As someone who values seamless and secure banking, I’ve explored the ins and outs of Bankwest Australia online banking to share a detailed guide that helps you navigate this digital platform with ease.

Bankwest, a Perth-based bank and a subsidiary of the Commonwealth Bank since 2008, has transitioned into a digital-only bank by the end of 2024, making its online banking services a cornerstone for customers like you.

I can tell you that Bankwest Australia offers a seamless and user-friendly platform to manage your finances. Whether you’re checking your account balance, paying bills, or setting up savings goals, their online banking system is designed to make your life easier.

What Is Bankwest Online Banking?

I first encountered Bankwest online banking when I needed a convenient way to manage my accounts without visiting a branch.

Bankwest’s online platform, accessible via their website or the Bankwest mobile app, allows you to handle everyday banking tasks, from checking balances to paying bills, anytime, anywhere.

With the bank closing all physical branches in Western Australia by late 2024, as noted on their official site, their digital services are now the primary way to interact with your accounts.

For you, this means a streamlined, tech-driven banking experience designed to fit into your busy lifestyle.

The platform supports a range of services, including transaction accounts, savings accounts, home loans, and credit cards.

Whether you’re transferring funds or tracking your spending, Bankwest’s online banking is built to be intuitive and secure, ensuring you stay in control of your finances.

Key Features of Bankwest Online Banking

What I love about Bankwest online banking is its user-friendly features, which make managing money feel effortless. Here’s a breakdown of what you can expect:

1. Account Management

I can check my transaction accounts, savings accounts, and home loan balances with a few clicks. You can nickname your accounts (e.g., “Vacation Fund”) and reorder them to prioritize what matters most.

The app also lets you download statements or request a proof of balance, which I found handy for tax season.

2. Payments and Transfers

Making payments is a breeze. You can:

- Transfer money between your Bankwest accounts instantly.

- Pay bills using BPAY, a secure Australian payment system.

- Set up PayID with your mobile number or email for quick transfers.

- Schedule recurring payments to avoid missing due dates.

I’ve used BPAY to pay utilities, and the ability to send payment receipts via the app saves me time. You’ll appreciate how these tools keep your finances organized.

3. Card Management

One feature that stood out to me was the ability to manage my debit and credit cards directly in the app. You can:

- Activate a new card.

- Lock or replace a lost/stolen card.

- Add your card to Google Pay, Apple Pay, Samsung Pay, or other digital wallets for contactless payments.

- Reset your card PIN.

If you’re like me and occasionally misplace your card, locking it temporarily via the app gives peace of mind.

4. Security and Fraud Monitoring

Bankwest takes security seriously, which I’ve come to trust. Their systems monitor for unusual activity, and they’ll contact you if something seems off.

For example, I once received a notification about a suspicious transaction, which I quickly disputed through the app.

Bankwest’s policy, as stated on their website, ensures you’re protected from losses due to unauthorized transactions, provided you comply with their terms.

You can enhance your security by enabling Easy Alerts for real-time notifications about account activity, like salary deposits or overseas transactions. I recommend setting a strong PIN or using fingerprint login for quick, secure access.

5. Home Loan and Savings Tools

If you have a home loan, you can track your balance and see how much interest you’ve saved using offset accounts.

For savings, the app lets you set savings goals and track progress, which motivated me to stick to my budget. You’ll find these tools especially useful if you’re saving for a big purchase or managing a mortgage.

6. Customer Support

I’ve messaged Bankwest’s support team through the app at all hours, and their 24/7 availability is a game-changer.

You can also call 13 17 19 within Australia or +61 8 9449 2840 if overseas. The app’s search function helps you find answers to common questions, reducing the need to wait for assistance.

What to Know about Westpac Online Banking

Enrolling in Bankwest Online Banking

Enrolling in Bankwest’s online banking is straightforward, and I’m excited to walk you through it. Whether you’re a new customer or an existing one, you’ll need to set up your account to access these digital tools. Here’s how you can do it:

Gather Your Details

To start, I make sure I have my Personal Access Number (PAN), which Bankwest provides when you open an account. You’ll find it in your welcome email, letter, or account statements.

If you’re new to Bankwest, check your inbox for this detail. You’ll also need your date of birth, email address, and mobile phone number for verification. Having these ready saves time.

Visit the Bankwest Website or App

I usually head to the Bankwest website (www.bankwest.com.au) or download the Bankwest App from the App Store or Google Play.

The app is particularly handy if you prefer banking on your phone. Once you’re there, look for the “Register” or “Sign Up” option on the online banking login page. It’s clearly marked, so you won’t miss it.

Complete the Registration Form

Here’s where you’ll input your details. I enter my PAN, date of birth, and email address as prompted. Bankwest will send a verification code to your mobile phone, so keep it nearby.

You’ll use this code to confirm your identity. This step ensures that only you can set up your account, which I appreciate for security reasons.

Set Up Your Login Credentials

Next, you’ll create a password. I always choose a strong one, mixing letters, numbers, and symbols, to keep my account secure.

You can also set up a 4-digit PIN or enable fingerprint login for faster access on the app. Bankwest’s system guides you through this, making it easy to customize your login preferences.

Confirm and Explore

Once you’ve completed the form and verified your details, you’re enrolled! I received a confirmation email from Bankwest, and I was ready to log in.

