When I first explored options for managing healthcare costs, I stumbled upon the Avidia Health Savings Account (HSA). As someone who values financial flexibility and tax advantages, I found the Avidia HSA to be a compelling choice.

In this article, I’ll walk you through what an Avidia HSA is, how it works, and why it might be the right fit for you. Whether you’re new to HSAs or looking for a reliable provider, this guide will help you make an informed decision.

What Is an Avidia Health Savings Account?

An HSA is a tax-advantaged account designed to help you save for medical expenses if you’re enrolled in a high-deductible health plan (HDHP). Avidia Health, a division of Avidia Bank based in Hudson, Massachusetts, specializes in offering these accounts.

I was impressed to learn that Avidia Health operates in all 50 states, servicing over 275,000 accounts and managing $378 million in HSA deposits.

What sets Avidia apart? For me, it’s their focus on simplicity and accessibility. Their HSA is easy to open, use, and maintain, making it ideal for both beginners and seasoned savers. You can think of it as a financial tool that not only covers medical costs but also acts as a long-term savings vehicle.

Key Features of Avidia HSA

- No Monthly Maintenance Fees: Unlike some providers, Avidia doesn’t charge you a monthly fee, which means more of your money stays in your account.

- Mobile App Access: The AvidiaHealth mobile app lets you check your balance, review transactions, and make payments on the go. It’s secure, with encrypted transmissions and no sensitive data stored on your device.

- Investment Options: Once your account balance grows, you can invest your HSA funds, potentially increasing your savings over time.

- Nationwide Availability: Whether you’re in Massachusetts or California, you can open an Avidia HSA without geographic restrictions.

Health Savings Account vs. Flexible Spending Account

Why Choose an HSA? My Perspective

Before diving deeper into Avidia’s offering, let’s talk about why an HSA matters. When I enrolled in an HDHP, I realized I needed a way to manage out-of-pocket medical expenses. An HSA allows you to:

- Contribute pre-tax dollars, reducing your taxable income.

- Pay for qualified medical expenses, like doctor visits, prescriptions, and even dental care, tax-free.

- Roll over unused funds year after year, unlike a Flexible Spending Account (FSA).

For you, this means greater control over healthcare costs. Imagine setting aside money for future medical needs while enjoying tax benefits today. It’s a win-win, and Avidia makes it seamless.

