As someone who’s navigated the world of healthcare finances, I’ve often wondered about the ins and outs of a Health Savings Account (HSA). If you’re asking, “Does a health savings account rollover?” you’re not alone. It’s a common question, especially if you’re enrolled in a high-deductible health plan (HDHP) or considering one.

In this article, I’ll break down everything you need to know about HSA rollovers, using my insights and research to ensure you walk away confident and informed.

What Is a Health Savings Account (HSA)?

Let’s clarify what an HSA is. An HSA is a tax-advantaged savings account designed for individuals enrolled in an HDHP. I’ve found it to be a powerful tool for managing medical expenses.

You can contribute pre-tax dollars to the account, use the funds for qualified medical expenses (like doctor visits, prescriptions, or dental care), and enjoy tax-free withdrawals for those expenses.

Plus, any interest or investment gains in the account grow tax-free. It’s like a financial Swiss Army knife for healthcare costs

But here’s where it gets interesting: unlike some other accounts, HSAs aren’t tied to your employer or a specific year. This brings us to the heart of your question: Does the money in your HSA rollover?

Do HSA Funds Roll Over Year to Year?

I’m happy to share that, yes, HSA funds do roll over year to year. Unlike a Flexible Spending Account (FSA), which often has a “use it or lose it” rule, your HSA balance carries forward indefinitely. When I first learned this, it was a game-changer.

You don’t have to scramble to spend your HSA funds by December 31st. Whether you have $50 or $5,000 left in your account, that money is yours to keep and use for future qualified medical expenses.

This feature makes HSAs a fantastic option for long-term healthcare planning. For example, I’ve let my HSA balance grow over the years, knowing I can tap into it for unexpected medical costs or even save it for retirement. You can do the same thing with your HSA as a safety net that grows with you.

Why This Matters to You

The ability to roll over HSA funds means you’re not pressured to spend unnecessarily. It also encourages you to contribute strategically, knowing your savings won’t vanish. Plus, if you invest your HSA funds (many providers allow this), your balance can grow over time, giving “

System: You have even more financial flexibility for future healthcare needs.

Can You Roll Over an HSA to Another HSA?

Now, let’s address another aspect of the rollover question: transferring funds from one HSA to another. I’ve gone through this process myself when I switched jobs, and it’s straightforward.

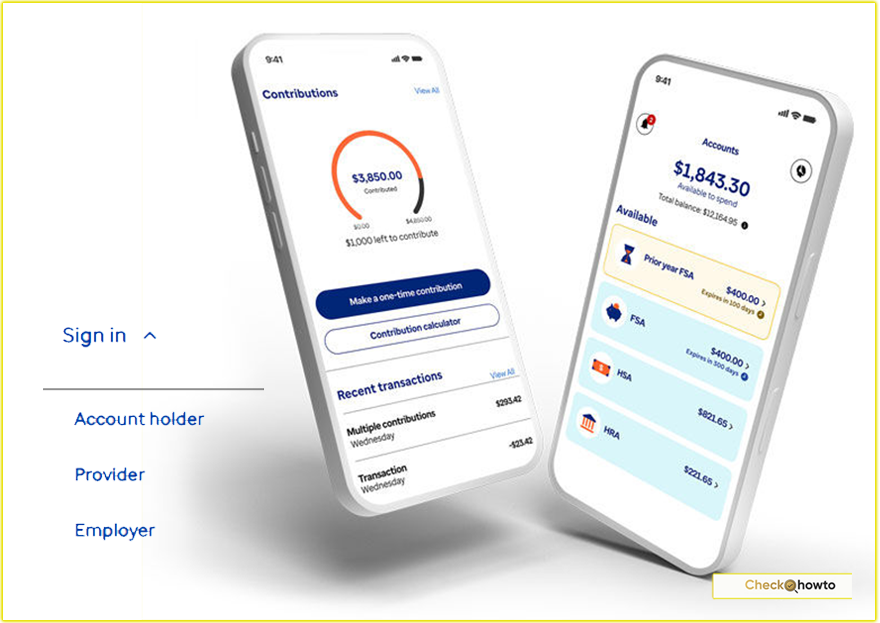

An HSA rollover refers to moving funds from one HSA provider to another, often to consolidate accounts, access better investment options, or reduce fees. You can absolutely roll over your HSA, and here’s how it works.

Steps to Roll Over Your HSA

- Choose a New HSA Provider: Research providers like Fidelity, HealthEquity, or Bank of America to find one with low fees, good investment options, or features you value. I compared a few based on customer service and ease of use before deciding.

- Open the New HSA Account: You’ll need an active HSA account with the new provider. Make sure you’re still enrolled in an HDHP to remain eligible.

- Request a Transfer: Contact your current HSA provider to initiate a direct transfer to the new account. This is often called a “trustee-to-trustee transfer,” and it’s the cleanest way to avoid tax complications. When I did this, I found that most providers have online forms or customer service reps to guide you.

- Confirm the Transfer: Once the funds move, double-check your new account balance. It typically takes a few business days.

Benefits of an HSA Rollover

- Simplify Your Finances: Consolidating multiple HSAs (if you’ve had several jobs) makes tracking easier. I had two HSAs at one point, and merging them saved me time and hassle.

