As someone who’s navigated the maze of healthcare options, I know how overwhelming it can feel to choose the right plan for you. One option that’s been a game-changer for me and could be for you too, is the Cigna Health Savings Account (HSA).

In this article, I’ll walk you through what a Cigna HSA is, how it works, its benefits, and how you can make the most of it. My goal is to help you feel confident about using an HSA to manage your healthcare expenses effectively.

What Is a Cigna Health Savings Account?

A Health Savings Account (HSA) is a tax-advantaged account designed to help you save for medical expenses when you’re enrolled in a qualified high-deductible health plan (HDHP).

With Cigna, this account pairs seamlessly with their HDHPs, giving you a powerful tool to cover out-of-pocket costs. I’ve found that combining a Cigna HSA with an HDHP empowers me to take control of my healthcare spending while saving money in the long run.

You might be wondering, “What makes an HSA different from other accounts?” Unlike a Flexible Spending Account (FSA) or Health Reimbursement Account (HRA), an HSA is yours to keep, even if you change jobs or health plans.

The funds roll over year after year, and you can invest them for future growth. Cigna makes it easy to manage your HSA through their secure myCigna portal, where you can track your balance, submit claims, and more.

Key Features of a Cigna HSA

- Tax Benefits: Contributions are made with pre-tax dollars, earnings grow tax-free, and withdrawals for eligible expenses are tax-free.

- Portability: The account stays with you, no matter where life takes you.

- Flexibility: Use funds for a wide range of qualified medical expenses, from doctor visits to prescription drugs.

- Investment Options: Once your balance reaches a certain threshold, you can invest your HSA funds for potential growth.

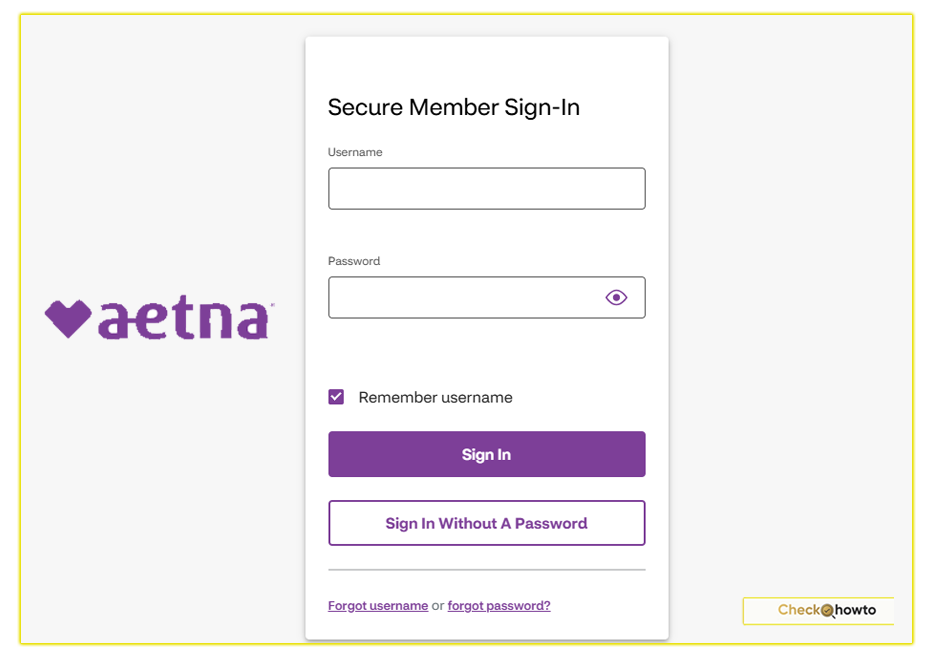

How I Login to My Cigna Health Savings Account

Why Choose a Cigna HSA?

When I first considered an HSA, I was hesitant about the high-deductible plan requirement. But after researching, I realized it’s a smart choice for many, especially if you’re generally healthy or want to plan for future healthcare costs. Here’s why a Cigna HSA might be right for you:

1. Save Money with Tax Advantages

The triple tax benefit of an HSA is hard to beat. I contribute pre-tax dollars through payroll deductions, which lowers my taxable income. Any interest or investment gains in the account are tax-free, and when I use the funds for eligible expenses, I don’t pay taxes on those withdrawals either. For you, this could mean significant savings, especially if you’re in a higher tax bracket.