Opening and Managing Your Avidia HSA

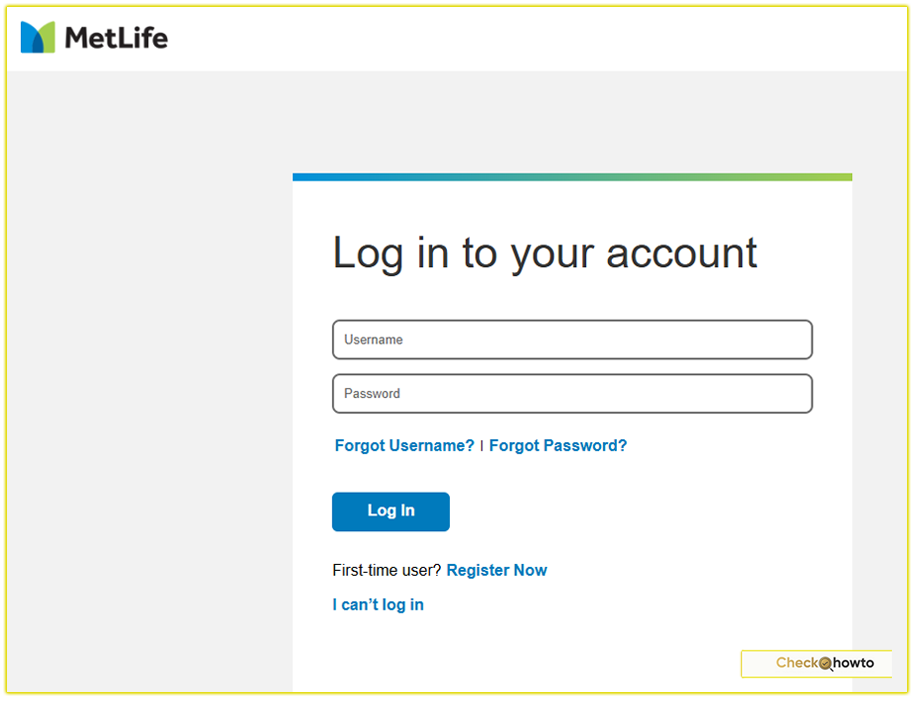

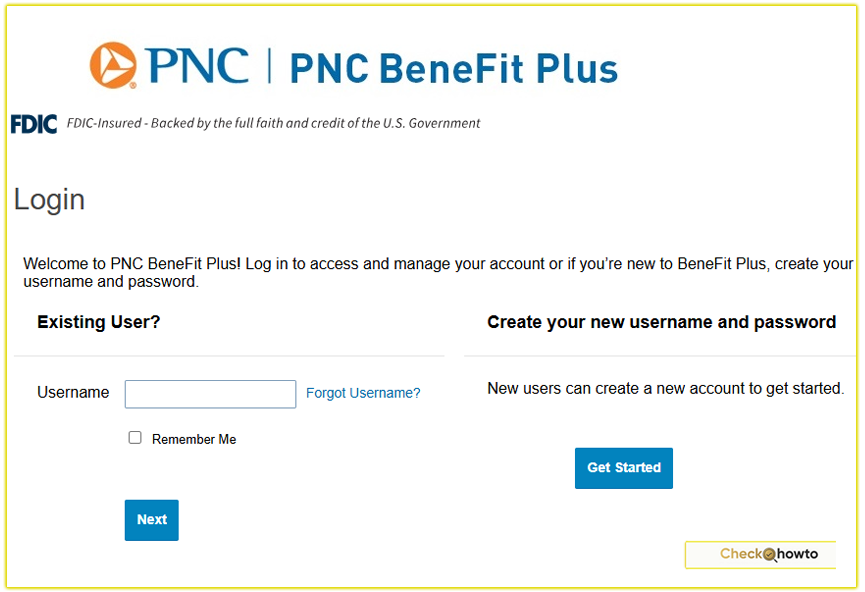

Opening an Avidia HSA was straightforward for me. You can start by visiting the Avidia Health website or their WealthCare Portal. The registration process is user-friendly, requiring basic personal information. Once your account is set up, you’ll receive a debit card to pay for qualified expenses directly from your HSA.

Funding Your Account

You can contribute to your HSA through:

- Payroll Deductions: If your employer offers this, it’s an easy way to automate savings.

- Direct Deposits: Link your checking account to transfer funds.

- Manual Contributions: Though less convenient, you can mail a check, as I discovered when exploring deposit options.

One thing to note: I found the app and website could be more intuitive for tasks like linking a bank account for deposits. Some users have reported similar challenges, so you might need to contact customer support for assistance.

Using the Mobile App

The AvidiaHealth mobile app is a game-changer for busy people like you and me. I can check my balance or review recent transactions in seconds. The app also supports catch-up contributions for those over 55 and lets you repay ineligible expenses online.

However, some users have noted that the app’s navigation isn’t as polished as other modern platforms, so patience may be required.

Fees and Costs: What You Need to Know

One of the reasons I chose Avidia is their low-fee structure. There’s no monthly maintenance fee, which is a big plus for keeping your savings intact.

However, you should be aware of a $1.95 quarterly fee for mailed statements. To avoid this, I opted for electronic delivery through the WealthCare Portal, and I recommend you do the same.

Other potential costs include transaction fees for certain investment options, so check Avidia’s fee schedule before investing. Transparency is key, and Avidia provides clear information to help you avoid surprises.

Investment Opportunities with Avidia HSA

Once my HSA balance reached a comfortable level, I explored Avidia’s investment options. You can invest in mutual funds or other securities, turning your HSA into a retirement savings tool. This feature is particularly appealing if you’re young and healthy, as your funds can grow tax-free over decades.

However, keep in mind that investments carry risks. I always review the available options and consult a financial advisor to ensure my choices align with my goals. You might want to do the same to maximize your HSA’s potential.

Transitioning from Avidia: What Happened?

In 2022, I learned that Avidia Bank was scaling back its HSA business, transitioning accounts to Navia’s WealthCare Saver HSA. This process involved a five-day blackout period from October 31 to November 4, during which account holders couldn’t access their funds.

Thankfully, Navia ensured a smooth transfer, and my existing debit card worked with the new account.

If you’re considering Avidia today, this transition may not affect you, as they’ve streamlined their offerings. Still, it’s worth noting their commitment to minimizing disruptions during such changes.

Tips for Maximizing Your Avidia HSA

Based on my experience, here are some tips to get the most out of your Avidia HSA:

- Contribute the Maximum: For 2025, the IRS allows individuals to contribute up to $4,300 and families up to $8,550 (plus $1,000 catch-up for those 55+). Maxing out your contributions boosts your tax savings.

- Keep Receipts: Even if you pay medical expenses out of pocket, save receipts. You can reimburse yourself from your HSA later, tax-free.

- Explore Resources: Avidia’s website offers tools and FAQs to help you understand your account. Take advantage of these to stay informed.

- Go Paperless: Opt for e-delivery of statements to avoid the quarterly fee and reduce clutter.

Is Avidia HSA Right for You?

I’ve found Avidia’s HSA to be a reliable, low-cost option for managing healthcare expenses. Its no-fee structure, mobile app, and investment opportunities make it appealing for savers like you and me. However, the app’s user experience could improve, and some tasks, like deposits, may require extra effort.

If you’re enrolled in an HDHP and want a hassle-free HSA with nationwide access, Avidia is worth considering. Visit Avidia Health or their WealthCare Portal to explore more. For additional details on fees or investments, check HSA Search or The HSA Report Card.

In my journey with Avidia, I’ve gained peace of mind knowing my healthcare savings are secure and flexible. I hope this guide helps you decide if an Avidia HSA is the right step for your financial future.