As someone who’s navigated the world of personal finance, I’ve learned that managing credit card debt can feel like an uphill battle, especially when high interest rates eat away at your payments.

That’s where a credit card balance transfer comes in, a tool that can help you consolidate debt, lower interest rates, and simplify your payments.

If you’re considering a balance transfer with Navy Federal Credit Union (NFCU), you’re in the right place.

What Is a Credit Card Balance Transfer?

A balance transfer involves moving debt from one or more credit cards to another card, typically one with a lower interest rate. I’ve found this strategy particularly useful for consolidating high-interest debt into a single account, making it easier to manage and potentially saving money on interest.

Navy Federal Credit Union offers compelling balance transfer options, especially for military members, veterans, and their families, with competitive rates and no transfer fees.

When you transfer a balance, you’re essentially using a new credit card to pay off the debt on your existing cards. The goal? To secure a lower annual percentage rate (APR), reduce monthly payments, or take advantage of a promotional rate to pay down debt faster.

For example, I once transferred a high-interest balance to a card with a 0% introductory APR, which allowed me to focus on paying off the principal without interest piling up.

Card Balance Transfer: What It Is & How It Works

Why Choose Navy Federal for a Balance Transfer?

Navy Federal Credit Union stands out for its member-focused approach, offering benefits tailored to those with military ties. Here’s why I think their balance transfer options are worth considering:

- No Balance Transfer Fees: Unlike many issuers that charge 3% to 5% of the transferred amount, Navy Federal doesn’t charge a fee, saving you significant upfront costs. For instance, transferring a $5,000 balance with a 3% fee elsewhere would cost $150, but with NFCU, it’s $0.

- Low Introductory APR: The Navy Federal Platinum Credit Card offers a 0.99% introductory APR on balance transfers for 12 months if requested within 60 days of account opening. After that, the variable APR ranges from 10.99% to 18.00%, based on your creditworthiness, which is lower than the industry average of over 20%.

- Member-Friendly Terms: Navy Federal’s cards, including the Platinum, have no annual fees and low cash advance fees (none if done at an NFCU branch or ATM). This makes them a cost-effective choice for debt management.

As someone who values transparency, I appreciate that Navy Federal’s terms are straightforward, and their customer service consistently ranks high—evidenced by their #2 ranking in Forrester’s 2024 US Customer Experience Index.

Is a Balance Transfer Right for You?

Before you jump into a balance transfer, ask yourself a few key questions to ensure it aligns with your financial goals. I’ve learned that a balance transfer isn’t a one-size-fits-all solution, so consider the following:

- What’s Your Current Interest Rate? Check the APR on your existing cards. If you’re paying a high rate (say, 20% or more), transferring to a Navy Federal card with a 0.99% intro APR could save you hundreds. Use NFCU’s debt consolidation calculator to estimate savings.

- Can You Pay Off the Balance During the Promotional Period? The 0.99% intro APR lasts 12 months. If you can’t pay off the balance within that time, the standard APR (10.99%–18.00%) will apply. I recommend creating a repayment plan to tackle the debt before the promotional rate expires.

- What’s Your Credit Score? Navy Federal’s Platinum card typically requires good to excellent credit (around 670 or higher). If your score is lower, you may still qualify, but the APR could be on the higher end.

When I considered a balance transfer, I weighed these factors carefully. For instance, I had a $6,000 balance at 23% APR. Transferring it to a card with a 0% intro APR saved me over $1,000 in interest over a year, assuming I paid it off within the promotional period.

How to Do a Navy Federal Balance Transfer

Here’s a step-by-step guide to help you execute a balance transfer with Navy Federal. I’ve broken it down to make the process as clear as possible:

Step 1: Confirm Your Eligibility

Navy Federal is exclusive to military members, veterans, Department of Defense civilians, and their families. If you’re not a member, check your eligibility and join at navyfederal.org. I found the membership process straightforward, requiring basic documentation like proof of military service or a family connection.

Step 2: Choose the Right Card

Navy Federal offers several credit cards, but the Platinum Credit Card is the best for balance transfers due to its 0.99% intro APR for 12 months and no transfer fees.

Other cards, like the cashRewards or More Rewards American Express, offer rewards but may have higher intro APRs (e.g., 1.99% for cashRewards). Compare cards on Navy Federal’s website to find the best fit for your needs.

If you’re unsure, use NFCU’s prequalification tool to check your approval odds without impacting your credit score. I did this before applying, and it gave me confidence in my decision.

Step 3: Apply for the Card or Use an Existing One

If you’re a new cardholder, apply for the Platinum card and select the balance transfer option during the application. You’ll need:

- The name and address of the financial institution holding your current card.

- Your account number for that card.

- The amount you want to transfer (up to your approved credit limit).

If you already have an NFCU card, request a transfer via:

