When it comes to understanding financial concepts, some terms can seem complicated. One of those terms is (APY) Annual Percentage Yield. I remember when I first came across it, and like many others, I had questions. What exactly does it mean? How does it impact my savings or investments? If you’re like me and you’ve wondered about APY, you’re in the right place. I’ll break down what APY is, how it’s calculated, and why it matters to you in a way that’s easy to follow.

What Is APY?

APY stands for Annual Percentage Yield. In simple terms, it’s a way of measuring how much your money will grow over a year when it’s invested or saved, considering the effect of compound interest. If you’ve ever opened a savings account or invested in a financial product, you’ve probably seen APY mentioned. It’s the percentage that tells you how much you’ll earn on your money over the course of a year. But it’s not just a straightforward percentage – it takes compounding into account.

When I say compounding, what I mean is that the interest you earn doesn’t just apply to your initial deposit. Instead, as your money earns interest, that interest itself starts earning interest too. This is where APY becomes different from a simple interest rate, or what we call APR (Annual Percentage Rate). While APR gives you the interest on your principal only, APY accounts for the interest-on-interest effect, which can significantly boost your earnings.

So, in short, APY gives you a more accurate picture of how much money you’ll make, as it factors in the compounding effect that happens over time.

Why Does APY Matter?

Now, you might be thinking, “Why should I care about APY?” Well, it’s crucial because it shows you the real return on your money. Whether you’re putting your money in a savings account, certificate of deposit (CD), or investment product, you’ll want to know how much you’ll actually make. APY allows you to compare different financial products accurately.

Let’s say you’re comparing two savings accounts. One offers an interest rate of 2%, and the other offers 1.95% but has daily compounding. Because of the compounding effect, the account with the 1.95% interest rate could end up giving you a higher APY and, in turn, a better return on your savings over time. So, by understanding APY, you can make smarter decisions about where to put your money.

I’ve personally found that keeping an eye on APY has helped me maximize my savings. In fact, when I opened a high-yield savings account a while back, I paid close attention to the APY to ensure I was getting the best deal. And honestly, once you start using it to compare rates, you’ll see just how important it is.

See; What Is a Savings Account and How Does It Work?

The Difference Between APY and APR

You may have heard of another financial term: APR, or Annual Percentage Rate. It’s easy to confuse APR with APY, but they’re not the same thing. The key difference is that APY takes into account compound interest, while APR does not.

APR is typically used to describe how much interest you’ll pay on a loan, credit card, or mortgage. For example, if you take out a loan with a 5% APR, you’ll pay 5% of the loan amount in interest over the course of a year, but it doesn’t account for how that interest compounds over time. APY, on the other hand, is focused on what you’ll earn or pay when compounding is factored in.

So, when you’re looking at a financial product where you’re earning money, such as a savings account or an investment, you’ll want to focus on the APY. But if you’re borrowing money, then APR is the more relevant term to watch out for. Keeping this distinction clear will help you avoid confusion.

How Is APY Calculated?

Now that you understand what APY is, let’s talk about how it’s actually calculated. I won’t go too deep into complicated math, but I’ll give you enough so that you understand the process.

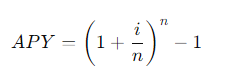

The formula to calculate APY is

Where:

- i is the interest rate (or APR),

- n is the number of compounding periods per year.

This formula might look a bit intimidating at first, but let me walk you through it.

- Interest Rate (i): The APR or nominal interest rate is the base rate your bank or investment offers before accounting for compounding.

- Compounding Periods (n): This refers to how often interest is added to your account. The more often interest is compounded (daily, monthly, quarterly, etc.), the higher the APY will be because compounding gives you interest on top of your interest more frequently.

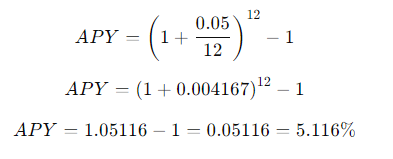

Let’s break it down with an example so you can see it in action. Imagine you have an account with a 5% interest rate (APR), and interest compounds monthly. In this case, your “n” would be 12 (since interest compounds 12 times per year).

