When I first considered consolidating my credit card debt, I was overwhelmed by the options. You might feel the same way, wondering how to tackle high-interest balances without losing control of your finances.

That’s when I stumbled upon the Fidelity Rewards Visa Signature® Card and its balance transfer feature. While not specifically designed for balance transfers, this card offers a practical way to manage debt, and I’m excited to share my insights with you.

In this article, I’ll walk you through the process, benefits, and key considerations of using the Fidelity credit card for a balance transfer, ensuring you have all the details to make an informed decision.

What Is a Balance Transfer, and Why Consider It?

A balance transfer involves moving debt from one credit card to another, typically to take advantage of a lower interest rate or better terms. I’ve found this strategy useful for reducing the cost of high-interest debt, especially when you’re juggling multiple cards.

With the Fidelity credit card, you can transfer balances, but it’s not specifically designed for this purpose, so you’ll need to weigh the pros and cons carefully.

Why might you consider a balance transfer? It’s a great way to simplify your finances by consolidating debt into one payment or to save on interest if you can pay off the balance quickly.

However, as I’ve learned, not all cards are created equal for balance transfers, and the Fidelity card has some limitations you should know about.

Card Balance Transfer: What It Is & How It Works

Can You Do a Balance Transfer with the Fidelity® Rewards Visa Signature® Card?

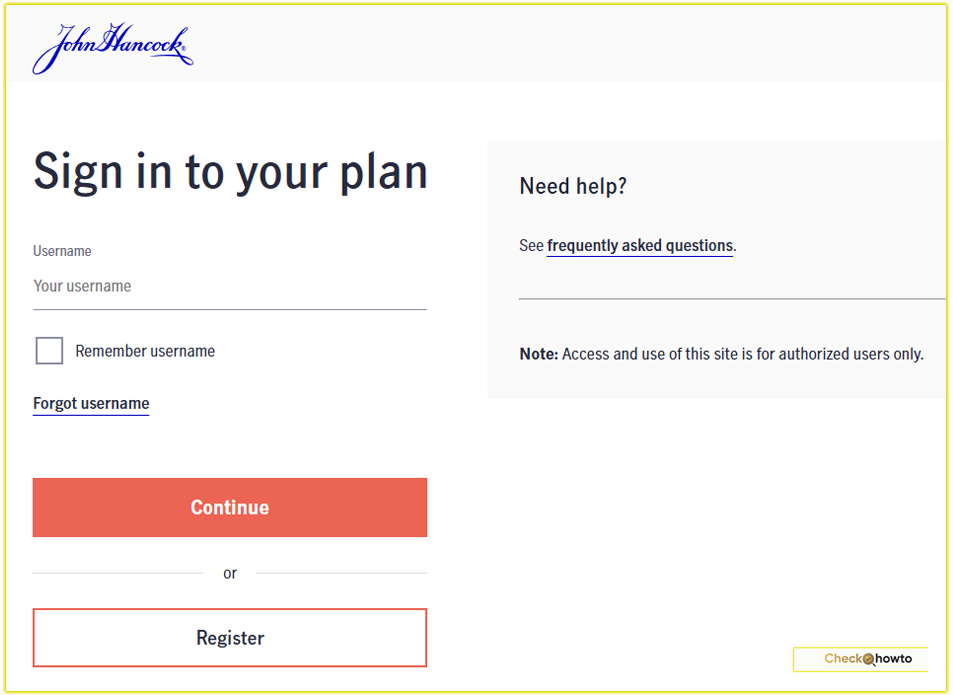

Yes, you can perform a balance transfer with the Fidelity® Rewards Visa Signature® Card, but it’s not the most competitive option out there. I discovered that you can initiate a transfer by logging into your online banking account at FidelityRewards.com or by calling Elan Financial Services at (888) 551-5144.

The process is straightforward: you’ll provide the details of the card you’re transferring from, including the payee information and the amount you want to move.

Here’s a step-by-step guide based on my research and experience:

- Log In or Call: Access your account online or contact Elan Financial Services.

- Select Balance Transfer: Choose the “Request a Balance Transfer” option in the online portal or inform the representative.

- Provide Payee Details: Enter the name, address, and account number of the card you’re transferring from. If your provider isn’t listed, you’ll need to manually input this information.

- Specify the Amount: Decide how much of the balance you want to transfer.

- Review and Submit: Double-check the details and submit your request. You’ll receive confirmation via email once it’s processed.

However, before you dive in, there are some key factors to consider, which I’ll explain next.

Key Features and Limitations of the Fidelity Credit Card for Balance Transfers

If you look into the Fidelity credit card balance transfer option, I noticed it lacks some features that make other cards more attractive for this purpose. Here’s what you need to know:

Interest Rate (APR)

The Fidelity card has a standard variable APR of 18.24%, which is relatively low compared to some cards but not ideal for balance transfers.

Unlike competitors like the Citi Double Cash® Card, which offers a 0% introductory APR on balance transfers for 18 months, the Fidelity card doesn’t provide an introductory 0% APR.

This means you’ll start accruing interest immediately at the standard rate, which could eat into your savings if you don’t pay off the balance quickly.

Balance Transfer Fee

There’s a balance transfer fee of 3% of the transfer amount (minimum $5) for transfers completed within the first four months of account opening. After that, the fee jumps to 5% (minimum $5).

For example, transferring a $5,000 balance would cost you $150 initially, and $250 after the introductory period. I’ve found that some cards waive this fee during a promotional period, so this is a notable drawback for the Fidelity card.

No Introductory Offer

Many balance transfer cards entice you with a 0% APR for 12–21 months, giving you a window to pay down debt without interest. The Fidelity card, however, doesn’t offer this perk. If your goal is to save on interest, you might want to explore cards specifically designed for balance transfers, as I’ll discuss later.

