When I first learned about Health Savings Accounts (HSAs), I was thrilled at the idea of saving pre-tax dollars for medical expenses. But like you might be wondering now, I asked myself, “Can I use my HSA for dental care?” The short answer is yes, you can use your HSA for many dental expenses, but there are nuances you need to understand to make the most of it.

In this article, I’ll walk you through what I’ve learned about using an HSA for dental care, ensuring you have the details to navigate this financial tool confidently.

What Is a Health Savings Account (HSA)?

I think of my HSA as a financial safety net for healthcare costs. It’s a tax-advantaged account available to individuals enrolled in a high-deductible health plan (HDHP).

You can contribute pre-tax dollars, let the funds grow tax-free, and withdraw them tax-free for qualified medical expenses. The triple tax benefit is what makes HSAs so appealing to me, and I bet you’ll find it attractive too.

HSAs are designed to cover a wide range of healthcare costs, from doctor visits to prescriptions. But as I discovered, they also extend to dental care, which can be a game-changer for managing out-of-pocket costs.

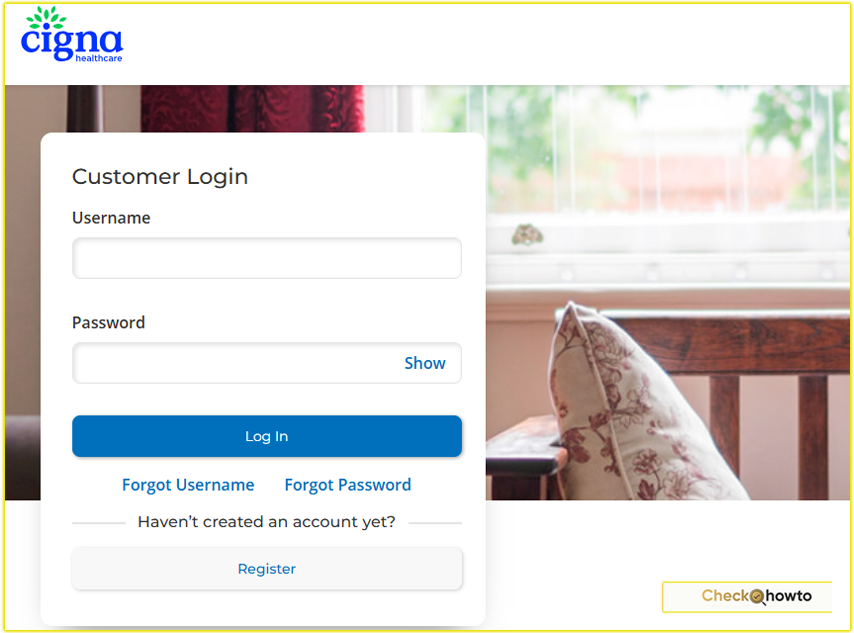

If you’re enrolled in an HDHP, you’re likely eligible to open an HSA, but always check with your plan provider to confirm.

Can You Use an HSA for Dental Expenses?

Yes, you can use your HSA for dental expenses, and I was relieved to learn this when I faced a hefty dental bill. According to the IRS, qualified medical expenses include many dental treatments, as long as they’re necessary for maintaining or improving your health.

This covers both routine and specialized dental care, which means you have flexibility in how you use your HSA funds.

Here’s what I found: the IRS Publication 502 lists dental expenses like cleanings, fillings, braces, and extractions as eligible for HSA reimbursement. However, not every dental cost qualifies.

For example, cosmetic procedures like teeth whitening or veneers typically don’t make the cut unless they’re medically necessary. If you’re unsure whether a specific treatment qualifies, I recommend checking with your HSA provider or a tax professional to avoid penalties.

Examples of HSA-Eligible Dental Expenses

To give you a clearer picture, here’s a list of dental expenses I’ve confirmed are generally HSA-eligible:

- Routine Dental Care: Cleanings, checkups, and X-rays.

- Restorative Treatments: Fillings, crowns, and root canals.

- Orthodontics: Braces and Invisalign, if medically necessary.

- Oral Surgery: Extractions, including wisdom teeth removal.

- Dental Implants: If needed for health reasons, not purely cosmetic.

- Preventive Care: Sealants and fluoride treatments.

I’ve used my HSA for routine cleanings and even a filling, and it’s been a straightforward process. You can pay directly with an HSA debit card or reimburse yourself later, but keep receipts for documentation.

If you’re planning a major procedure like braces, double-check with your provider to ensure it’s covered, as some plans may have specific requirements.

Can You Use HSA for Eyeglasses?

What Dental Expenses Are Not HSA-Eligible?

While HSAs are versatile, I learned the hard way that not every dental expense qualifies. Cosmetic procedures are a common gray area. For instance, I once considered teeth whitening but found out it’s not HSA-eligible unless it’s addressing a medical condition. Here are some expenses you generally can’t use your HSA for:

- Cosmetic Dentistry: Teeth whitening, veneers, or bonding for aesthetic purposes.