Take a moment to explore the dashboard, you’ll see options for account management, payments, and even savings goal tracking. It’s intuitive, so you’ll get the hang of it quickly.

Tip: If you run into issues, you can message Bankwest’s support team through the app or call 13 17 19. They’re available 24/7, which I’ve found super helpful.

What to Know About Vanguard 401k

Logging Into Bankwest Online Banking

Now that you’re enrolled, logging in is a breeze. I access my account regularly to check transactions or make payments, and the process is consistent whether I’m using the website or app. Here’s how you can log in:

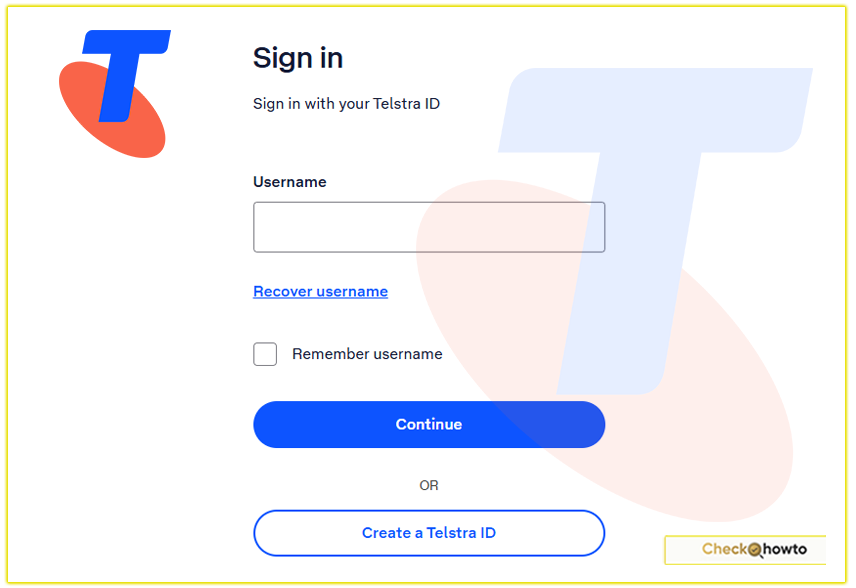

Navigate to the Login Page

Go to www.bankwest.com.au or open the Bankwest App. On the website, click “Log In” at the top right. In the app, you’ll land on the login screen automatically. It’s designed for quick access, which I love when I’m in a rush.

Enter Your Credentials

You’ll need your PAN and password. If you’ve set up a PIN or fingerprint login on the app, you can use those instead. I often use fingerprint login for speed, but the password works just as well. Double-check your PAN, it’s easy to mistype.

Verify Your Identity (If Needed)

For added security, Bankwest may send a one-time code to your phone or email, especially for new devices.

I’ve had this happen when logging in from a different computer, and it only takes a second to enter the code. This extra layer makes me feel confident that my account is protected.

Access Your Account

Once verified, you’re in! You’ll see your account overview, recent transactions, and options to transfer money, pay bills, or manage cards.

The app’s interface is clean, though some users have noted it requires scrolling on smaller screens. I find it manageable, but it’s something to keep in mind.

Tip: If you forget your password, click “Forgotten Password” on the login screen. You’ll reset it using your PAN, date of birth, email, and phone. It’s quick, and you’ll be back in no time.

Benefits of Using Bankwest Online Banking

From my experience, Bankwest online banking offers several advantages that make it a go-to for digital banking:

- Convenience: Access your accounts 24/7 from anywhere, whether you’re at home or traveling.

- Time-Saving: Features like PayID and scheduled payments reduce manual tasks.

- Cost-Effective: Bankwest offers fee-free withdrawals at major Australian bank ATMs (CommBank, ANZ, NAB, Westpac) for eligible customers, as noted on their contact page.

- Eco-Friendly: Digital statements and receipts cut down on paper waste.

For you, these benefits translate to a banking experience that’s both efficient and tailored to your needs.

Challenges and How to Overcome Them

No platform is perfect, and I’ve noticed a few areas where Bankwest could improve, based on user feedback from platforms like the App Store and Google Play.

Some users, for instance, have complained about the app’s updated interface, citing excessive whitespace and scrolling.

Others, like a reviewer who wanted expenditure graphs, felt the app lacked advanced budgeting tools compared to competitors like NAB.

Here’s how you can navigate these challenges:

- Interface Issues: Take time to explore the app’s menu and customize your dashboard. If the layout feels clunky, check for app updates, as Bankwest often releases fixes.

- Missing Features: While expenditure graphs aren’t available, you can track spending by tapping on transactions for detailed info, including business type and location. For advanced budgeting, consider linking your accounts to a third-party app like PocketSmith.

- Technical Glitches: If the app doesn’t fit your screen (an issue reported on older devices like the iPhone X), ensure your app and device software are updated. Contact support if problems persist.

Conclusion

Exploring Bankwest Australia online banking has shown me how powerful and convenient digital banking can be.

From managing my accounts to paying bills on the go, the platform has simplified my financial life, and I’m confident it can do the same for you.

By registering today, exploring its features, and following the tips above, you’ll unlock a seamless banking experience tailored to your needs.

For more details, visit the official Bankwest website or download the app from the App Store or Google Play. If you have questions, their 24/7 support team is just a message away.