As someone who’s navigated the maze of healthcare costs, I’ve found that a Health Savings Account (HSA) can be a game-changer for managing medical expenses. Among the many HSA (Health Savings Account) providers out there, Lively stands out for its user-friendly platform and cost-effective approach.

If you’re looking to take control of your healthcare savings, I’m here to walk you through what makes Lively’s HSA a top choice, how it works, and why it might be the right fit for you.

What Is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account designed for individuals enrolled in a High Deductible Health Plan (HDHP). It allows you to save pre-tax dollars for qualified medical expenses, such as doctor visits, prescriptions, and dental care. The beauty of an HSA lies in its triple tax advantage:

- Tax-deductible contributions: Money you put into the account reduces your taxable income.

- Tax-free growth: Interest and investment earnings grow without tax implications.

- Tax-free withdrawals: Funds used for qualified medical expenses are not taxed.

I’ve personally benefited from this structure, as it’s helped me plan for both immediate and future healthcare costs. For you, this means more money stays in your pocket to cover medical needs.

Why Choose Lively for Your HSA?

Lively, a San Francisco-based company, has built a reputation for creating a modern HSA that’s intuitive and cost-effective.

According to a 2024 Business Wire report, Lively account holders boast 2x higher investment rates and 17% higher account balances than the industry average, showcasing its appeal for savers and investors alike.

Here’s why I think Lively is worth considering and why you might agree.

1. No Maintenance Fees for the Spending Account

One of the first things I noticed about Lively is that its basic HSA spending account is free for individuals and families.

Unlike some providers that nickel-and-dime you with monthly fees, Lively eliminates maintenance charges, making it ideal for those who primarily use their HSA for everyday medical expenses.

As noted by The HSA Report Card, this fee-free model is perfect for “spenders” who want to avoid administrative costs.

For you, this means you can focus on saving for healthcare without worrying about hidden fees eroding your balance. Whether you’re paying for a doctor’s visit or a prescription, Lively’s transparent pricing keeps things simple.

2. User-Friendly Platform and Mobile App

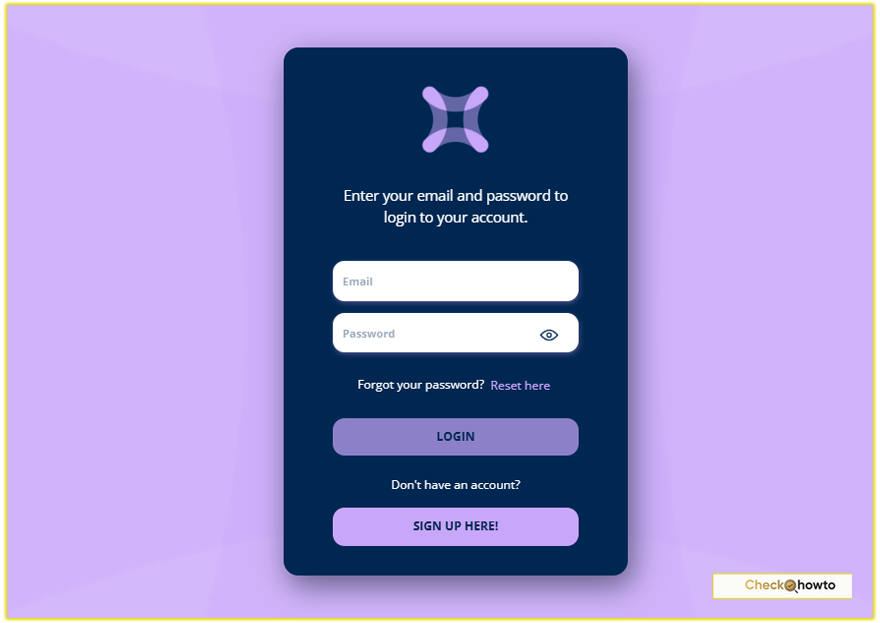

Managing an HSA should be hassle-free, and Lively delivers on this front. I’ve found their online dashboard and Lively HSA mobile app to be incredibly intuitive.

