As an individual who has navigated the intricacies of personal finance, I understand the importance of having access to reliable credit services. Big Star Credit offers a range of financial solutions designed to meet diverse needs. In this article, I will guide you through the process of accessing Big Star Credit’s online services, highlight the benefits they offer, and provide insights into managing your credit effectively.

Understanding Big Star Credit’s Online Platform

Big Star Credit provides an online platform that allows users to manage their credit accounts conveniently. By logging into your account, you can view your loan details, make payments, and access other essential services.

How to Access the Big Star Credit Login Page

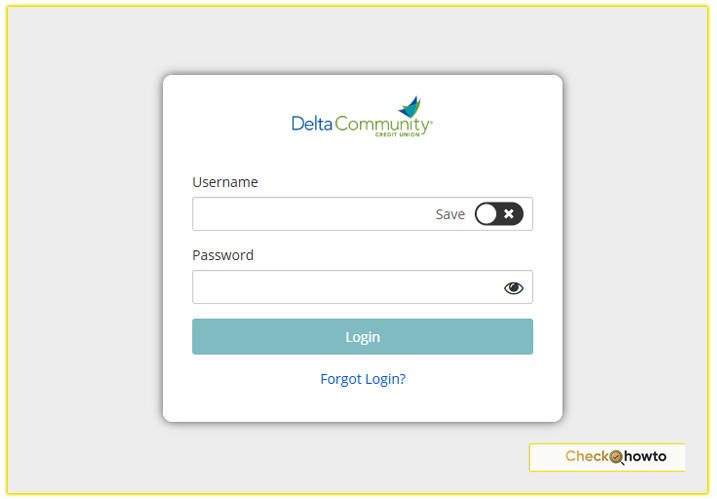

To access your Big Star Credit account, follow these steps:

- Visit the Official Website: Navigate to Big Star Credit’s official website.

- Locate the Login Section: On the homepage, find the “Sign In” option, typically located at the top right corner.

- Enter Your Credentials: Input your registered email address and password in the respective fields.

- Click “Sign In”: After entering your credentials, click the “Sign In” button to access your account.

Troubleshooting Login Issues

If you encounter difficulties while trying to log in:

- Forgotten Password: Use the “Forgot Password” feature to reset your password.

- Account Lockout: After multiple unsuccessful login attempts, your account may be temporarily locked. Wait for a specified period before retrying or contact customer support.

- Browser Compatibility: Ensure you’re using an updated browser with JavaScript enabled, as the platform may require it for optimal functionality.

Credit Hero Score Login at Creditheroscore.com

Benefits of Using Big Star Credit’s Online Services

Managing your credit account online with Big Star Credit offers several advantages:

- Convenience: Access your account anytime, anywhere, without the need to visit a physical branch.

- Real-Time Updates: Stay informed about your loan status, payment schedules, and available credit.

- Secure Transactions: The platform employs robust security measures to protect your personal and financial information.

Exploring Big Star Credit’s Financial Solutions

Beyond online account management, Big Star Credit offers various financial products tailored to different needs:

- Personal Loans: Flexible loan options with competitive interest rates to help you meet your financial goals.

- Credit Repair Services: Assistance in improving your credit score by addressing inaccuracies in your credit report.

- Financial Education: Resources and tools to help you make informed financial decisions.

Online Banking for US Bank – Enroll and Login

Best Practices for Managing Your Credit

Effective credit management is crucial for financial well-being. Here are some tips:

- Timely Payments: Always pay your bills on time to maintain a positive credit history.Investopedia

- Monitor Your Credit Report: Regularly review your credit reports for inaccuracies and dispute any errors promptly.

- Maintain Low Credit Utilization: Keep your credit card balances low relative to your credit limits to positively impact your credit score.

- Limit New Credit Applications: Avoid applying for multiple credit accounts in a short period, as it can negatively affect your credit score.

Conclusion

Accessing and managing your Big Star Credit account online provides a seamless and secure way to handle your financial needs. By leveraging their online platform, you can stay on top of your credit obligations and make informed decisions to enhance your financial health.