When I first started exploring retirement savings options, the term “401k” felt like financial jargon that was hard to crack. But as I dove deeper, I realized it’s one of the most powerful tools you can use to build a secure future. If you’re looking to understand Fidelity 401k plans, you’re in the right place.

I’ve spent time researching and navigating Fidelity’s offerings, and I’m here to break it down for you in a way that’s clear, practical, and actionable.

This article will guide you through what a Fidelity 401k is, how it works, its benefits, and key considerations to help you make informed decisions.

What Is a Fidelity 401k?

A 401k is a workplace retirement savings plan that lets you save and invest a portion of your paycheck before taxes are taken out. Fidelity, one of the largest financial services firms, is a leading provider of 401k plans, managing trillions in assets.

I remember feeling overwhelmed by the idea of choosing a provider, but Fidelity’s reputation for robust tools and customer support made it stand out.

Fidelity’s 401k plans are designed for employees of companies that partner with them, as well as self-employed individuals through their Self-Employed 401k option. You contribute a portion of your salary, often with employer matching contributions, and invest in options like mutual funds, ETFs, or bonds.

The money grows tax-deferred until you withdraw it in retirement. According to Fidelity, they manage plans for millions of participants, offering a wide range of investment choices to suit your goals.

Why Choose Fidelity for Your 401k?

When I was deciding on a 401k provider, I looked for reliability and flexibility. Fidelity checks both boxes. Here’s why you might consider them:

- Diverse Investment Options: You can choose from Fidelity and non-Fidelity mutual funds, stocks, bonds, ETFs, and CDs. This variety lets you tailor your portfolio to your risk tolerance and retirement timeline.

- User-Friendly Tools: Fidelity’s NetBenefits platform and mobile app make it easy for you to track your balance, adjust contributions, and explore investment strategies. I’ve found their interface intuitive, even as a beginner.

- Educational Resources: From webinars to articles, Fidelity offers tools to boost your financial literacy. I’ve personally benefited from their retirement planning calculators to estimate how much I need to save.

- Low Fees: Fidelity offers $0.00 commissions on online U.S. equity trades and ETFs in retail accounts, though some funds may have management fees. Always check the fine print to understand costs.

How Does a Fidelity 401k Work?

Let’s break down the mechanics so you can see how a Fidelity 401k fits into your financial plan. When I started my 401k, I was surprised by how straightforward the process was once I understood the steps.

Contributions

You decide how much of your paycheck to contribute, up to the IRS limit. In 2024, the employee contribution limit is $23,000, increasing to $23,500 in 2025. If you’re 50 or older, you can add a catch-up contribution of $7,500 (or up to $11,250 for ages 60-63 in 2025, depending on your plan).

I set up automatic contributions through my employer, which made saving effortless. Many employers offer a match—say, 50 cents for every dollar you contribute up to 6% of your salary. Check with your HR department to maximize this “free money.”

Investment Choices

Once your money is in the 401k, you choose how to invest it. Fidelity offers a broad range of options, from target-date funds (which adjust risk as you near retirement) to individual stocks.

I started with a target-date fund because it was low-maintenance, but as I learned more, I diversified into ETFs. You can use Fidelity’s tools to analyze performance and risk, ensuring your investments align with your goals.

Tax Advantages

One of the biggest perks of a 401k is its tax-deferred growth. Your contributions lower your taxable income, and your investments grow without annual taxes on gains. When you withdraw funds in retirement (typically after age 59½), you’ll pay income tax.

If you opt for a Roth 401k, you contribute after-tax dollars, but withdrawals in retirement are tax-free. I chose a mix of traditional and Roth contributions to hedge against future tax changes.

Withdrawals and Loans

You generally can’t withdraw money before 59½ without a 10% penalty and taxes, unless you qualify for an exception (like disability or a first-time home purchase). Fidelity allows loans or hardship withdrawals in some cases, but I’ve learned these can derail your retirement savings due to taxes, penalties, and lost growth. If you’re considering a loan, explore other options first.

Special Features of Fidelity’s 401k

Fidelity offers unique features that can enhance your retirement strategy. Here are a few that caught my attention:

- Self-Employed 401k: If you’re self-employed, Fidelity’s plan lets you save up to $23,000 as an employee deferral in 2024, plus employer profit-sharing contributions. You can also designate Roth deferrals for tax-free withdrawals. I know freelancers who rave about this flexibility.