- Lower Fees: Some providers charge high maintenance fees. Rolling over to a provider with lower costs can save you money.

- Better Investment Options: Many HSA providers, like Fidelity, allow you to invest your funds in mutual funds or stocks, potentially growing your balance faster.

A Word of Caution

While you can roll over your HSA, be mindful of IRS rules. You’re allowed one HSA rollover per 12-month period if you take possession of the funds (e.g., receiving a check). To avoid this limit, opt for a direct transfer.

I learned this the hard way when I almost triggered a taxable event by mishandling a transfer. Always consult your provider or a tax professional to stay compliant.

Can You Roll Over Other Accounts into an HSA?

You might be wondering if you can roll over funds from other accounts, like an IRA or 401(k), into your HSA. I explored this when I was looking to boost my HSA balance. The answer is limited but possible in specific cases.

- IRA-to-HSA Rollover: You can make a one-time transfer from an IRA to an HSA, up to the annual HSA contribution limit for the year (e.g., $4,300 for individuals or $8,550 for families in 2025, plus $1,000 catch-up for those 55+). This is a tax-free transfer, but it’s a once-in-a-lifetime option, so use it wisely. I considered this but decided to preserve my IRA for retirement instead.

- 401(k) or Other Accounts: You cannot directly roll over funds from a 401(k), FSA, or other retirement accounts into an HSA. However, you could roll over a 401(k) to an IRA and then use the IRA-to-HSA option, though this adds complexity.

Always check with a financial advisor before making these moves, as they can impact your taxes and retirement strategy. You don’t want to make a costly mistake, and I’ve seen how a little planning goes a long way.

What Happens to Your HSA When You Change Jobs?

One concern I hear often is what happens to your HSA when you switch jobs. The good news? Your HSA is portable. Unlike employer-sponsored retirement plans, your HSA belongs to you, not your employer. When I changed jobs, my HSA came with me, and I could continue using it as long as I was enrolled in an HDHP.

Here’s what you can do:

- Keep Your Existing HSA: You don’t have to move the funds. Continue using the account for medical expenses or let it grow.

- Roll Over to a New HSA: If your new employer offers a different HSA provider, you can transfer your balance, as I described earlier.

- Stop Contributing: If your new health plan isn’t an HDHP, you can’t contribute to your HSA, but you can still use the existing balance for qualified expenses.

This portability gives you flexibility, so you can focus on your career without worrying about losing your healthcare savings.

Using Your HSA in Retirement

One of my favorite HSA perks is its potential as a retirement tool. After age 65, you can use HSA funds for any purpose without penalties, though non-medical withdrawals are subject to income tax.

This makes your HSA a versatile savings vehicle. I’ve been stashing away extra funds in my HSA, knowing I can use them for healthcare costs or other expenses in retirement.

For example, you could:

- Pay for Medicare premiums (but not Medigap premiums).

- Cover out-of-pocket medical costs, which tend to rise in retirement.

- Use the funds for non-medical expenses, like travel or home improvements, after age 65 (with taxes applied).

By letting your HSA roll over year after year, you’re building a nest egg that can support your health and lifestyle in later years.

Common Misconceptions About HSA Rollovers

I’ve come across a few myths about HSAs that can confuse you. Let’s clear them up:

- Myth: HSA funds expire if you don’t use them. Truth: As I’ve emphasized, HSA balances roll over indefinitely.

- Myth: You lose your HSA when you leave your job. Truth: Your HSA is yours forever, regardless of employment.

- Myth: You can’t roll over an HSA. Truth: You can transfer funds to a new provider or even roll over an IRA (once) into an HSA.

If someone tells you otherwise (like the Reddit user whose company claimed HSAs don’t roll over), double-check the facts. Misinformation can lead to missed opportunities.

Tips for Maximizing Your HSA

Based on my experience, here are a few ways you can make the most of your HSA:

- Contribute the Maximum: For 2025, the IRS limits are $4,300 for individuals and $8,550 for families, plus $1,000 for those 55+. Maxing out contributions boosts your savings.

- Invest Your HSA Funds: If your provider offers investment options, consider putting your funds in low-cost mutual funds or ETFs to grow your balance over time.

- Keep Receipts: You can reimburse yourself years later for medical expenses paid out-of-pocket, as long as you have documentation. I’ve saved receipts for this reason.

- Review Fees: Some HSA providers charge high fees. Compare options to ensure you’re not losing money unnecessarily.

These strategies have helped me turn my HSA into a robust financial tool, and they can work for you too.

Conclusion

So, does a health savings account roll over? Absolutely—both year to year and to new providers when needed. I’ve found HSAs to be a flexible, tax-advantaged way to manage healthcare costs, and their portability and rollover features make them even more valuable. Whether you’re saving for next year’s doctor visits or planning for retirement, your HSA is a powerful ally.

If you’re still unsure about your HSA options, reach out to your provider or a financial advisor. And if you’re curious about specific HSA providers or rules, check trusted resources like Fidelity, HealthEquity, or Healthcare.gov. Now that you know the ins and outs, you’re ready to take control of your HSA and make it work for you. What’s your next step?