You can set up and fund your account, track expenses, submit receipts for reimbursement, and even monitor investments, all from your phone or computer. The app is available on both the App Store and Google Play, ensuring accessibility wherever you are.

Imagine being at the pharmacy and needing to check your HSA balance or pay for a prescription with your Lively HSA debit card. With the mobile app, you can handle it in seconds. This seamless experience makes Lively a standout for tech-savvy users like you and me.

3. Robust Investment Options

If you’re like me and want your HSA to grow over time, Lively’s investment options are a major draw. Unlike some providers that require a minimum balance to start investing, Lively offers first-dollar investing, meaning you can invest as soon as funds hit your account. They partner with industry leaders like Charles Schwab and Devenir to provide two investment pathways:

- Schwab Health Savings Brokerage Account: You can invest funds above $3,000 with no access fee from Lively, or pay a $24 annual fee for unrestricted investing. Note that Schwab may charge additional fees.

- Devenir Guided Portfolio: This option includes automated features like rebalancing but comes with a 0.50% annual management fee.

I’ve used similar investment accounts to grow my savings tax-free, and Lively’s low threshold makes it accessible for beginners. For you, this could mean turning your HSA into a powerful tool for long-term financial planning, especially if you’re saving for future healthcare costs or retirement.

4. Triple Tax Advantage

Lively’s HSA leverages the full triple tax advantage I mentioned earlier. Contributions are tax-deductible (or pre-tax if made through payroll), earnings grow tax-free, and withdrawals for qualified expenses are tax-free.

This structure has saved me hundreds of dollars annually, and it can do the same for you. For 2025, the IRS allows contributions up to $4,300 for individuals and $8,550 for families, with an additional $1,000 catch-up contribution for those 55 and older.

5. Educational Resources

Lively’s Resource Center is a treasure trove of articles, guides, and calculators to help you maximize your HSA. When I was new to HSAs, I relied on similar resources to understand eligible expenses and contribution limits.

You can use Lively’s tools to estimate how much to save, explore qualified medical expenses, or learn about HSA rollovers and transfers. Their proactive education ensures you’re equipped to make informed decisions.

How to Get Started with Lively

Setting up a Lively HSA is straightforward, and I’ve gone through similar processes with other providers, so I can attest to its simplicity. Here’s what you need to do:

- Confirm Eligibility: You must be enrolled in an HDHP and not covered by another health plan (like Medicare) or claimed as a dependent on someone else’s tax return.

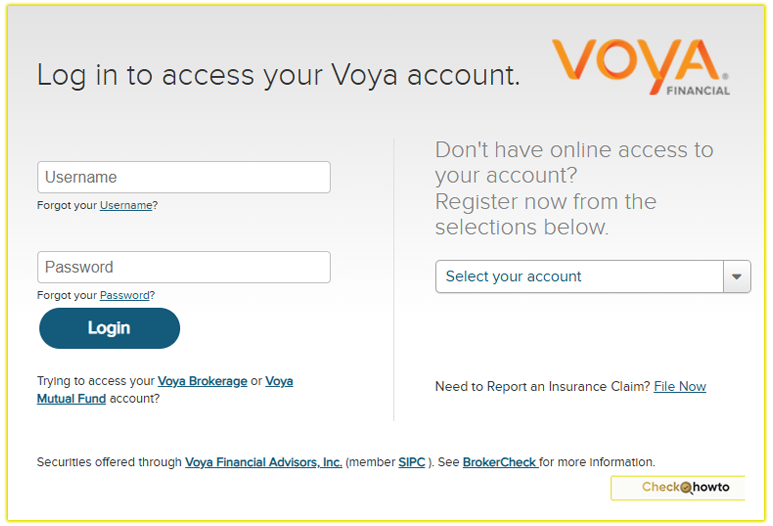

- Open an Account: Visit Lively’s website or partner banks like Centier Bank, BMO, or First Mid Bank & Trust to start your application. It’s paperless and takes minutes.