Here’s what the calculation would look like:

So, in this example, even though the APR is 5%, the APY is 5.116% due to the effect of monthly compounding.

Factors That Affect APY

Several factors can influence APY, and knowing these will help you make informed decisions about your finances. Here’s what you should keep in mind:

- Interest Rate (APR): The higher the interest rate, the higher the APY will generally be.

- Compounding Frequency: As I mentioned earlier, the more frequently interest compounds, the higher your APY. Daily compounding will result in a higher APY than monthly or quarterly compounding, even if the APR stays the same.

- Length of Time: APY assumes that your money will stay in the account for a full year. If you withdraw your money before the year ends, you won’t earn the full APY. So, for accounts like CDs or fixed-term investments, it’s important to understand how long your money needs to stay in the account to benefit from the advertised APY.

- Fees: Some financial products come with fees that can lower your actual returns. Even if the APY looks great on paper, be sure to check if there are any maintenance or early withdrawal fees that could eat into your earnings.

- Minimum Balances: Many banks require a minimum balance to earn the advertised APY. If your balance falls below that minimum, you might earn a lower interest rate, which will result in a lower APY.

Comparing APY to Different Financial Products

APY is commonly used for savings accounts, CDs, and other interest-earning products, but it’s essential to compare APY when choosing between these options. Here’s a quick rundown of how APY plays a role in each:

1. Savings Accounts:

Most traditional savings accounts offer a modest APY, typically around 0.01% to 1%. However, high-yield savings accounts can offer much higher APYs, sometimes 4% or more. In my experience, these high-yield accounts are a great way to grow your emergency fund or short-term savings.

2. Certificates of Deposit (CDs):

CDs often offer higher APYs than savings accounts in exchange for locking up your money for a set period, usually ranging from 3 months to 5 years. The longer the term, the higher the APY tends to be. However, if you withdraw your money early, you may face penalties, so be sure to only use money you won’t need in the short term.

3. Money Market Accounts:

Money market accounts combine features of both savings and checking accounts, offering higher APYs than traditional savings accounts while giving you more access to your funds. However, they often require higher minimum balances to earn the top APY.

See; How to Set Financial Goals for Your Future

How to Maximize APY in Your Financial Strategy

Understanding APY is just the first step. To make the most of it, you need to know how to incorporate it into your financial strategy.

- Shop Around for the Best Rates: When it comes to APY, not all financial institutions are created equal. Take the time to compare rates across banks and credit unions. You’d be surprised how much difference even a small percentage increase can make over time.

- Look for High-Yield Accounts: High-yield savings accounts are a great option if you’re looking to maximize APY. Many online banks offer significantly higher APYs compared to traditional brick-and-mortar banks. I’ve personally found that moving my savings to an online high-yield account made a noticeable difference in how quickly my money grew.

- Choose the Right Compounding Frequency: If you have the option, choose accounts that offer daily compounding over those that compound monthly or quarterly. As we’ve seen, the more frequently your interest compounds, the higher your APY, and the more money you’ll earn over time.

- Keep an Eye on Fees and Minimum Balances: To truly benefit from APY, you need to avoid fees and ensure you maintain the required minimum balance. Even the best APY won’t help you much if fees are eating into your earnings or if you aren’t keeping enough money in the account to qualify for the advertised rate.

Conclusion

By now, you should have a clearer understanding of what APY is, how it’s calculated, and why it matters. Whether you’re saving for a rainy day, building an emergency fund, or investing for the long term, paying attention to APY can help you make smarter financial decisions.

It’s worth noting that APY isn’t something that only applies to the ultra-wealthy. Anyone with a savings account or investment product can benefit from knowing how APY works. By keeping an eye on it, you can maximize your earnings and grow your wealth over time.

So the next time you’re comparing savings accounts or investment options, take a close look at the APY. It’s one of the most important numbers when it comes to understanding your real return on investment. And now that you know what it is and how it’s calculated, you’re better equipped to make informed financial decisions.