When I first heard about a Health Savings Account (HSA), I was skeptical. Could a savings account really make a dent in my healthcare costs while offering tax benefits? After diving into the details and using an HSA myself, I’ve learned it can be a game-changer for many—but it’s not for everyone.

In this article, I’ll walk you through what an HSA is, its benefits, potential drawbacks, and how you can decide if it’s worth it for your financial and healthcare needs.

What Is a Health Savings Account?

An HSA is a tax-advantaged savings account designed for individuals enrolled in a high-deductible health plan (HDHP). It allows you to save money for qualified medical expenses, like doctor visits, prescriptions, and even dental care, while enjoying significant tax benefits.

According to HealthEquity, an HSA paired with an HDHP lets you contribute pre-tax dollars, which can be used tax-free for eligible expenses.

Here’s how it works: I contribute money to my HSA each year, up to the IRS limit ($4,300 for individuals or $8,550 for families in 2025). Those funds roll over year after year, unlike a Flexible Spending Account (FSA), which often has a “use it or lose it” rule.

Over time, I’ve built a nest egg for medical costs, and I can even invest the funds for potential growth, as Fidelity Investments notes.

But you might be wondering: Why should you care about an HSA? Let’s break down the benefits to see if it aligns with your needs.

The Benefits of an HSA: Why I Love It

1. Triple Tax Advantage

The standout feature of an HSA is its triple tax advantage, a phrase I’ve seen echoed across sources like HSA Bank and posts on X. Here’s what that means:

- Tax-deductible contributions: When I contribute to my HSA, that amount reduces my taxable income. For example, if I earn $60,000 and contribute $4,000, I’m taxed on $56,000.

- Tax-free growth: Any interest or investment gains in my HSA grow tax-free. I’ve invested mine in low-cost index funds, and it’s exciting to see the balance grow over time.

- Tax-free withdrawals: When I use HSA funds for qualified medical expenses, I pay no taxes on those withdrawals.

This combination is rare in the world of personal finance. As one X user pointed out, HSAs are “like a Roth IRA on steroids” for healthcare costs.

2. Flexibility and Control

I appreciate how an HSA puts me in the driver’s seat. Unlike traditional health plans, where insurance dictates much of the process, an HSA gives you control over how you spend your healthcare dollars. HSA Bank emphasizes that combining an HSA with an HDHP offers savings and tax advantages that traditional plans can’t match.

For instance, I can save receipts and pay medical bills out of pocket now, letting my HSA grow. Years later, I can reimburse myself tax-free, as long as I have proof of the expense. This strategy, highlighted by an X user, has helped me treat my HSA as a wealth-building tool.

3. Long-Term Savings and Retirement Planning

One of the biggest surprises for me was realizing an HSA isn’t just for immediate medical costs—it’s a powerful tool for retirement planning. After age 65, you can withdraw HSA funds for non-medical expenses without penalty (though you’ll owe income tax on those withdrawals).

This makes it a hybrid savings vehicle, as Cigna Healthcare notes.

I’ve started viewing my HSA as a supplement to my 401(k). By maxing out contributions and investing the funds, I’m preparing for future healthcare costs, which are projected to be significant in retirement. For you, this could mean peace of mind knowing you’re ready for unexpected medical bills down the road.

4. Portability and Rollover

Unlike other accounts tied to an employer, my HSA stays with me no matter where I work. The funds roll over indefinitely, so I don’t lose money if I don’t spend it by year-end. This portability, mentioned by Optum Bank, makes an HSA a reliable long-term solution.

Health Accounts with Bank of America

The Drawbacks: What You Need to Consider

While I’m a fan of my HSA, it’s not perfect. Here are some potential downsides you should weigh:

1. High-Deductible Health Plan Requirement

To qualify for an HSA, you must be enrolled in an HDHP, which typically has lower premiums but higher deductibles (at least $1,600 for individuals or $3,200 for families in 2025). This means you’ll pay more out of pocket before insurance kicks in.

For me, this works because I’m relatively healthy, but if you have frequent medical needs, the high deductible could strain your budget.

2. Upfront Costs

Contributing to an HSA requires disposable income. When I started, I had to budget carefully to max out my contributions. If you’re living paycheck to paycheck, diverting funds to an HSA might feel impossible, even with the tax savings.

3. Record-Keeping

Using an HSA strategically, like saving receipts for future reimbursements, requires organization. I’ve set up a digital folder for my medical receipts, but it’s an extra step. If you’re not diligent, you might miss out on the full benefits, as an X user warned about common HSA mistakes.