- Bitcoin Option: In 2022, Fidelity became the first major provider to offer Bitcoin as a 401k investment option, allowing up to 20% allocation. This is risky, so I’d recommend researching crypto volatility before diving in.

- Rollover Support: If you have an old 401k, Fidelity makes rollovers simple, helping you consolidate accounts for easier management. I rolled over an old 401k into a Fidelity IRA, and their team guided me through the process.

Key Considerations Before Investing

Before you jump into a Fidelity 401k, here are some factors to weigh:

- Employer Plan Rules: Your employer’s plan may limit investment options or have specific rules for matching contributions. Review your plan details on Fidelity’s NetBenefits.

- Fees and Expenses: While Fidelity’s retail accounts have low commissions, some funds charge management fees. Compare expense ratios to keep costs down.

- Risk Tolerance: Your investment choices should match your comfort with risk and your retirement timeline. I use Fidelity’s risk assessment tools to ensure my portfolio isn’t too aggressive.

- Required Minimum Distributions (RMDs): Starting at age 73 (or 75 if born in 1960 or later), you must take RMDs, which are taxable. Plan for these to avoid penalties.

Tips to Maximize Your Fidelity 401k

To make the most of your 401k, try these strategies I’ve found effective:

- Contribute Enough for the Match: If your employer offers a match, contribute at least enough to get the full amount. It’s essentially free money.

- Increase Contributions Over Time: I bump up my contribution by 1% each year. Small increases add up without feeling like a big hit to your paycheck.

- Diversify Investments: Spread your money across asset classes to reduce risk. Fidelity’s tools can help you build a balanced portfolio.

- Review Regularly: Check your account at least annually to adjust for life changes or market shifts. I set a calendar reminder to review my allocations.

- Consult a Professional: If you’re unsure about your strategy, Fidelity’s advisors or a tax professional can offer personalized guidance.

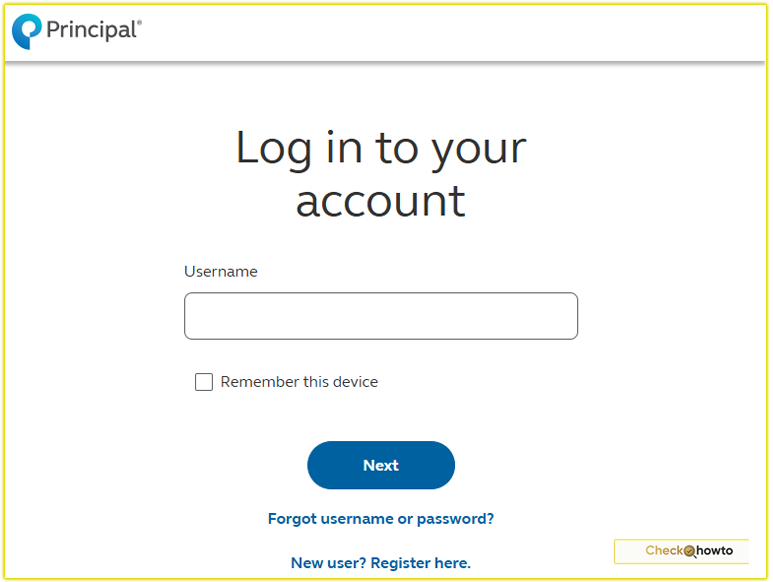

How I Login to My Fidelity 401k Account

Common Questions About Fidelity 401k

Can I Manage My 401k on My Phone?

Yes! Fidelity’s NetBenefits app lets you monitor your account, adjust contributions, and research investments. I love the convenience of checking my balance on the go.

What Happens If I Leave My Job?

You can leave your 401k with Fidelity, roll it into a new employer’s plan, or transfer it to an IRA. I’d recommend a rollover to maintain tax advantages and simplify management.

Is a Fidelity 401k Safe?

Fidelity is a trusted firm with robust security, including 2-factor authentication and encryption. However, investments carry market risk, so diversify to protect your savings.

What to Know About John Hancock 401k

Final Thoughts

Navigating a Fidelity 401k can feel daunting, but it’s a cornerstone of building long-term wealth. I’ve found that starting small, leveraging Fidelity’s tools, and staying consistent have made a big difference in my retirement planning.

You don’t need to be a financial expert to get started—just take the first step by reviewing your employer’s plan or exploring Fidelity’s resources. With the right strategy, your 401k can grow into a powerful nest egg.

For more details, visit Fidelity’s 401k page or log into NetBenefits. If you have specific questions, Fidelity’s customer service (800-835-5095) is available to help.