Rewards Consideration

One upside of the Fidelity card is its 2% cash back on all purchases when rewards are deposited into an eligible Fidelity account. However, balance transfers don’t earn rewards, so this benefit doesn’t apply here.

Still, if you’re using the card for regular purchases, you can funnel those rewards into investments, which I’ve found to be a smart way to grow wealth over time.

Eligibility and Credit Requirements

To qualify for the Fidelity card, you’ll need excellent credit (typically a FICO score of 720 or higher). When I applied for a similar card, I made sure my credit report was clean and my debt-to-income ratio was low.

You’ll also need to be a U.S. resident and at least 18 years old. Note that corporations, partnerships, or trusts can’t apply, and Fidelity doesn’t guarantee approval even for existing customers.

What to Know About Fidelity 401k

Pros and Cons of Using the Fidelity Card for Balance Transfers

To help you decide, I’ve outlined the advantages and disadvantages based on my analysis:

Pros

- Straightforward Process: Requesting a balance transfer is easy through online banking or a phone call.

- Low Standard APR: The 18.24% variable APR is lower than some high-interest cards, which can be helpful if you’re transferring from a card with a 25%+ APR.

- No Annual Fee: You won’t pay an annual fee, which keeps costs down.

- Rewards Program: The 2% cash back (when redeemed into a Fidelity account) is a nice perk for ongoing purchases, even if it doesn’t apply to transfers.

Cons

- No 0% Intro APR: Without an introductory offer, you’ll pay interest from day one.

- Balance Transfer Fee: The 3%–5% fee adds to your costs, unlike some cards with no-fee intro periods.

- Not Designed for Transfers: The card’s focus is on rewards, not balance transfers, making it less competitive.

- Limited Flexibility: You can’t transfer balances to a checking account, only to pay off other credit cards.

How I Login to My Fidelity 401k Account

How to Decide If a Fidelity Balance Transfer Is Right for You

When I considered a balance transfer, I asked myself a few key questions to ensure it aligned with my financial goals. Here’s what you should think about:

- Can You Pay Off the Balance Quickly? Since there’s no 0% intro APR, you’ll need to pay down the transferred balance fast to minimize interest. If you can clear it within a few months, the 18.24% APR and 3% fee might be manageable.

- Is the Fee Worth It? Calculate the cost of the transfer fee versus the interest you’re currently paying. For example, if your current card has a 22% APR, transferring to Fidelity’s 18.24% APR could save you money, but the fee might offset those savings.

- Do You Already Use Fidelity? The card’s rewards shine when paired with a Fidelity account (like an IRA, 529 plan, or brokerage account). If you’re not a Fidelity customer, the card’s value diminishes.

- Are There Better Options? If your primary goal is to save on interest, cards with 0% intro APRs are likely a better fit. I’ll share some alternatives below.

Alternatives to the Fidelity Credit Card for Balance Transfers

After researching, I realized the Fidelity card isn’t the best choice for balance transfers compared to specialized cards. Here are a few alternatives you might consider, based on my findings:

- Citi Double Cash® Card: Offers a 0% intro APR on balance transfers for 18 months (then 18.24%–28.24% variable APR). The intro balance transfer fee is 3% ($5 minimum) for the first four months, then 5%. You also earn 2% cash back (1% when you buy, 1% when you pay).

- Chase Freedom Unlimited®: Provides a 0% intro APR on balance transfers and purchases for 15 months (then 18.99%–28.49% variable APR). The intro balance transfer fee is 3% ($5 minimum). You earn 1.5%–5% cash back on purchases.

- Bank of America® Customized Cash Rewards: Features a 0% intro APR for 15 billing cycles on balance transfers made within 60 days of account opening (then 18.24%–28.24% variable APR). The balance transfer fee is 3% ($10 minimum).

These cards offer longer interest-free periods, which can save you significantly if you need time to pay off your debt. I recommend comparing their terms and fees to find the best fit for your situation.

Tips for a Successful Balance Transfer

Based on my experience, here are some practical tips to make your balance transfer smooth and cost-effective:

- Check Your Credit First: Ensure your credit score is strong enough for approval. You can get a free credit report annually from AnnualCreditReport.com.

- Calculate the Costs: Use an online balance transfer calculator to compare the fees and interest savings. This helped me decide whether a transfer made sense.

- Pay More Than the Minimum: To avoid interest piling up, pay as much as you can each month. I set up automatic payments to stay on track.

- Avoid New Purchases: The Fidelity card charges interest on new purchases immediately if you carry a balance, so focus on paying off the transferred amount first.

- Set Up Alerts: The Fidelity card lets you set email or text alerts for payment due dates or large transactions, which I found helpful for staying organized.

Costco Credit Card Balance Transfer

My Experience and Final Thoughts

When I explored balance transfers, I was drawn to the Fidelity® Rewards Visa Signature® Card because of its rewards program and no annual fee. However, I quickly realized it’s not the best tool for balance transfers due to the lack of a 0% intro APR and the transfer fee.

If you’re like me and value simplicity and rewards, this card can still be a great addition to your wallet for everyday spending, especially if you’re a Fidelity customer. But for tackling high-interest debt, you’re better off with a card designed specifically for balance transfers.

Before you proceed, take a moment to assess your financial situation. Are you transferring a small balance you can pay off quickly, or do you need a longer interest-free period? By weighing these factors, you’ll make a choice that aligns with your goals. If you have questions or need personalized advice, you can contact Elan Financial Services at (888) 551-5144 or visit FidelityRewards.com for more details.