- Fund Your HSA: Contribute via payroll deductions, bank transfers, or rollovers from another HSA. Lively doesn’t charge for rollovers or transfers.

- Use Your Funds: Pay for qualified expenses with the Lively HSA debit card or submit receipts for reimbursement through the dashboard or app.

- Invest (Optional): Link your account to Schwab or Devenir to start investing tax-free.

When I set up my HSA, having a clear checklist like this made the process stress-free. You’ll likely find Lively’s streamlined setup just as convenient.

Pros and Cons of Lively HSA

No provider is perfect, so let’s weigh the benefits and drawbacks based on my experience and research.

Pros

- No maintenance fees for the spending account, saving you money.

- First-dollar investing with no minimum threshold for Schwab accounts.

- Intuitive platform with a mobile app for easy management.

- Robust educational resources to guide your HSA journey.

- FDIC-insured uninvested funds through partner banks like Centier.

Cons

- Low interest rates on the spending account (0.02% to 0.09% as of 2024), which may not keep pace with inflation.

- Investment fees: The 0.50% fee for Devenir’s Guided Portfolio and potential Schwab fees can add up.

- Limited investment menu: Some users may find Lively’s investment options less extensive compared to competitors like Fidelity.

For me, the pros outweigh the cons, especially if you prioritize low fees and ease of use. You’ll need to decide if the investment fees align with your financial goals.

Who Should Use Lively HSA?

Lively is ideal for:

- Spenders: If you use your HSA for frequent medical expenses, the fee-free spending account and debit card are perfect.

- Investors: Those looking to grow their HSA through tax-free investments will appreciate the low entry point and reputable partners.

- Tech-savvy users: The mobile app and dashboard cater to those who value convenience.

- Beginners: Lively’s resources make it easy for HSA newcomers to get started.

If you’re enrolled in an HDHP and want a modern, cost-effective HSA, Lively is a strong contender. I’ve found it aligns well with my goal of balancing short-term healthcare needs with long-term savings, and it could do the same for you.

Health Accounts with Bank of America

Comparing Lively to Other HSA Providers

To give you a fuller picture, let’s briefly compare Lively to competitors like Fidelity and HealthEquity:

- Fidelity: Offers no account fees, a wider investment menu, and higher interest rates but lacks Lively’s mobile app experience.

- HealthEquity: Known for comprehensive benefits solutions but may charge fees that Lively avoids.

Lively’s edge lies in its free spending account and user-friendly technology, making it a great fit for those prioritizing simplicity and low costs.

Tips to Maximize Your Lively HSA

Based on my experience, here are some strategies to get the most out of your Lively HSA:

- Contribute the maximum: Aim for the 2025 limits ($4,300 individual, $8,550 family) to maximize tax savings.

- Invest early: Even small investments can grow significantly over time thanks to tax-free compounding.

- Keep receipts: Track expenses in the Lively dashboard to ensure compliance with IRS rules.

- Use the Resource Center: Leverage Lively’s guides to plan contributions and understand eligible expenses.

- Review investment fees: Compare Schwab and Devenir options to minimize costs.

These steps have helped me stretch my HSA dollars further, and they can work for you too.

Conclusion

As someone who values financial flexibility, I’ve found Lively’s Health Savings Account to be a reliable, user-friendly option for managing healthcare costs.

Its no-fee spending account, robust investment options, and intuitive platform make it a standout choice for both spenders and investors. Whether you’re new to HSAs or looking to switch providers, Lively offers the tools and transparency you need to save smarter.

Ready to take the next step? Visit livelyme.com to open your account and start building a healthier financial future. With Lively, you’re not just saving for medical expenses, you’re investing in peace of mind.