- Over-the-Counter Products: Toothpaste or mouthwash, unless prescribed by a dentist.

- Dental Insurance Premiums: You can’t use HSA funds to pay for dental insurance.

If you’re tempted to use your HSA for something like whitening, pause and verify eligibility. I made the mistake of assuming all dental costs were covered early on, and it took some research to clarify the rules. When in doubt, consult IRS guidelines or your HSA administrator to stay compliant.

How to Use Your HSA for Dental Care

Using my HSA for dental expenses has been a lifesaver, and I want to share how you can do it smoothly. Here’s a step-by-step guide based on my experience:

- Confirm Eligibility: Before scheduling a dental procedure, verify it’s HSA-eligible. Check IRS Publication 502 or contact your HSA provider.

- Pay for Services: You can use your HSA debit card, a linked bank account, or personal funds (then reimburse yourself later).

- Keep Records: Save receipts and Explanation of Benefits (EOB) forms. I keep a digital folder for all my HSA transactions to stay organized.

- Submit for Reimbursement (if needed): If you pay out-of-pocket, submit a claim to your HSA provider for reimbursement.

- Monitor Your Balance: HSAs don’t have a “use it or lose it” rule like FSAs, so you can roll over funds year to year. I love this feature because it lets me save for future dental needs.

One tip I share with friends: always ask your dentist for an itemized bill. It helps clarify which services are HSA-eligible, especially for complex treatments. If you’re like me and want to maximize your HSA, this small step can prevent headaches later.

HSA vs. FSA for Dental Expenses

You might be wondering how HSAs compare to Flexible Spending Accounts (FSAs) for dental care. I’ve used both, and here’s what I’ve learned:

- HSAs: Funds roll over indefinitely, and you own the account. You need an HDHP to qualify, but the tax benefits are robust.

- FSAs: These are often “use it or lose it” accounts, with funds expiring at year-end (though some plans allow a grace period or carryover). FSAs don’t require an HDHP, making them more accessible.

Both can cover dental expenses, but I prefer my HSA because I can save unused funds for future needs, like an unexpected root canal. If you have both, prioritize using FSA funds first for dental care since they expire, then tap into your HSA as needed.

Does a Health Savings Account Rollover?

Tips to Maximize Your HSA for Dental Care

Over the years, I’ve picked up strategies to make my HSA work harder for dental expenses. Here are my top tips for you:

- Plan Ahead: Schedule routine cleanings early in the year to spread out costs. I book mine biannually to stay on top of preventive care.

- Shop Around: Dental costs vary, so compare prices for procedures like implants or orthodontics. I saved hundreds on a crown by researching local providers.

- Invest Your HSA: If your HSA allows investments, consider it. I’ve invested part of my balance in low-risk funds, and it’s grown over time.

- Combine with Discounts: Some dentists offer cash discounts or payment plans. Pair these with HSA funds to stretch your dollars further.

By planning strategically, you can cover dental care without draining your savings. I’ve found that a little foresight goes a long way.

Common Questions About HSAs and Dental Care

As I explored this topic, I came across questions you might have too. Here are answers based on my research:

- Can I use my HSA for my family’s dental expenses? Yes, you can use your HSA for your spouse and dependents, even if they’re not on your HDHP.

- What if my dentist doesn’t accept HSA cards? Pay out-of-pocket and reimburse yourself from your HSA. Just keep detailed records.

- Can I use my HSA for dental expenses abroad? Yes, as long as the expenses are IRS-qualified, but verify with your provider.

If you have specific concerns, I suggest reaching out to your HSA administrator. They’ve helped me clarify tricky situations, like whether a procedure was medically necessary.

Why I Trust HSAs for Dental Care

My experience with HSAs has been overwhelmingly positive, and I trust them because they’re regulated by the IRS and backed by clear guidelines.

Sources like HealthEquity and GoodRx confirm that dental expenses are a core part of HSA eligibility, giving me confidence in using my funds. Plus, the tax savings make a real difference; I’ve lowered my taxable income while covering dental costs.

For you, the key is understanding what qualifies and keeping good records. By following IRS rules, you can use your HSA without worrying about penalties. If you’re new to HSAs, start small with routine dental visits to get comfortable with the process.

Final Thoughts

When I first asked, “Can I use my HSA for dental?” I was delighted to learn how versatile these accounts are. From cleanings to braces, your HSA can cover a wide range of dental expenses, saving you money on taxes and out-of-pocket costs.

By planning ahead, verifying eligibility, and keeping records, you can make your HSA a powerful tool for dental care. I’ve shared my journey to help you navigate yours, and I hope you feel empowered to use your HSA confidently.

If you’re ready to explore more, check your HSA provider’s website or IRS Publication 502 for detailed guidelines. Have you used your HSA for dental expenses yet? Let me know your experience, I’d love to hear how it’s worked for you.