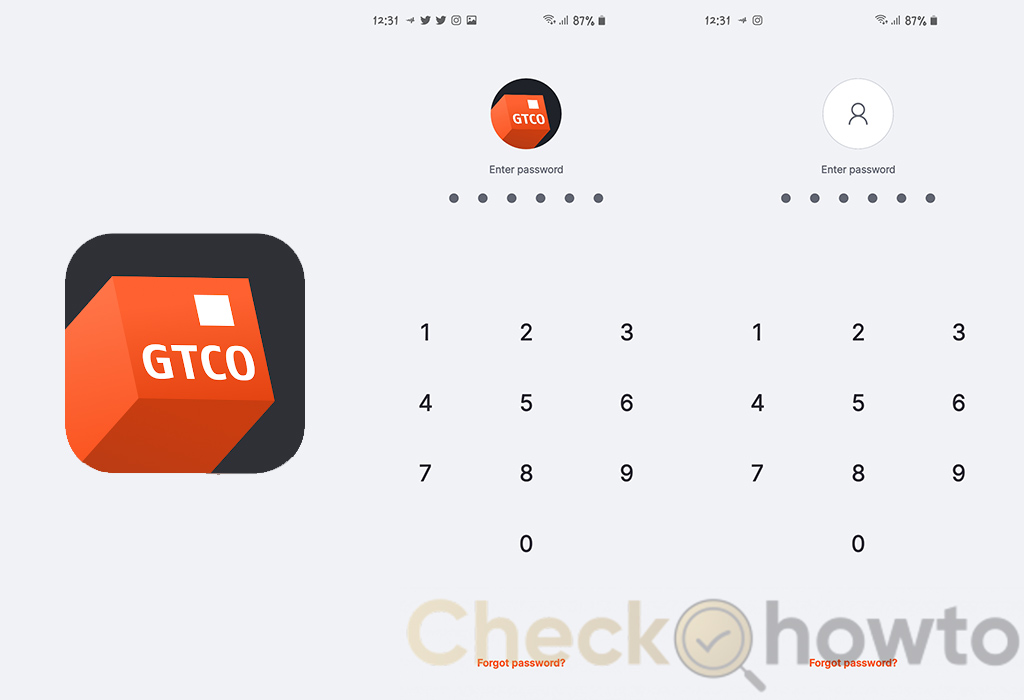

Skipping any payment will bring down your score. Making all your payments on time will increase your score. You can also set up an automatic payment through your bank, ensuring you do not miss any payments.

6. Monitor your Credit Score

Keeping an eye on your credit score will not improve your credit as a college student. But it will enable you to track your credit score, changes and growth, and activities on your accounts.

You will also correct errors on time before they affect your chance of getting a loan. Also, you will get a breakdown of how you are thriving with the significant credit score factors. This can help you improve your credit.

7. Spend Responsibly as a College Student

To improve your credit, you will have to spend responsibly. Using your credit card frequently will not move your credit score up. Spend healthy, and to do this, you must use your credit card like a debit card.

Make purchases that you know you can pay off. Also, keeping your credit utilization low and paying off your credit purchases regularly will keep your credit card account active and put your credit score in a good place.

How to Keep Your Credit High as a College Student

Improving your credit is very good, but you also must ensure your credit stays high. To make your credit stay high, here are some steps to take.

- Avoid going overboard. Too many credit cards can negatively affect your finances, even if you qualify. So, you need to avoid going overboard.

- Do not skip a payment, and ensure you make early payments because this can damage your credit record.

- If you do not want to use a particular credit card anymore, do not abruptly close the account; you will still have to keep the account open. This will help increase your credit utilization ratio.

Following these steps will help you keep your credit high.