4. Investment Risks

While I love investing my HSA funds, there’s always a risk of market losses. If you’re risk-averse, you might prefer keeping your HSA in a savings account, but that limits growth potential. Fidelity advises weighing your risk tolerance before investing.

Is a Health Savings Account (HSA) Worth It for You?

Now that I’ve shared my experience, let’s talk about whether a Health Savings Account (HSA) makes sense for you. Here are key factors to consider:

- Your Health Status: If you’re generally healthy and don’t anticipate high medical costs, an HDHP with an HSA can save you money on premiums and taxes. But if you have chronic conditions or frequent doctor visits, the high deductible might outweigh the benefits.

- Financial Situation: Can you afford to contribute to an HSA and cover the HDHP deductible if needed? If you have extra income to save, the tax advantages are hard to beat.

- Long-Term Goals: Are you looking for ways to save for retirement or future healthcare costs? An HSA’s flexibility makes it a strong option for forward-thinkers.

- Comfort with Risk: Are you okay with a higher deductible and potential investment fluctuations? If so, an HSA could align with your financial strategy.

For me, the HSA has been worth it because I’m healthy, have room in my budget, and love the idea of building a tax-advantaged healthcare fund. But your situation is unique, so take time to evaluate your needs.

Does a Health Savings Account Rollover?

Tips to Maximize Your HSA

If you decide an HSA is right for you, here are some strategies I’ve found helpful, inspired by sources like X posts and HealthEquity:

- Max Out Contributions: Contribute the maximum allowed each year to fully leverage the tax benefits.

- Invest Your Funds: Treat your HSA like a retirement account by investing in diversified funds for long-term growth.

- Pay Out of Pocket When Possible: Save receipts and let your HSA grow, reimbursing yourself later tax-free.

- Stay Organized: Keep detailed records of medical expenses to ensure you can claim reimbursements years down the line.

- Review Your HDHP: Make sure your health plan still meets your needs each year during open enrollment.

Can You Use HSA for Eyeglasses?

Conclusion: My Verdict on HSAs

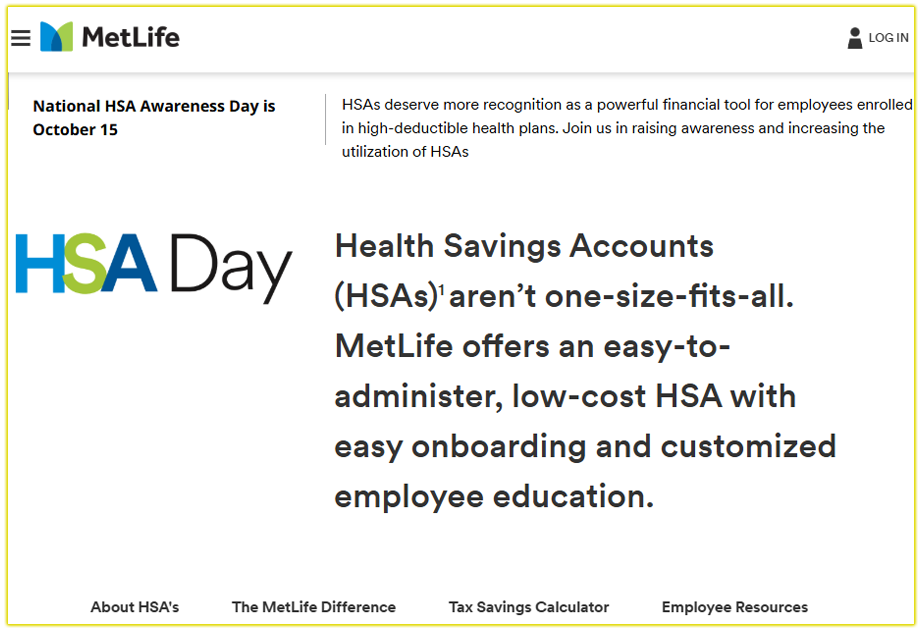

After years of using an HSA, I can confidently say it’s been a smart financial move for me. The triple tax advantage, flexibility, and potential for long-term savings make it a powerful tool, especially if you’re healthy and can manage a high-deductible plan. However, it’s not a one-size-fits-all solution. You need to assess your health, finances, and comfort with risk to decide if it’s worth it.

If you’re intrigued, I recommend checking out resources like the IRS website for eligibility details or exploring HSA providers like HealthEquity or Optum Bank. An HSA could be your ticket to smarter healthcare savings, but only you can decide if it’s the right fit.

What do you think? Are you ready to explore an HSA, or do you have concerns holding you back?