2. Plan for the Future

Unlike an FSA, where you “use it or lose it,” HSA funds never expire. I’ve been able to save for future medical needs, like unexpected surgeries or even retirement healthcare costs. You can do the same, building a nest egg for peace of mind.

3. Cover a Wide Range of Expenses

Cigna’s HSA lets you pay for eligible healthcare expenses, including doctor visits, dental care, vision services, and even over-the-counter medications. I was surprised to learn you can also use HSA funds for things like acupuncture or certain medical equipment. Check Cigna’s list of eligible expenses on their website to see what’s covered.

4. Employer Contributions

If your employer offers a Cigna HSA, they might contribute “‘free money’” to your account. For example, some plans include annual contributions to help you get started. I’ve benefited from this, and it’s like getting a head start on my savings. Ask your HR department if this applies to you.

How to Use Your Cigna HSA

Using a Cigna HSA is straightforward, but it helps to know the steps. Here’s how I manage mine, and how you can too:

Enroll in a Cigna HDHP

To open an HSA, you must be enrolled in a Cigna high-deductible health plan. These plans typically have lower premiums but higher deductibles, meaning you pay more out-of-pocket before insurance kicks in. I found this trade-off worth it because the HSA helps cover those costs.

Contribute to Your HSA

You can contribute to your HSA through payroll deductions, direct deposits, or one-time payments. For 2025, the IRS sets contribution limits at $4,300 for individuals and $8,550 for families, with an additional $1,000 catch-up contribution if you’re 55 or older. I set up automatic contributions to make saving effortless. You can adjust your contributions through the myCigna portal or app.

Pay for Eligible Expenses

When I need to pay for medical expenses, I use my HSA debit card or reimburse myself after paying out-of-pocket. Keep receipts, as you may need them for verification. You can also submit claims through myCigna to get reimbursed. Pro tip: Save for bigger expenses by paying smaller ones out-of-pocket and letting your HSA grow.

Invest for Growth

Once my HSA balance hit a certain amount, I started investing in mutual funds offered through Cigna’s platform. This isn’t required, but it’s a great way to grow your savings tax-free. If you’re comfortable with investing, talk to a financial advisor to explore your options.

Tips to Maximize Your Cigna HSA

Here are some strategies I’ve learned to get the most out of my HSA, and they can work for you too:

- Contribute the Maximum: If you can afford it, contribute up to the IRS limit to maximize tax savings and future growth.

- Track Your Expenses: Use the myCigna app to monitor your spending and ensure you’re using funds for eligible expenses.

- Save for Retirement: After age 65, you can withdraw HSA funds for non-medical expenses without penalty (though you’ll pay income tax). I’m planning to use mine as a supplemental retirement fund.

- Stay Informed: Cigna’s website and myCigna portal offer resources to help you understand your plan. Check them regularly for updates.

Is a Cigna HSA Right for You?

A Cigna HSA is ideal if you’re enrolled in an HDHP, want tax-advantaged savings, and like the idea of controlling your healthcare spending. It’s been a lifesaver for me, especially during years with unexpected medical bills.

However, if you have frequent medical expenses or prefer lower deductibles, you might explore other options like a Cigna PPO or FSA. Talk to your employer or a Cigna representative to find the best fit.

Common Questions About Cigna HSAs

Here are answers to questions I had when I started, which you might find helpful:

- Can I use my HSA for my family? Yes, you can use it for your spouse and dependents, even if they’re not on your HDHP.

- What if I leave my job? Your HSA is yours to keep, and you can continue using it as long as you’re enrolled in an HDHP.

- Are there fees? Some HSAs have administrative fees, but Cigna’s are typically low. Check with your plan for details.

Health Accounts with Bank of America

Final Thoughts

I’ve found my Cigna Health Savings Account to be a powerful tool for managing healthcare costs while saving for the future. By pairing it with a high-deductible plan, you can enjoy lower premiums, tax benefits, and the flexibility to cover a wide range of expenses.

Whether you’re just starting out or planning for retirement, a Cigna HSA gives you control and peace of mind.

Ready to explore your options? Visit www.cigna.com or log into myCigna to learn more about setting up your HSA. You’ve got this—take the first step toward smarter healthcare savings today!