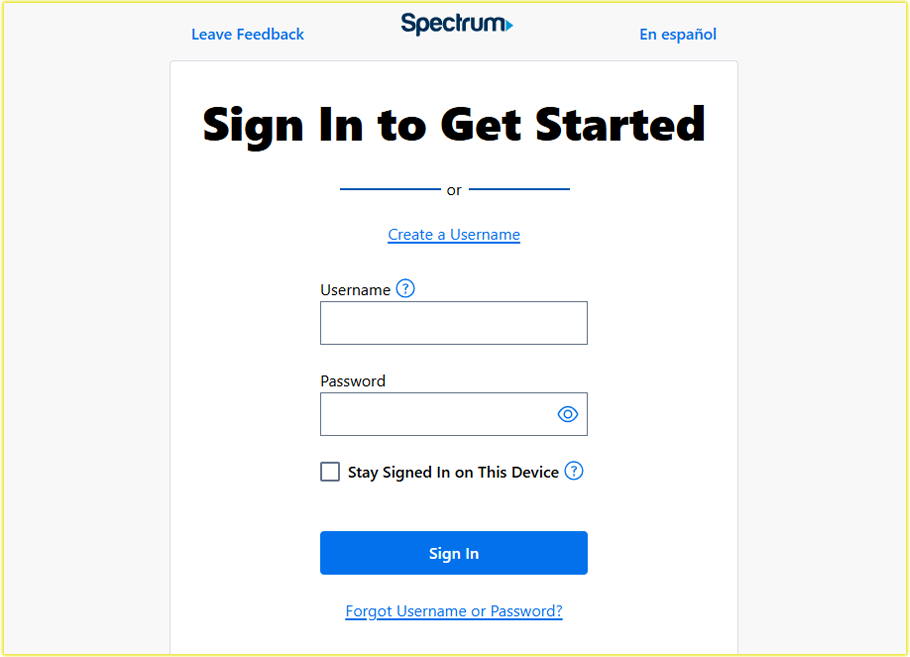

- Online Banking: Sign in, go to the “Transfers” tab, select “Make a Credit Card Balance Transfer,” and enter the required details.

- Mobile App: Navigate to “Account Management,” then “Balance Transfer,” and follow the prompts.

When I requested a transfer, I used the mobile app for convenience, and the interface was user-friendly.

Step 4: Continue Payments on Your Old Card

Balance transfers can take up to two weeks to process (10 days for new accounts, plus up to 14 days for the payment to reach your old issuer).

To avoid late fees or penalties, keep making payments on your original card until the transfer is confirmed. I set a calendar reminder to check the status after a week to stay on top of it.

Step 5: Verify the Transfer

Once the transfer posts, check both your old and new accounts to confirm the balance has moved correctly. Navy Federal will pay off the specified amount on your old card, and you’ll now owe that amount on your NFCU card.

Step 6: Plan Your Repayment

To maximize savings, aim to pay off the transferred balance within the 12-month 0.99% intro APR period. For example, if you transfer $5,000, you’d need to pay roughly $417 per month to clear it in 12 months. I used a budgeting app to track my payments and ensure I stayed on schedule.

Fidelity Credit Card Balance Transfer

Benefits of a Navy Federal Balance Transfer

From my experience, here are the key advantages of choosing Navy Federal for a balance transfer:

- Save on Interest: The 0.99% intro APR is nearly interest-free, letting you focus on paying down the principal. For a $6,000 balance, you could save approximately $1,176 compared to a card with a 20% APR.

- Consolidate Payments: If you have multiple cards with balances, transferring them to one NFCU card simplifies your finances with a single monthly payment.

- No Impact on Credit Score for Existing Cards: Transferring to an existing NFCU card doesn’t require a hard inquiry, preserving your credit score.

- Additional Perks: The Platinum card offers benefits like collision damage waiver for car rentals and no foreign transaction fees, which I found useful for occasional travel.

Things to Watch Out For

While balance transfers can be a game-changer, there are pitfalls to avoid. Here’s what I’ve learned to watch for:

- Promotional Period Limits: The 0.99% intro APR applies only to transfers requested within 60 days of account opening. After 12 months, the standard APR (10.99%–18.00%) kicks in, so plan to pay off the balance before then.

- Credit Utilization: Transferring a large balance could increase your credit utilization ratio on the new card, potentially affecting your credit score. I kept my utilization below 30% to minimize impact.

- Avoid New Purchases: Interest on purchases accrues immediately unless you pay the full balance (including transfers) each month. I made a point to use a separate card for new purchases to avoid complicating my repayment plan.

- Don’t Close Old Accounts Rashly: Closing an old card after a transfer might shorten your credit history or increase utilization, potentially lowering your score. I left my old card open with a zero balance to maintain my credit health.

Common Myths About Balance Transfers

There are misconceptions about balance transfers that can trip you up. Here are a few I’ve encountered, debunked:

- Myth: A balance transfer reduces the amount you owe. A transfer doesn’t erase debt; it moves it to a new card with better terms. You still need to pay off the full amount.

- Myth: Balance transfers always hurt your credit score. A transfer itself doesn’t directly impact your score, especially if you use an existing card. However, opening a new card may cause a temporary dip due to a hard inquiry.

- Myth: You can transfer balances repeatedly. Frequently transferring balances to chase promo rates can signal risk to lenders and hurt your credit. Navy Federal also limits transfers within its own cards.

My Personal Tips for Success

Having gone through a balance transfer myself, here are some tips to make the most of it:

- Use a Calculator: Navy Federal’s debt consolidation calculator helped me estimate savings and plan payments. You can find it on their website.

- Set Up Auto-Payments: To avoid missing due-union-paypal, I set up automatic payments to ensure I never incurred late fees.

- Choose the Right Card: If you want rewards, consider cards like the More Rewards American Express, but for pure debt repayment, the Platinum’s low APR is ideal.

- Monitor Your Progress: Track your balance regularly to stay motivated. I checked my NFCU account weekly to celebrate small milestones.

Costco Credit Card Balance Transfer

Conclusion

A Navy Federal credit card balance transfer can be a powerful tool to manage and reduce credit card debt, especially with the Platinum card’s 0.99% intro APR and no transfer fees.

By consolidating high-interest debt, you can save money, simplify payments, and work toward financial freedom. My experience with a balance transfer taught me the importance of planning and discipline to maximize savings.

If you’re eligible for Navy Federal membership, I encourage you to explore their credit card options and use their tools to make an informed decision.

Ready to get started? Visit navyfederal.org to check eligibility, prequalify, and apply for a card that suits your needs. With careful planning, you can take control of your debt and achieve your financial goals.